WELCOME TO ISSUE NO #69

Webinar | Masterclasses | Shop | Newsletter | Speaking | Training

THIS WEEK’S ISSUE AT A GLANCE

This issue’s finance Gems 💎 vote your favorite in the poll section

Accounting vs. Finance Careers

The CEO’s Performance Checklist

20 Cash Flow Drivers to Know

7 Cost Drivers to Use

BONUS Content: My custom cash flow measure

The Finance Gem has gone bi-weekly

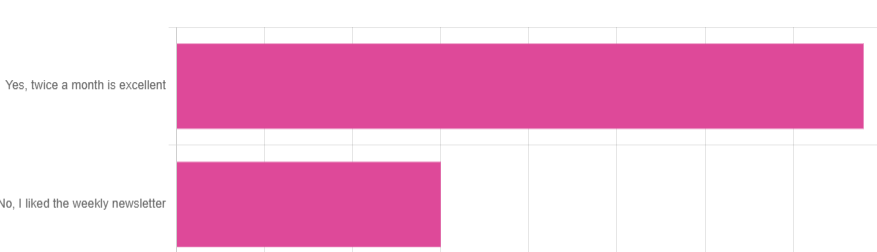

Thanks to all that have taken the time to answer the poll below. For everyone else getting value from this newsletter, here’s your chance to contribute your thoughts!

Thousands of you reached out and answered polls over the past few months to suggest the length and frequency of the newsletter could be revised. I’m starting by reducing the frequency from 4x monthly to 2x monthly. Stay tuned for more updates.

As of this issue, you will find more custom content and practical examples included in every post to help you both understand and apply concepts better.

Let me know if you’re loving these changes using the poll below!

Are you excited to hear The Finance Gem will publish less frequently?

Check out the results of some of this week’s polls and share your votes and comments below:

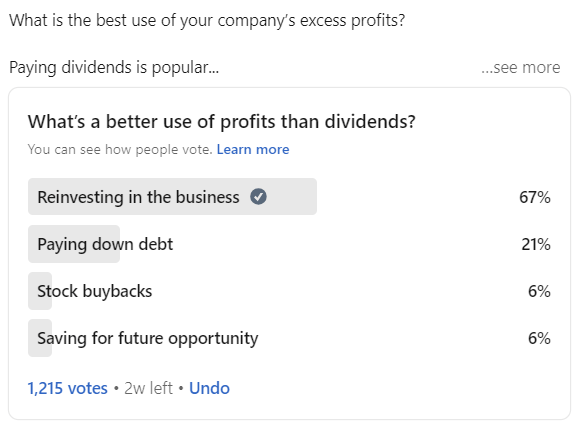

Poll #1 - what’s your take?

What's a better use of profits than dividends?

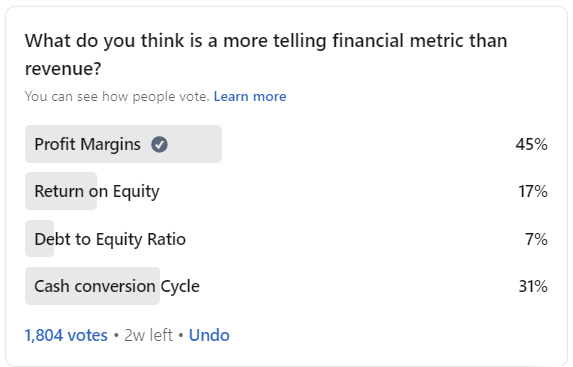

Poll #2 - what’s your take?

What do you think is a more telling financial metric than revenue?

Poll #3 - what’s your take?

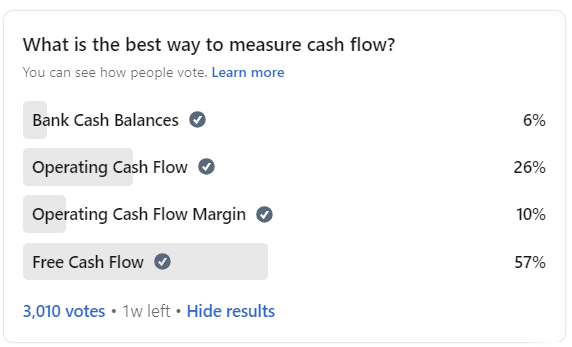

What is the best way to measure cash flow?

My new course is now live: The Financial Analysis Masterclass sale is on. Save with the launch price for a limited time. Details below.

I’m speaking once again at the largest finance conference in the world! AFP2024 takes place in Nashville in October - reply to this email to let me know if you’re attending!

If you had a magic wand, what would you change about The Finance Gem💎?

Upgrade to continue reading.

Become a paying subscriber of The Finance Gem to get access to this post and the entire archive of past posts, indexed by topic. Enjoy additional exclusive benefits like access to masterclass courses, webinars and Q&A sessions.

Upgrade