Welcome to a new edition of The Finance Gem 💎

weekly strategic finance gems to accelerate your career and grow your business

This Week’s Strategic Finance Insights

Once upon a time, a CFO, a Budget and a Corporate Finance Cheat Sheet were walking together….

10 Steps you need to follow for the perfect Master Budget.

The place and purpose of the CFO Office

Controllership vs. FP&A vs. Strategic Finance

The Cash Conversion Cycle (CCC) drives your profitability.

The Corporate Finance Cheat Sheet.

Let’s see what happens next!

By the way, have you visited my digital store yet? Many of my viral cheat sheets, checklists and infographics are now available in full resolution, so go check them out and turn your favorites into posters!

This newsletter issue is brought to you by JotForm - a powerful online form builder that makes it easy to create robust forms and collect important data. Jotform is trusted by over 20M users worldwide, such as nonprofits, educational institutions, small businesses, and enterprises. Use my affiliate link to try Jotform for free up to 5 forms, and experience the power of smart automated workflows and automation. This helps support my work at no cost to you, keeping this newsletter free for yourself and over 30,000 readers.

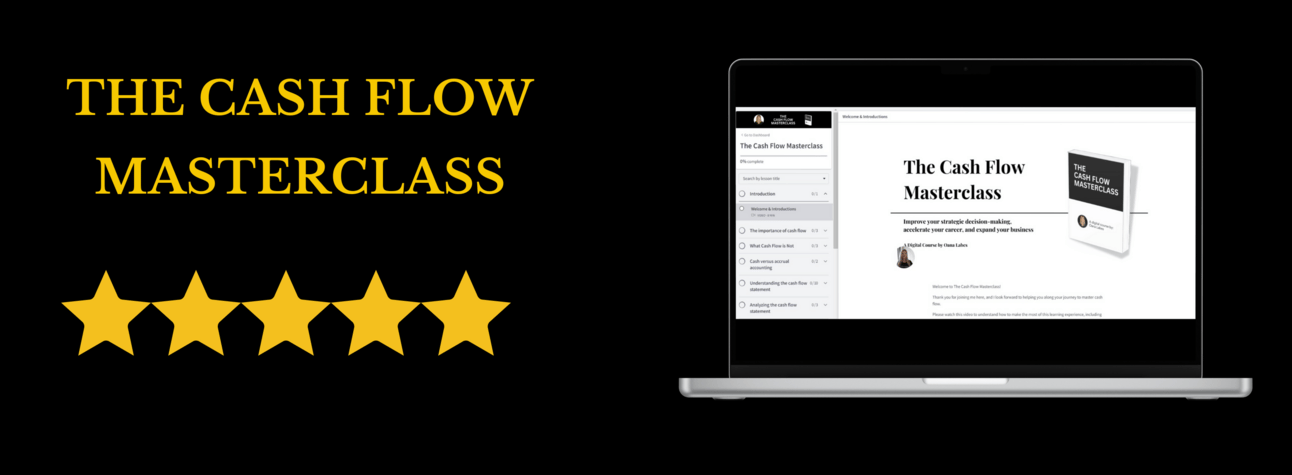

And if you’re still unsure if this course with 5* reviews is for you, consider this:

☑️ It’s GOOD: you will learn from one of the best coaches - my unique expertise includes finance, accounting, business management and commercial finance

☑️ It’s FAST: it takes less than 2 hours to breeze through the course on any device, and you can pause anytime

☑️ It’s PRACTICAL: you get dynamic financial models included in the course and you will be applying what you learn for the rest of your career

☑️ It’s VALUABLE: the course cost is nominal compared to the value, and there are even payment plans available

☑️ It’s YOURS: you get lifetime access on any device (audio mode available in the app)

Enroll today - your career and your organization will thank you!

New this week

If you’re interested in Promotions and Free Finance Webinars, add your name to the waitlist.

New pricing options are available for The Cash Flow Masterclass to make it more affordable than ever to get strategic cash flow management education. You can now choose between an upfront payment, a 2-month payment plan and a monthly subscription.

The Finance Gem 💎 Referral Program is here - share this newsletter with your network and earn great rewards! Scroll down to the end to find out more!

Reading for the first time? Please Subscribe here.

Let’s get into this week’s strategic finance insights:

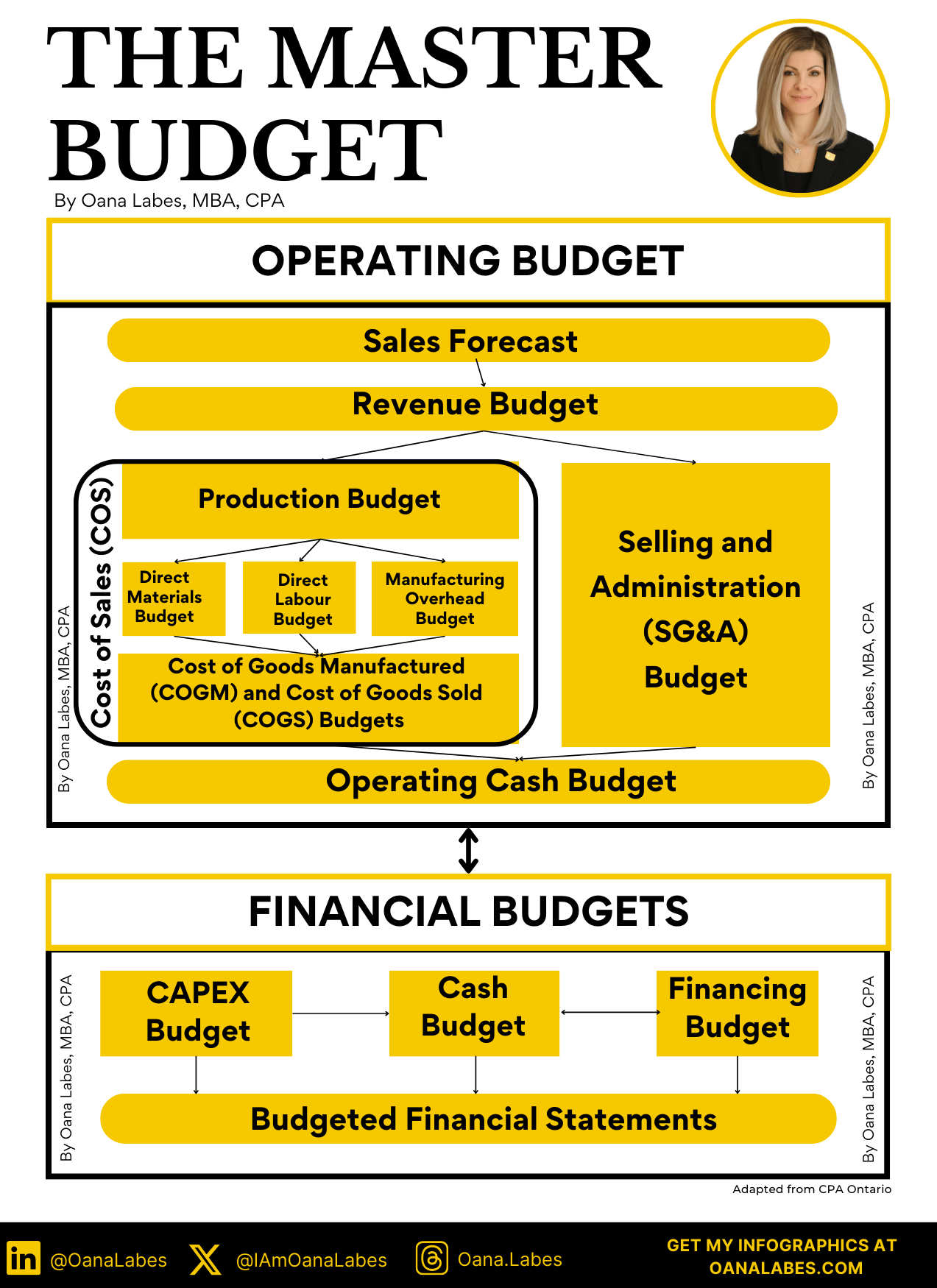

10 Steps you need to follow for the perfect Master Budget

➡️ 1. The Master Budget is a detailed financial plan that allocates resources and shows your income and expense expectations for a year or more into the future.

➡️ 2. It’s built off historical trends, known changes in the present, anticipated future changes and extrapolations of existing data, all of which you should be able to support with appropriate evidence.

➡️ 3. It includes an Operating Budget and several Financial Budgets, including a full set of Budgeted Financial Statements (income statement, balance sheet and cash flow statement).

➡️ 4. It starts with the Sales Forecast for the period which presents your anticipated sales volumes in units.

➡️ 5. Your Sales Forecast drives the Revenue Budget, which drives both the Production Budget (for manufacturers) and the SG&A Budget

➡️ 6. If you’re a service company, you don’t sell products so you won’t have Production Budgets and Cost Of Goods Sold.

Instead you will typically have Cost of Sales (COS).

➡️ 7. If however you do have a Production Budget, it will drive the next 3 Budgets for Direct Labor, Direct Materials and Manufacturing Overhead.

These in turn will drive your COGM and your COGS.

➡️ 8. Your SG&A Budget is driven by your Sales Forecast and all non-manufacturing expenses.

These include sales, marketing, research and development, and general administration.

They also include your non-manufacturing overhead.

➡️ 9. Your Operating Budget will further drive 3 other inter-connected budgets:

>> Your Investment or CAPEX Budget, which will list expected cash invested in or driven from fixed asset purchase and sale transactions

>> Your Financing Budget, which will list expected cash paid or received from debt or equity financing transactions

>> Your Cash Budget, which will list your total expected receipts and disbursements for the period

➡️ 10. Once all your Budgets are completed, you’ll finally be able to get a unified view of your projected future performance through your Budgeted Income Statement, Balance Sheet and Cash Flow Statement.

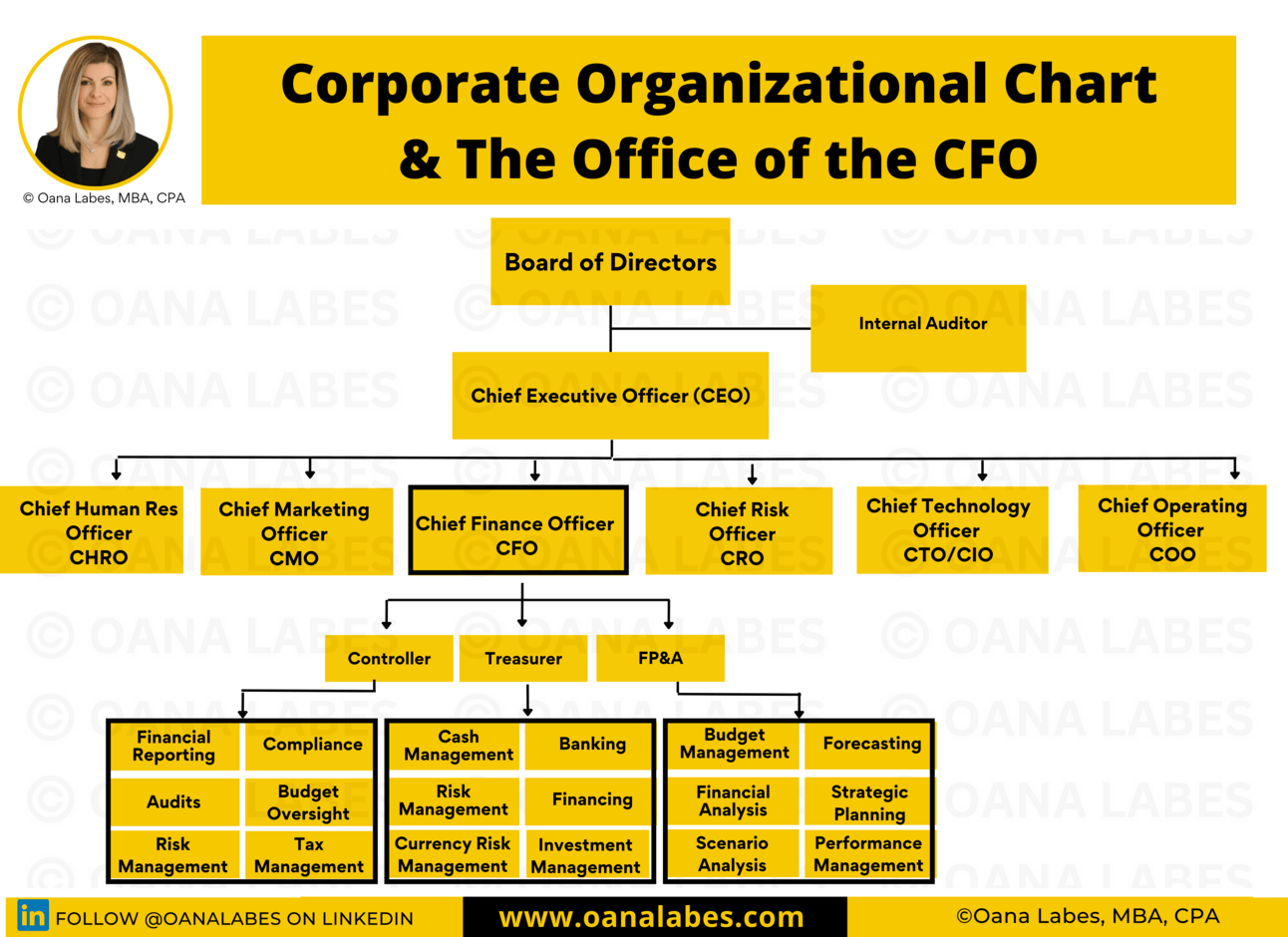

The place and purpose of the CFO Office

Do you know the place and purpose of the CFO Office in your Org Chart?

Think about it like this: if your organization was a building, the org chart would be its blueprint.

Your org chart:

🎯 outlines your company structure

🎯 shows different departments and teams

🎯 provides a plan for organizing resources

🎯 defines roles, inter-relations, and reporting hierarchies

🎯 promotes communication and coordination

The design of your org chart may vary, but it still needs to perform relevant functions for your business.

The CFO Office has three primary functions: controlling, treasury, and FP&A.

1️⃣ Controlling ensures financial reporting compliance:

⚫ financial reporting involves preparation of monthly, quarterly, and annual financial statements

⚫ compliance involves ensuring legal and regulatory adherence

⚫ risk management involves mitigating financial reporting risk

⚫ audit management involves coordinating the annual audit process

⚫ budget oversight involves ensuring budget data accuracy

⚫ tax management involves regulatory reporting and tax filings

2️⃣ Treasury ensures your company meets financial obligations:

⚫ cash management involves forecasting daily cash requirements

⚫ banking management ensures efficient banking operations

⚫ currency risk management involves mitigating foreign currency exposure

⚫ risk management involves assessment and mitigation of key threats

⚫ financing coordinates long-term and short-term funding needs

⚫ investment management identifies suitable investment opportunities

3️⃣ FP&A provides decision-making support:

⚫ budget management involves creating the budget

⚫ financial analysis interprets company financial information

⚫ forecasting provides timely financial and operational trend analysis

⚫ scenario analysis helps identify and manage critical threats

⚫ strategic planning provides decision-making assistance

⚫ performance management involves establishing performance indicators

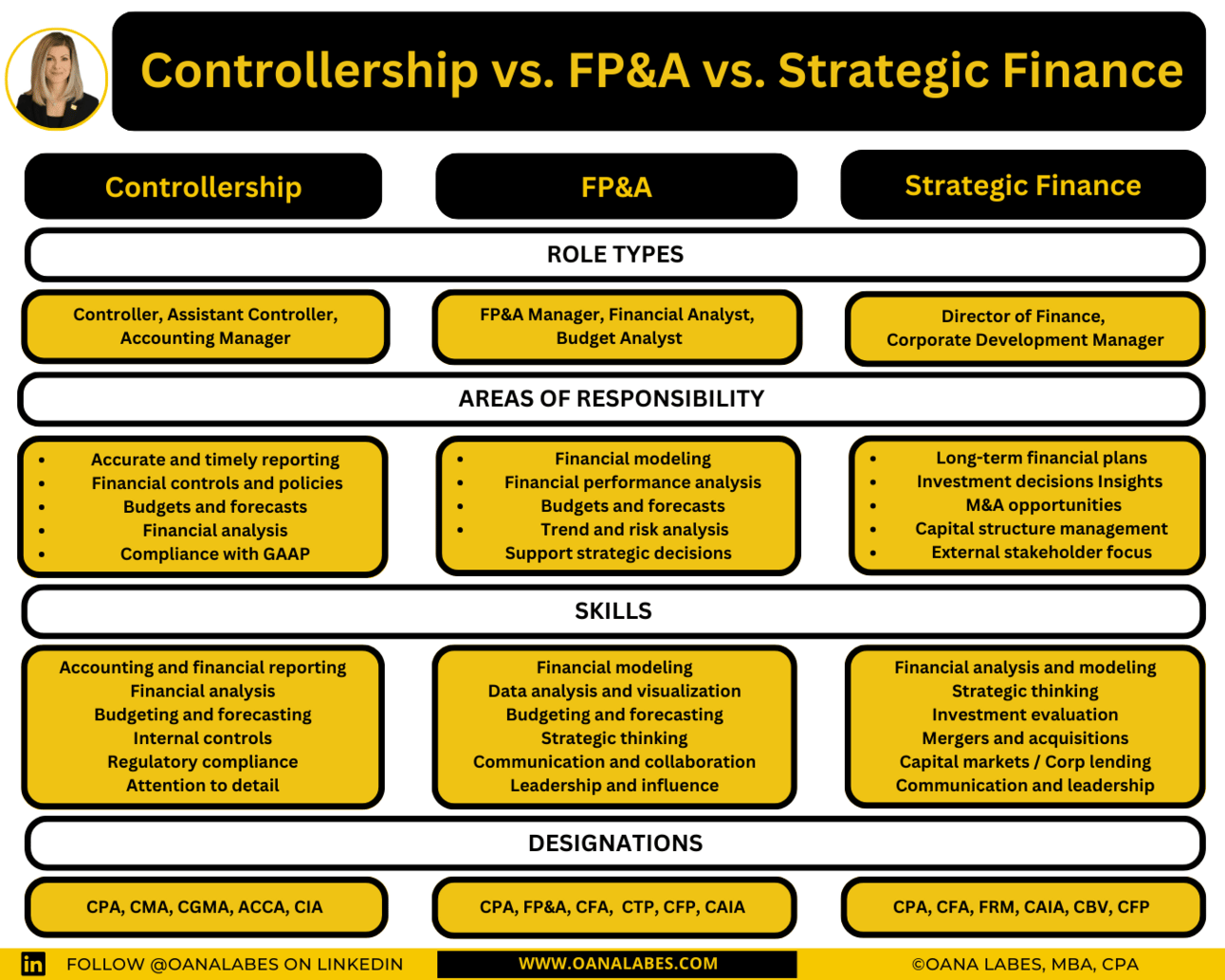

Controllership vs. FP&A vs. Strategic Finance

➡️ Controllership:

🎯 focuses on accounting and financial reporting

🎯 responsible for ensuring that financial statements are accurate, timely, and compliant with local GAAP

🎯 roles: Controller, Assistant Controller, Accounting Manager

🎯 competencies: accounting and financial reporting, budgeting and forecasting, internal controls, regulatory compliance

🎯 key relationships: other finance functions & other departments (operations, sales, procurement)

🎯 professional designations:

1. CPA (Chartered Professional Accountant /Certified Public Accountant)

2. CMA (Certified Management Accountant)

3. CGMA (Chartered Global Management Accountant)

4. ACCA (Association of Chartered Certified Accountants)

➡️ FP&A (Financial Planning and Analysis)

🎯 focuses on insights into financial performance for strategic decision-making

🎯 responsible for providing guidance on strategic business decisions based on financial data and analysis

🎯 roles: FP&A Manager, Financial Analyst, Budget Analyst

🎯 competencies: financial modeling, data analysis and visualization, budgeting and forecasting, strategic thinking, communication and influence

🎯 key relationships: other finance functions, other departments (sales, operations, procurement)

🎯 professional designations:

1. CPA (Chartered Professional Accountant /Certified Public Accountant)

2. FP&A (Certified Corporate Financial Planning & Analysis Professional)

3. CFA (Chartered Financial Analyst)

4. CMA (Certified Management Accountant)

5. CGMA (Chartered Global Management Accountant)

and others.

➡️ Strategic Finance

🎯 focuses on the long-term financial planning and analysis of the company

🎯 provides insights into investment decisions, mergers and acquisitions, and capital raising

🎯 roles: Director of Strategic Finance, Corporate Development Manager, Treasury Manager

🎯 competencies: financial analysis and modeling, business strategy, investments, M&A, capital markets, corporate banking, communication and leadership

🎯 key relationships: other finance functions, other departments (legal and operations) to execute investment and acquisition opportunities

🎯 professional designations:

1. CPA (Chartered Professional Accountant /Certified Public Accountant)

2. CFA (Chartered Financial Analyst)

3. FRM (Financial Risk Manager)

and others.

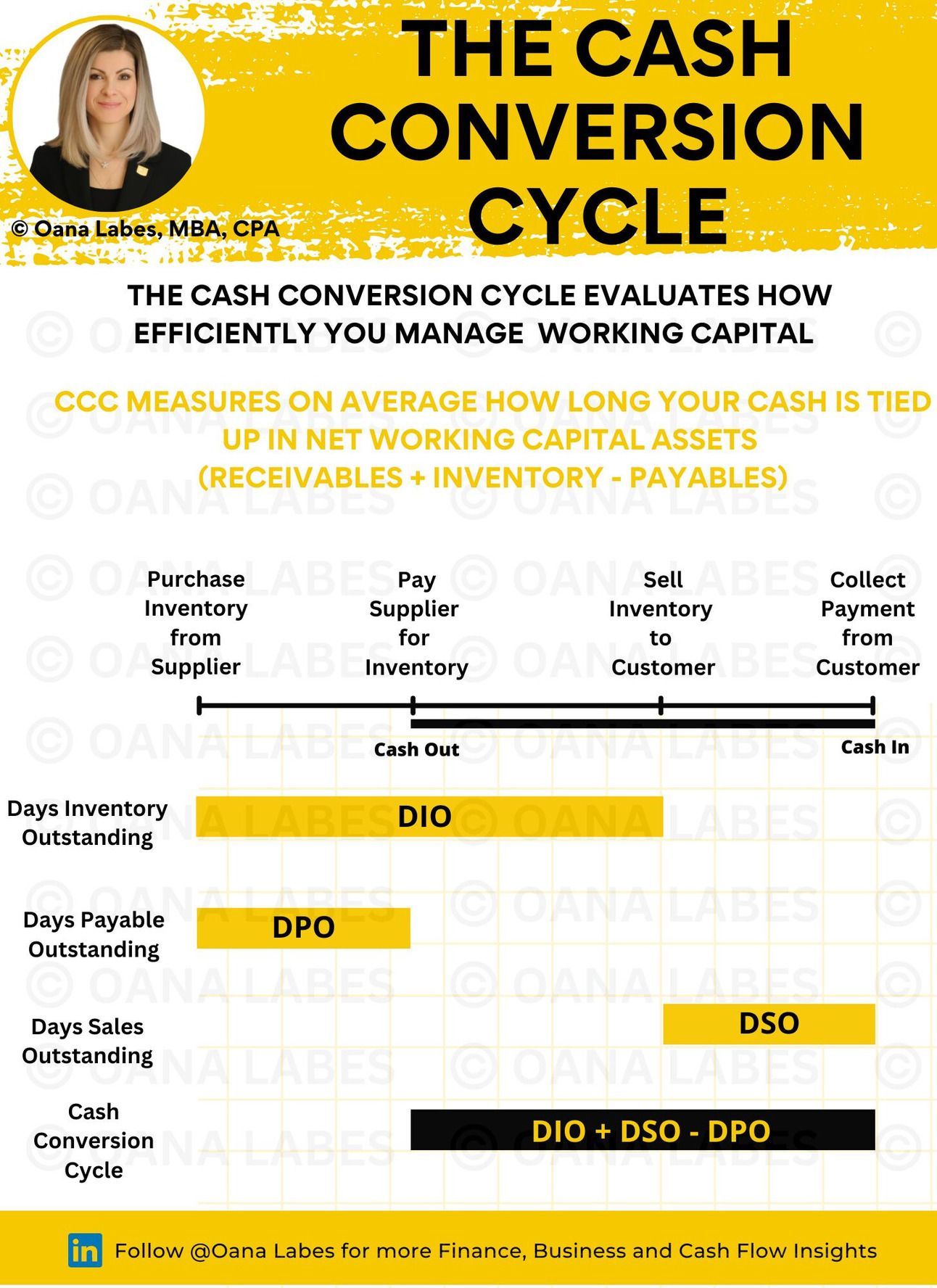

The Cash Conversion Cycle (CCC) drives your profitability.

☑️ To learn how to master these and many other essential cash flow concepts, check out my 5* Cash Flow Masterclass.

☑️ What is the CCC:

1. a cash flow KPI used to evaluate the efficiency of your company's working capital management

2. an essential tool to understand how effectively your company is managing liquidity and cash flow

☑️ How to use the CCC:

3. Track over periods, compare against historical and forecasted results, use to forecast future cash availability, compare with peers

4. The shorter the CCC, the faster your company converts inventory into cash, the better your liquidity, efficiency and operating cash flow

5. The longer the CCC, the longer your company takes to collect receivables & pay suppliers, which can result in cash flow issues and potential financial distress

6. Negative CCC indicates you’re leveraging your substantial bargaining power with suppliers and strong supply chain management to finance your working capital assets, operations and growth - i.e you only pay suppliers after collecting payment from customers

☑️ How to calculate the CCC:

7. The Formula for the CCC = DIO + DSO - DPO

8. Days Inventory Outstanding (DIO) = the average number of days it takes your company to sell its inventory

= Average Inventory / Purchases x 365

- Simplified formulas use COGS instead of Purchases in the denominator

- Purchases = Ending Inventory - Opening Inventory + COGS

9. Days Sales Outstanding (DSO) = the average number of days it takes your company to collect payment from customers

= Average Accounts Receivable / Credit Sales x 365

10. Days Payable Outstanding (DPO) = the average number of days it takes your company to pay suppliers for goods and services received

= Average Accounts Payable / COGS x 365

☑️ How to manage the CCC:

11. The correct approach to managing the CCC is focused on optimization:

>> reduce DIO without jeopardizing sales due to stock outs

>> reduce DSO without loosing sales opportunities

>> increase DPO without jeopardizing supplier relationships

12. Working capital management can dramatically change your profitability by impacting inventory holding costs, terms with suppliers, speed of sales turnover and ability to support your sales growth.

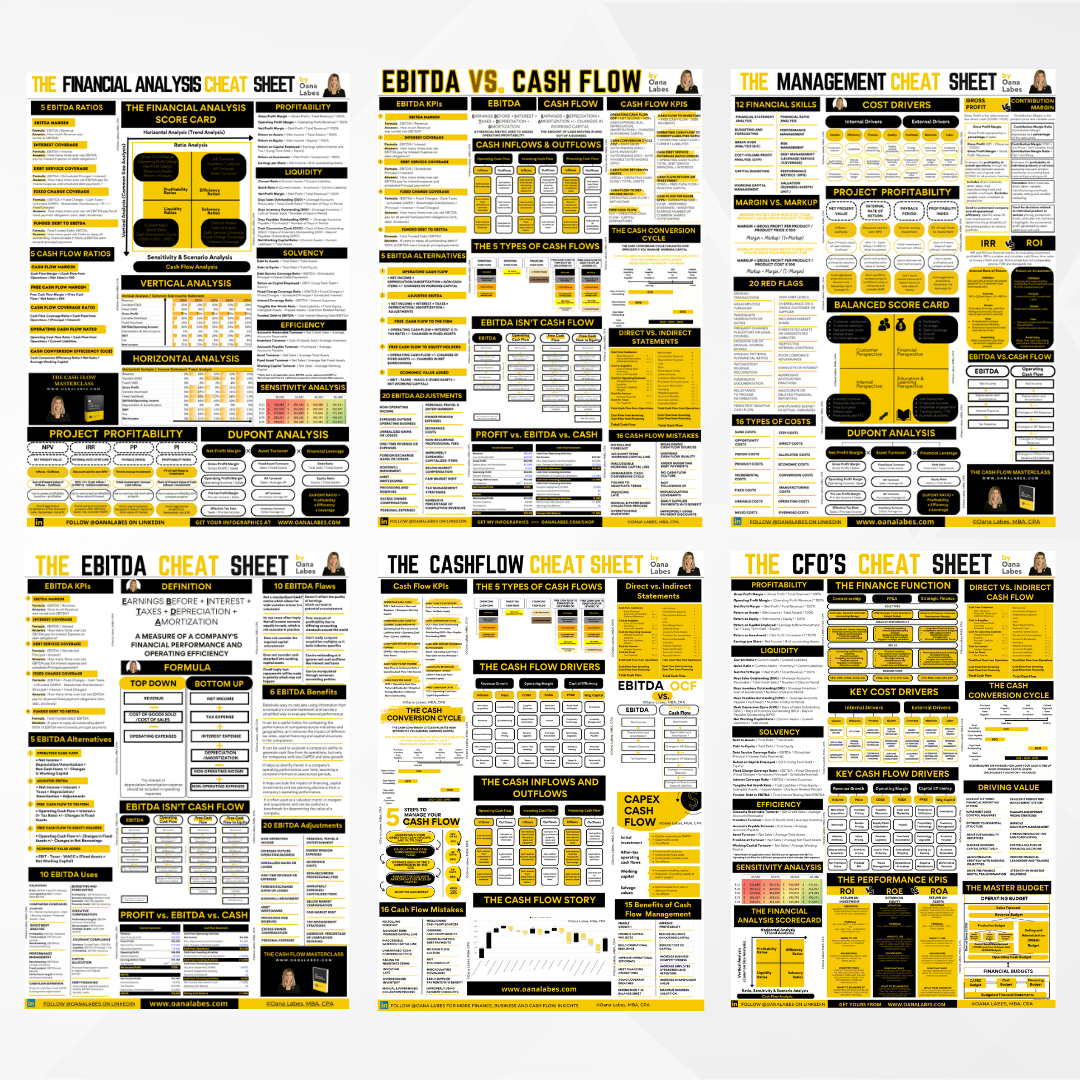

The Corporate Finance Cheat Sheet

Because one insightful page can hold most of the knowledge you need.

Corporate Finance can be tough to understand.

But having the right perspective can change everything.

👉 𝐇𝐞𝐫𝐞 𝐢𝐬 𝐰𝐡𝐚𝐭 𝐭𝐡𝐢𝐬 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 10-𝐢𝐧-1 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐂𝐡𝐞𝐚𝐭 𝐒𝐡𝐞𝐞𝐭 𝐋𝐢𝐭𝐞 𝐢𝐧𝐜𝐥𝐮𝐝𝐞𝐬:

🎯1. Financial model assumptions for growth, cost breakdown, CAPEX and working capital investments, salvage values, tax rate and initial equity investment

🎯2/3/4. Vertical dynamic 3-statement financial model linked to assumptions for the Income Statement, Balance Sheet and Cash Flow Statement

🎯 5. Working Capital Schedule linked to financial statement model with component calculations for the Cash Conversion Cycle (DSO, DIO and DPO)

🎯 6. Break-even Analysis: Contribution Margin & Break Even Revenue

🎯 7. Capital Budgeting: NPV, IRR, Payback Period

🎯 8. Financial Analysis Ratios & Metrics

🎯 9. Vertical / Common Size Analysis

🎯 10. Horizontal / Trend Analysis

☑️ Download a free copy of the Lite version here, or purchase the 16-in-1 Full Model in my digital store.

Referral Program

If you’re enjoying this newsletter, please forward it to a friend. It only takes 3 seconds. Writing this took 4 hours.

Share The Finance Gem 💎 with your team and peers, and earn exclusive rewards!

🎯Refer 5 people who sign up using your custom link below, and get my eBook 10 Essential Strategic Finance Concepts that link Accounting, Finance and Strategy. Exclusive to you as a referring subscriber.

🎯Refer 10 people who sign up using your custom link below, and get an exclusive $10 Off coupon for your favorite infographic in my digital store.

Poll Time

What was your favorite topic this week?

How did it feel reading this week's issue?

As always, if you have suggestions or feedback, simply reply to this email.

Looking for More ?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on-demand video course.

Work with me. Tap into my 20+ years of strategic finance & business intelligence, and get coaching for your own career. Availability is very limited. Book here.

Get growth business advisory for your organization with short, medium and long term financial planning, and big-picture financial models so you’re always finance-ready. Reach out here.

Sponsor a future issue of The Finance Gem 💎and get your brand in front of an exceptional audience of strategic finance, accounting, sales and technology professionals and executives.

Train your team on strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana

: