Welcome to this week's edition of The Finance Gem 💎 where I bring you my unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter edition is brought to you by my favorite software for collecting customer testimonials. Testimonial.to allows you to get testimonials from your customers with ease and in minutes, you can collect text and video testimonials with no need for a developer or website hosting.

To see how it works, head over to Testimonial's page here and share a quick testimonial. It's fast, easy, and it helps others understand the value of reading my posts and following me on Linkedin. Thank you so much to everyone who already shared their thoughts - find your testimonial featured here!

Before we get started with this week's newsletter, I have some great news to share!

Here's what's inside the Cash Flow Masterclass:

28 lessons on cash flow intelligence

190 downloadable slides

10 downloadable infographics

10 downloadable practice Excel models

Purchased Power Parity Pricing

Coaching packages

Here's what's included in the Curriculum:

Cash flow fundamentals

Techniques to read, analyze, and prepare a cash flow statement

The key cash flow management principles and cash flow drivers

The strategic approach to effectively improve cash flow

The main cash flow traps and how to avoid them

For more details, head over to oanalabes.com to check out a free preview!

Without further ado, let's begin:

Accounting vs. Finance Cheat Sheet

Accounting and Finance and not the same.

🎯 They define value differently.

🎯 They have different objectives

🎯 They have different perspectives

🎯 They require different technical skills.

🎯 Knowing how they differ will help you appreciate how each of them ads value.

🎯 Knowing how they work together will help advance your career.

The 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐯𝐬. 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 𝐂𝐡𝐞𝐚𝐭 𝐒𝐡𝐞𝐞𝐭 𝐢𝐧𝐜𝐥𝐮𝐝𝐞𝐬:

🎯 Accounting vs. Finance Differences across Scope, Focus, Timeframe, Regulatory environment and Tools of their trade

🎯 Accounting vs. Finance Designations to learn what they mean and what to pursue

🎯 Accounting vs. Finance Careers to learn about their work

🎯Accounting vs. Finance in the CFO Office

🎯 Accounting vs. Finance KPIs to help you learn what to monitor

🎯The Accounting Budget Flow to help you learn how budgets are built

🎯20 Confusing Accounting Topics to help you differentiate between them

🎯10 Essential Finance Skills for Managers to help prioritize what to learn

🎯 The Financial Analysis Scorecard to help structure your financial analysis

🎯5 Key EBITDA Ratios to help you make better use of EBITDA

Controllership vs. FP&A vs. Strategic Finance

Controllership vs FP&A vs. Strategic Finance

Do you know the differences?

These three functions are part of the same CFO Office, and they work as a team, but they couldn’t be more different in focus, skills and responsibilities.

**Controllership:**

🎯 focuses on accounting and financial reporting

🎯 responsible for ensuring that financial statements are accurate, timely, and compliant with local GAAP

🎯 roles: Controller, Assistant Controller, Accounting Manager

🎯 competencies: accounting and financial reporting, budgeting and forecasting, internal controls, regulatory compliance

🎯 key relationships: other finance functions, other departments (operations, sales, procurement)

🎯 professional designations:

1. CPA (Certified Public Accountant)

2. CMA (Certified Management Accountant)

3. CGMA (Chartered Global Management Accountant)

4. ACCA (Association of Chartered Certified Accountants)

5. CIA (Certified Internal Auditor)

**FP&A (Financial Planning and Analysis):**

🎯 focuses on insights into financial performance for strategic decision-making

🎯 responsible for providing guidance on strategic business decisions based on financial data and analysis

🎯 roles: FP&A Manager, Financial Analyst, Budget Analyst

🎯 competencies: financial modeling, data analysis and visualization, budgeting and forecasting, strategic thinking, communication and influence

🎯 key relationships: other finance functions, other departments (sales, operations, procurement)

🎯 professional designations:

1. FP&A (Certified Corporate Financial Planning & Analysis Professional)

2. CFA (Chartered Financial Analyst)

3. CTP (Certified Treasury Professional)

4. CFP (Certified Financial Planner)

5. CAIA (Chartered Alternative Investment Analyst)

**Strategic Finance:**

🎯 focuses on the long-term financial planning and analysis of the company

🎯 provides insights into investment decisions, mergers and acquisitions, and capital raising

🎯 roles: Director of Strategic Finance, Corporate Development Manager, Treasury Manager

🎯 competencies: financial analysis and modeling, strategic thinking, investment evaluation, mergers and acquisitions, capital markets, corporate banking, communication and leadership

🎯 key relationships: other finance functions, other departments (legal and operations) to execute investment and acquisition opportunities

🎯 professional designations:

1. CFA (Chartered Financial Analyst)

2. FRM (Financial Risk Manager)

3. CAIA (Chartered Alternative Investment Analyst)

4. CBV (Chartered Business Valuator)

5. CFP (Certified Financial Planner)

Controllership vs. FP&A vs. Strategic Finance - Oana Labes, MBA, CPA

Margin vs. Markup

Do you know your Margin from your Markup?

▶️ Margin shows how much of a product's sales price you got to keep.

▶️ Markup shows how much over cost you've sold the product for.

🎯 Let's dig deeper into each of these . Note we’ll be looking at per unit calculations, but you can easily extrapolate formulas to calculate totals:

1// Margin (or Gross Profit Margin in this case) is the proportion of a product’s Sales Price that exceeds the Product Cost.

☑️ Margin = (Product Sales Price - Product Cost)/ Product Sales Price

☑️ Margin = Gross Profit per Product / Product Sales Price x 100

Note that Margin is calculated as a percentage.

Meanwhile, Gross Profit is calculated as an amount.

To get the Gross Profit Margin you need to divide Gross Profit per Product by the Sales Price per Product and multiply by 100.

2// Markup is the proportion by which you increase the Product Cost to arrive at the Sales Price.

☑️ Markup = (Product Sales Price - Product Cost)/ Product Cost

☑️ Markup = Gross Profit per Product / Product Cost x 100

Note that markup can be calculated based on a product's variable cost or based on its total (absorption) cost.

☑️ Marking up the variable cost could result in under costing and underpricing the product, which in turn may increase revenues at the expense of reduced profitability and cash flows. Use Cost-Volume-Profit analysis to determine the number of units you will need to sell to break even.

☑️ Marking up the absorption cost could result in over costing and overpricing, which in turn could reduce revenues also at the expense of reduced profitability and cash flows. Be especially careful with the fixed manufacturing depreciation expense which gets included in the full/absorption cost of a product.

🎯 To calculate your margin if you know your markup:

☑️ Margin = Markup /(1+Markup)

🎯 To calculate your markup if you know your margin:

☑️ Markup = Margin / (1-Margin)

🎯 Here’s an example:

Assume a product with a Cost of $20 has a Sales Price of $24.

Margin = (Product Sales Price - Product Cost)/ Product Price = ($24 - $20)/ $24 = 17%

Markup = (Product Sales Price - Product Cost)/ Product Cost = ($24 - $20) / $20 = 20%

If you know the Margin is 17%, then the Markup will be 0.17 / (1-0.17) = 0.20 or 20%

If you know the Markup is 20%, then the Margin will be 0.2 / (1+0.2) = 0.17 or 17%

🎯 How to use Margin and Markup:

☑️ Both Margin and Markup calculate the difference between price and cost.

☑️ Margin relates that difference to the product Price.

☑️ Markup relates that difference to the product Cost.

☑️ If you know the Product Cost, use Markup to determine an appropriate selling Price.

☑️ If you know the Product Gross Profit, use it to determine the Gross Profit Margin and track profitability over time.

☑️ And because Price is (ideally) always larger than Cost, remember that Markup will always be the larger metric.

Margin vs. Markup - Oana Labes, MBA, CPA

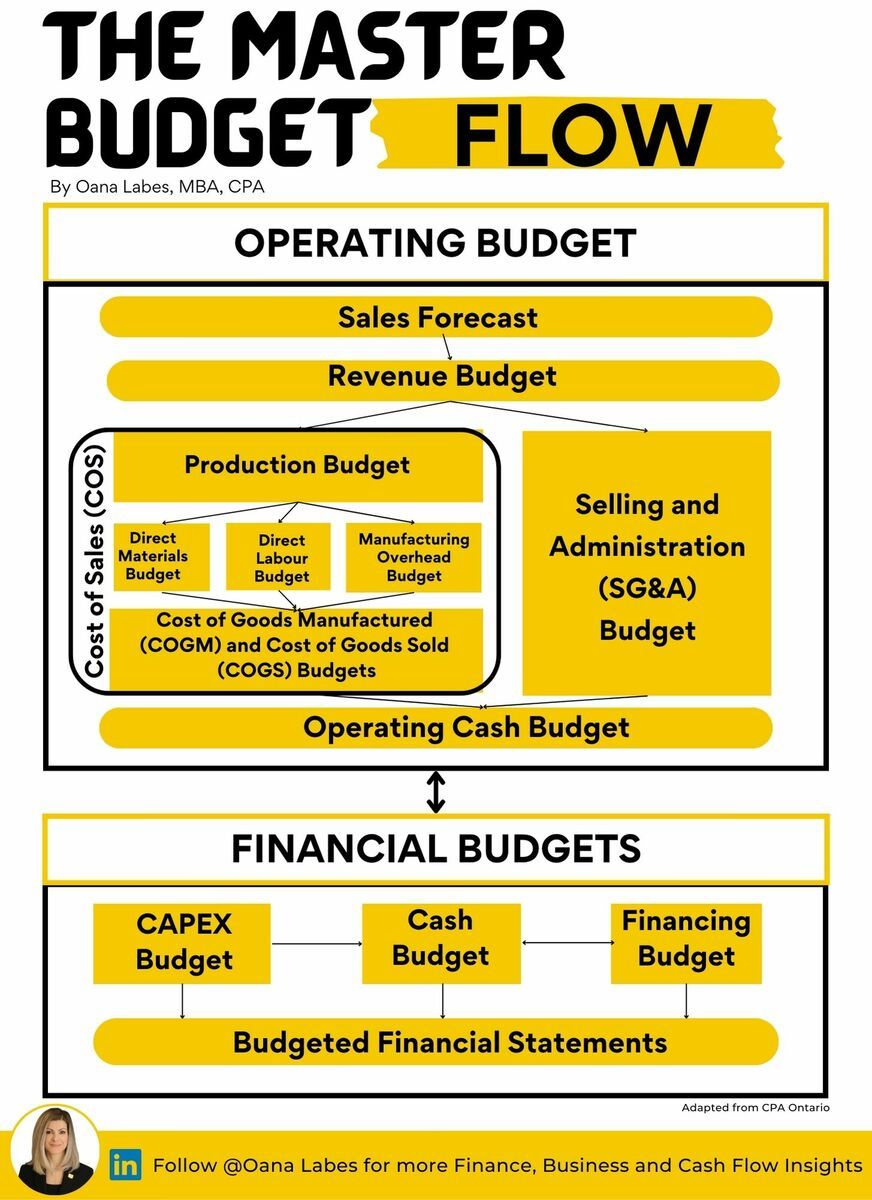

Are you Mastering your Master Budget?

Whether you’re in a manufacturing or non-manufacturing business, if you’re going to be successful you will need a Master Budget.

Here are 10 critical things to know about your Master Budget and its flow:

🎯 It’s a detailed financial plan that allocates resources and shows your income and expense expectations for a year or more into the future.

🎯 It’s built off historical trends, known changes in the present, anticipated future changes and extrapolations of existing data, all of which you should be able to support with appropriate evidence.

🎯 It includes an Operating Budget and several Financial Budgets, including a full set of Budgeted Financial Statements (income statement, balance sheet and cash flow statement).

🎯 It starts with the Sales Forecast for the period which presents your anticipated sales volumes in units.

🎯 Your Sales Forecast drives the Revenue Budget, which drives both the Production Budget (for manufacturers) and the SG&A Budget

🎯 If you’re a service company, you don’t sell products so you won’t have Production Budgets and Cost Of Goods Sold.

Instead you will typically have Cost of Sales (COS).

🎯 If however you do have a Production Budget, it will drive the next 3 Budgets for Direct Labor, Direct Materials and Manufacturing Overhead.

These in turn will drive your COGM and your COGS.

🎯 Your SG&A Budget is driven by your Sales Forecast and all non-manufacturing expenses.

These include sales, marketing, research and development, and general administration.

They also include your non-manufacturing overhead.

🎯 Your Operating Budget will further drive 3 other inter-connected budgets:

>> Your Investment or CAPEX Budget, which will list expected cash invested in or driven from fixed asset purchase and sale transactions

>> Your Financing Budget, which will list expected cash paid or received from debt or equity financing transactions

>> Your Cash Budget, which will list your total expected receipts and disbursements for the period

🎯 Once all your Budgets are completed, you’ll finally be able to get a unified view of your projected future performance through your Budgeted Income Statement, Balance Sheet and Cash Flow Statement.

The Budget Flow - Oana Labes, MBA, CPA

Next steps for you to consider:

Upgrade your strategic finance skills with my Cash Flow Masterclass! Use it to drive sustainable business growth and accelerate your career. Check it out at oanalabes.com

Looking for 1-1 coaching? - Book my calendar directly here

Sponsor this newsletter - partner with me and bring your business in front of a highly engaged professional community made up of CFOs, CEOs, CPAs, MBAs, FMVAs, Controllers, Finance Managers, Presidents, Business Owners, and upcoming leaders. Book directly here.

Forward this newsletter - to help your network enjoy it the way you do. Your friends and colleagues will appreciate your thoughtfulness and will respect your deep knowledge of finance.

Thanks so much for reading. See you next week.

The mother of Cash and EBITDA - compliments of Nicolas Boucher