Welcome to a new edition of The Finance Gem 💎

Here are this week’s strategic finance gems to help you accelerate your career and grow your business.

This newsletter issue is brought to you by Jotform, a powerful online form builder that makes it easy to create robust forms and collect important data. The platform is trusted by over 20M users worldwide, such as nonprofits, educational institutions, small businesses, and enterprises. Jotform also powers my Cash Flow Masterclass sign up forms for upcoming webinars and purchase parity discounts. The starter plan is free for up to 5 forms, so if you’d like to test it out use my affiliate link to create an account and give it a try today.

And Speaking of Cash…

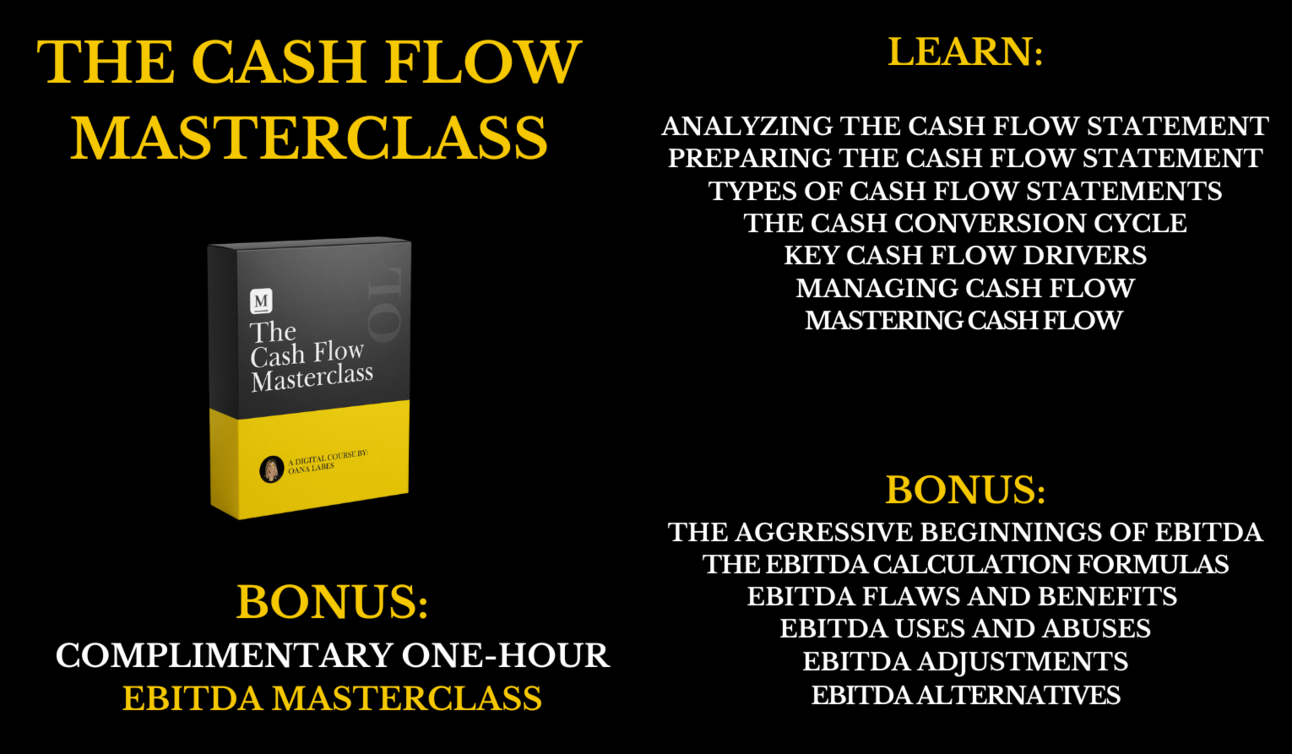

For a limited time, when you buy The Cash Flow Masterclass, you will also receive the exclusive recording of my 1-hour EBITDA Masterclass webinar. Don’t miss this exclusive opportunity to gain a deeper understanding of EBITDA, and the practical skills needed to make better strategic decisions when using this critical financial metric. But hurry up - this special offer is only valid until August 12!

Don’t miss out!

Professionals just like you from a variety of backgrounds are loving The Cash Flow Masterclass. Here’s what everyone’s saying:

“The slides, quizzes and infographics are of excellent quality

“Practical insights that can be easily applied in our day to day life”

“The Cash Flow Masterclass is amazing.”

“This course is necessary for all finance professionals.”

“The course is excellent.”

“I must say it was an incredibly valuable experience. “

“Great value and both practical skills and strategic knowledge”

“The instructor did an excellent job of explaining these concepts”

Don’t get left behind!

Click below I look forward to seeing you in class!

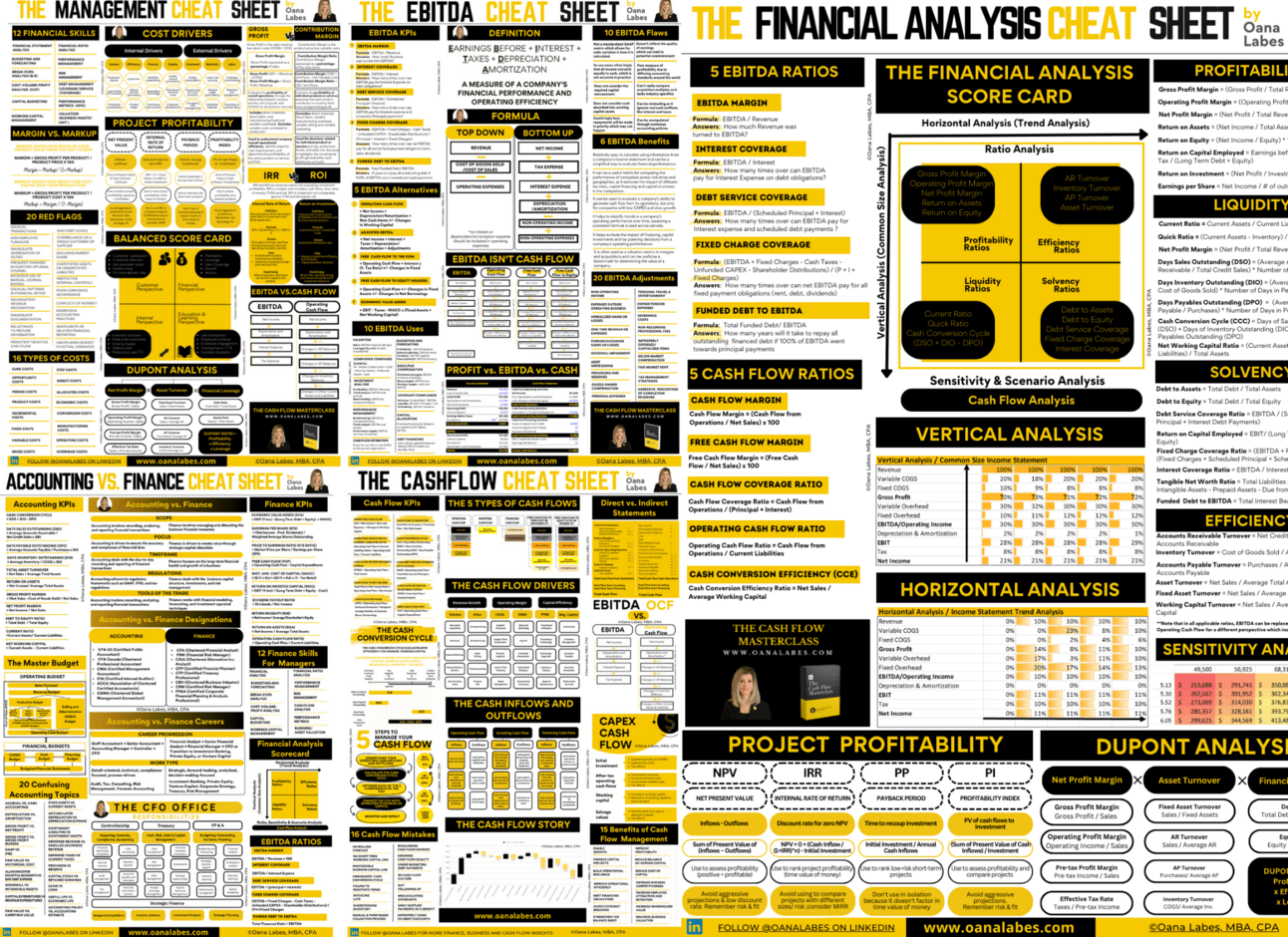

New this Week

My viral cheat sheets, checklists and infographics are now available in full resolution. Visit my web store and turn your favorites into posters! Or give them as gifts and become the coolest finance buff!

Another EBITDA Webinar is in the works for this fall in partnership with CPA Ontario. Given the success of the first one, this one will be FREE but spaces will be limited. Add your name to this list to learn about it first.

If you’re on Twitter, please follow me there as well and reach out to connect: @IAmOanaLabes

Coming Soon: The Finance Gem 💎Referral Rewards

What would you rather get for introducing your coworkers to The Finance Gem?

Good Reads to Subscribe for this Week

The Power of Incentives by Secret CFO

How to Read Tech Balance Sheets by Tech CFO

Your CFO Guy Blog by Josh Aharonoff

Trends in Finance & Accounting by Anders Liu-Lindberg

The Best Investment Content by Quality Compounding

Financial Modelling Education Blog by Chris Reilly

This week’s Strategic Finance Insights

5 Key EBITDA Ratios you Should Know and Use

Is EBITDA the same as Free Cash Flow?

14 Types of Costs you Should Know

20 Cost KPIs

The CFO Cheat Sheet

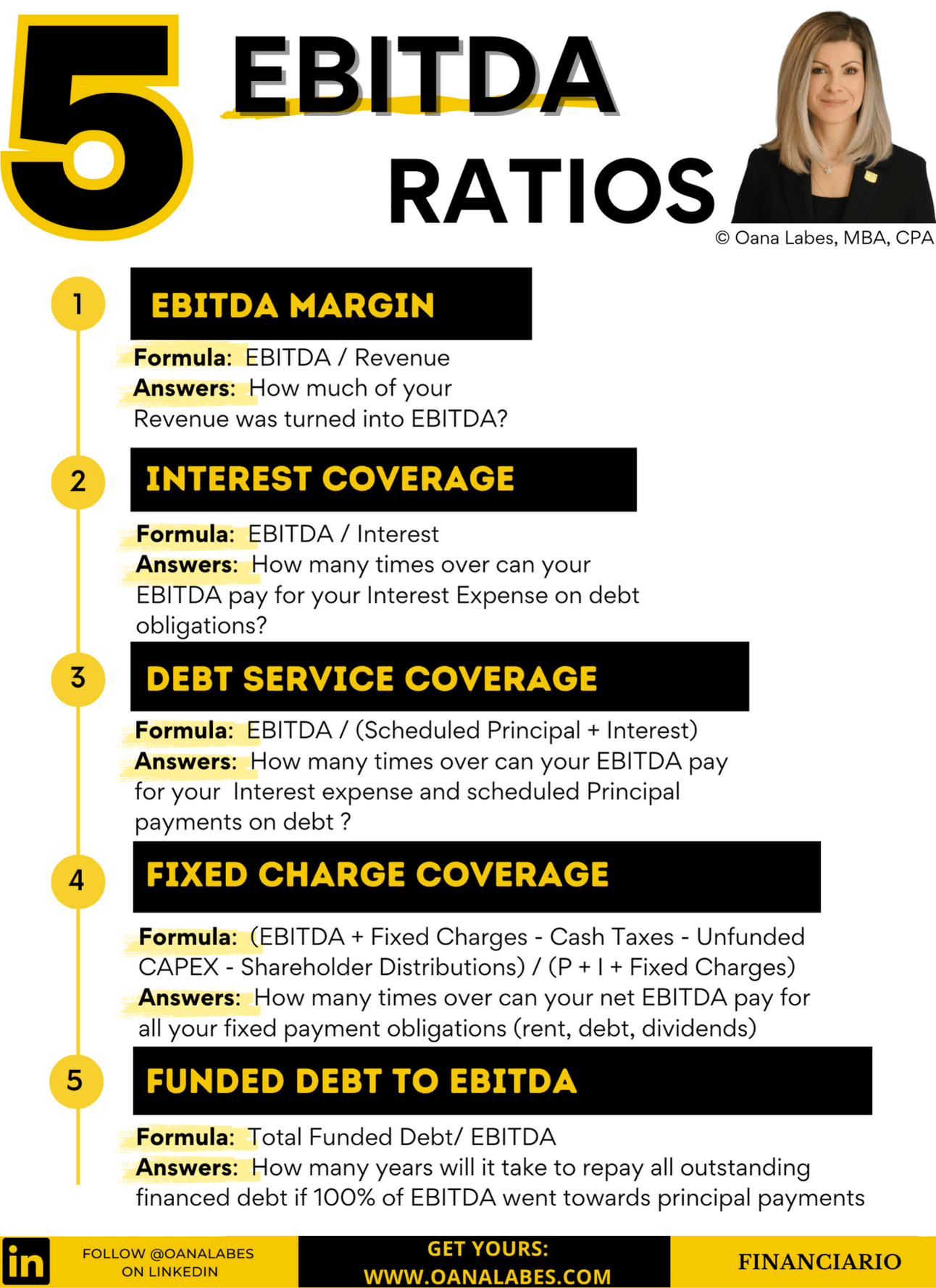

5 Key EBITDA Ratios you Should Know and Use

Use them to track your profitability, debt servicing capability and leverage.

1// EBITDA margin

🎯 How to Calculate: Divide EBITDA by Revenue x 100

🎯 Why Calculate: To determine the percentage of Revenue that gets converted into EBITDA (operating profit before interest, taxes, depreciation and amortization)

🎯 How to Use:

>> Industry Benchmarking

>> Financial Analysis

2// Interest Coverage

🎯 How to Calculate: Divide EBITDA by Interest Expense

🎯 Why Calculate: To determine whether the EBITDA you generated in the period is sufficient to pay for the company’s Interest Expense during the period

🎯 How to Use:

>> Industry Benchmarking

>> Financial Analysis

>> Covenant Tracking and Compliance

3// Debt Service Coverage

🎯 How to Calculate: Divide EBITDA by the total scheduled Principal + Interest payments made during the period.

🎯 Why Calculate: To determine whether your company can pay for its Interest expense as well as scheduled Principal payment obligations using the EBITDA generated during the period.

🎯 How to Use:

>> Financial Analysis

>> Covenant Tracking and Compliance

4// Fixed Charge Coverage Ratio

🎯 How to Calculate:(EBITDA + Fixed Charges - Cash Taxes - Unfunded CAPEX - Shareholder Distributions) / (Principal +Interest +Fixed Charges)

🎯 Why Calculate: To determine whether your company can pay for its fixed payment obligations (Interest, Scheduled Principal, Rent) using the EBITDA generated in the period, adjusted to reflect the cash drain of unfinanced CAPEX and distribution payments made to shareholders

🎯 How to Use:

>> Financial Analysis

>> Covenant Tracking and Compliance

5// FD/EBITDA

🎯 How to Calculate: Divide Total Financed Debt by EBITDA

🎯 Why Calculate: To determine how many years it would take you to repay the outstanding financed debt balance, assuming current EBITDA levels are maintained in future years and 100% of annual EBITDA went towards debt repayment.

🎯 How to Use:

>> Financial Analysis

>> Covenant Tracking and Compliance

Note that these are typically calculated as annual ratios so either Annual EBITDA, or Rolling 4 quarters EBITDA (the sum of EBITDA over 4 consecutive quarters) is used in formulas.

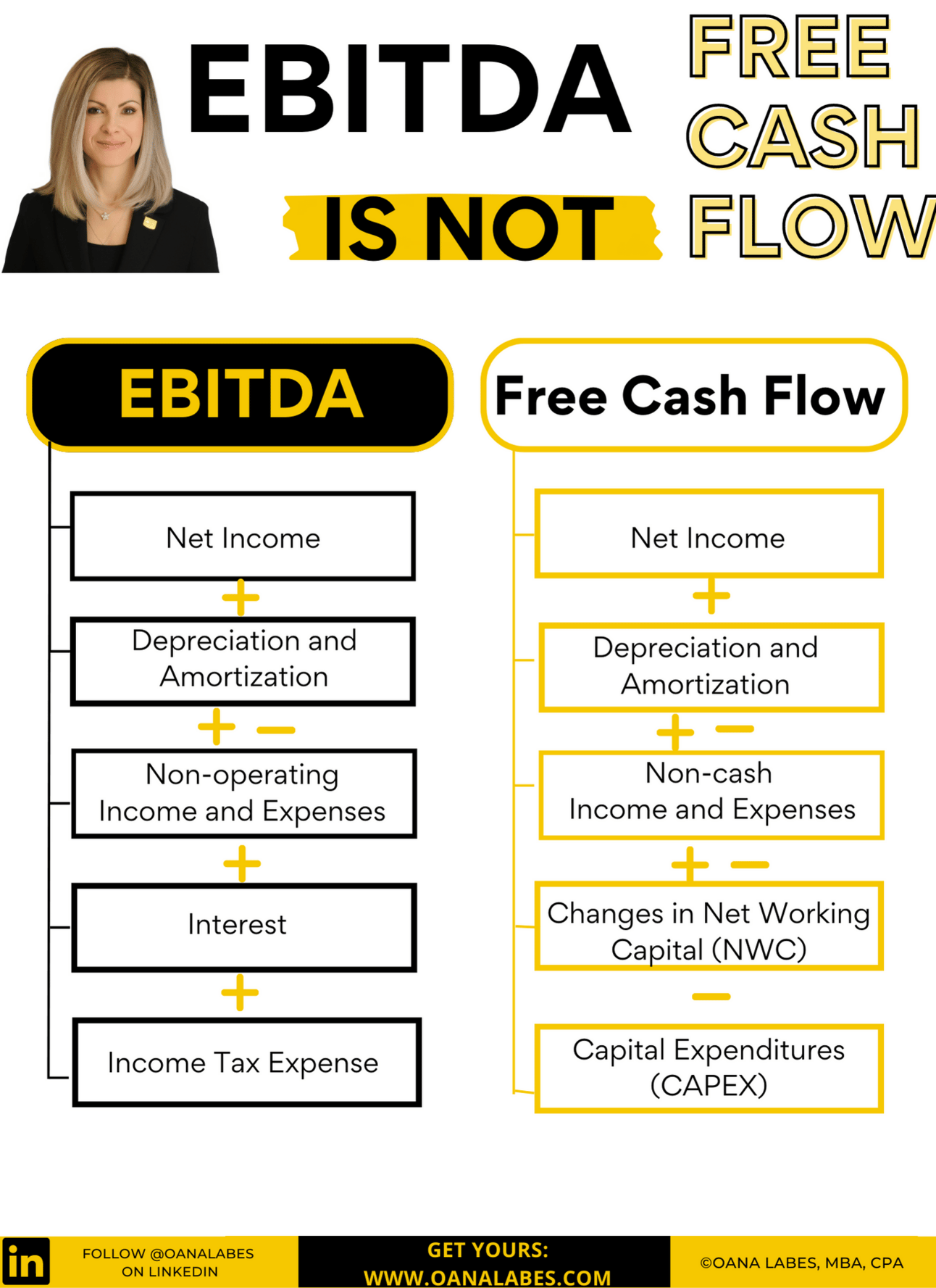

Is EBITDA the same as Free Cash Flow?

Is EBITDA the same as Free Cash Flow?

Not at all.

Here's why:

1️⃣ EBITDA is not a GAAP metric so everyone calculates it however they like.

Then they try to persuade you to buy into their formula.

2️⃣ EBITDA implies that all net income translates into cash the same way, ignoring non cash expenses and working capital changes.

3️⃣ EBITDA does not consider the amount of required reinvestment in fixed assets.

For capital intensive businesses, at a minimum these should cover minimum replacement CAPEX and roughly match non-cash depreciation expense.

4️⃣ EBITDA implies that the company will first use available cash flows to repay debt principal payment obligations.

In fact it could distribute it all to the shareholders before any debt payments are made.

5️⃣ EBITDA doesn’t say anything about the quality of earnings, which could be poor due to aggressive revenue and expense recognition policies.

🎯 If EBITDA is flawed and so far off cash flow, we need cash flow metric to replace it.

What about 𝗙𝗿𝗲𝗲 𝗖𝗮𝘀𝗵 𝗙𝗹𝗼𝘄 (𝗙𝗖𝗙)?

☑️ This is the cash remaining in the business after considering cash outflows that support operations (OPEX + working capital) and maintain its fixed capital assets (CAPEX).

☑️ Free Cash Flow (FCF) Formula

= Operating Cash Flow +/- Changes in Fixed Assets

☑️ Advantages of Free Cash Flow:

✅ Easy to calculate

✅ Available to both capital providers and borrowers

✅ Resolves some important EBITDA flaws and accounts for both CAPEX and cash consumed by sales growth or working capital efficiency losses

☑️ Limitations of Free Cash Flow:

❌Assumes all CAPEX is a required investment, despite the fact most companies have an annual mix of replacement and growth CAPEX

❌Overstates CAPEX in the year of acquisition and understates it in subsequent years

❌There is no standardized calculation of Free Cash Flow so for external use it’s important to check with your banks or investors for their definitions

❌ Can be manipulated just like the other accounting metrics. A company that wants to increase free cash flow can simply under-invest in fixed assets.

14 Types of Costs you Should Know

🎯 Costs by Relevance to Decision Making

➡️ Relevant/Incremental Costs: Future costs that are relevant to decision-making

➡️ Irrelevant/Sunk Costs: Past costs that are irrelevant to decision-making

🎯 Costs by Function

➡️ Product Costs: Inventoried costs associated with the production of products or services

➡️ Period Costs: Costs not related to production and expensed in the period

➡️ Manufacturing Costs: total costs associated with the production of goods, including direct materials, direct labor, and manufacturing overhead

➡️ Operating Costs: total costs associated with day to day operations

➡️ Conversion Costs: costs incurred when converting raw materials into finished products

➡️ Overhead Costs: indirect costs not tied to a specific product or service, often including items like rent, utilities, and administration costs (can be manufacturing or non-manufacturing)

🎯 Costs by Traceability

➡️ Direct Costs: Costs that can be traced directly to a specific cost object

➡️ Indirect Costs: Costs that cannot be traced directly to a specific cost object

🎯 Costs by Behavior

➡️ Fixed Costs: Costs that remain constant regardless of the level of production or services

➡️ Variable Costs: Costs that vary in direct proportion to the level of production

➡️ Semi-variable Costs/Mixed Costs: Costs that contain both fixed and variable components

➡️ Step Costs: Costs that remain fixed only for a certain volume or range of activity

20 Cost KPIs

1// Cost of Goods Sold (COGS) and COGS Margin

🎯 Your direct costs associated with producing a product or delivering a service, expressed in absolute terms or as a percentage of revenue

COGS = Direct Materials + Direct Labor + Manufacturing Overhead

COGS = Opening Inventory + Purchases - Ending Inventory

2// Cost of Goods Sold (COGS) per Manufacturing Employee

🎯 The direct costs you incurred per manufacturing employee, as a measure of the productivity and efficiency of your manufacturing workforce

3// Cost of Goods Sold (COGS) per Sq. FT or Sq. M

🎯 The COGS you incurred per unit of manufacturing space expressed in square feet or meters, as a measure of your space utilization efficiency

4// Operating Expenses (OPEX) and OPEX Margin

🎯 The operating costs associated with your operation of the business, expressed in absolute terms or as a percentage of revenue

5// Operating Expenses (OPEX) per Non-Manufacturing Employee

🎯 The OPEX you incurred per non-manufacturing employee (sales, administration, engineering), as a measure of the productivity and efficiency of your non-manufacturing workforce

6// Operating Expense (OPEX) per Sq. FT or Sq. M

🎯 The OPEX you incurred per unit of SG&A space, as a measure of utilization efficiency for the sales and administration workspace.

7// Total SG&A Expense and SG&A Margin

🎯 The Selling, General and Administrative expense associated with your operation of the business, expressed in absolute terms or as a percentage of revenue.

8// Total Payroll Expense to (COGS + OPEX)

🎯 The total Payroll expense (manufacturing and non-manufacturing) relative to your total costs (COGS and OPEX), as a measure of the proportion of your total expenses absorbed by employee compensation and benefits.

Note that SG&A is a subcomponent of OPEX, and Payroll is a subcomponent of SG&A.

9// R&D Expense and R&D Expense Margin

🎯 The Research and Development expense incurred, expressed in absolute terms or as a percentage of revenue, as a measure of your innovation spend relative to the revenues generated in your business.

10// Sales and Marketing Expense and Margin

🎯 The Sales and Marketing expense you incurred, expressed in absolute terms or as a percentage of revenue, as a measure of how well your company is using its sales and marketing resources to drive up revenue.

11// Total Operating Cost

🎯 The total of direct and indirect, product and period expenses you incurred.

This measure is used to calculate your Operating Profit and determine your residual revenues after paying for all business expenses except Interest and Taxes.

12// Total Fixed Cost

🎯 The sum of all your business fixed costs, used to calculate your company’s break even point and determine the level of revenue or number of unit sales you need to break even and start earning a profit.

Note that Total Cost is also used to calculate your operating leverage, which is the proportion of fixed vs variable costs in the business.

13// Variable Cost per Unit

🎯 The sum of all your variable costs divided by the number of units produced, used to calculate your company’s contribution margin per unit and analyze the level of profitability across your various products, lines, customers and geographies.

Note that Variable Cost per unit is also used to calculate your company’s break even point and determine the level of revenue or number of unit sales required to break even and start earning a profit.

14// Client Acquisition Cost (CAC)

🎯 The cost of acquiring a new customer for your business, calculated by dividing the total Sales and Marketing expense by the number of new customers acquired during the period.

15// Cost per Click

🎯 The cost of acquiring a single click on your paid business advertisement, calculated by dividing your total advertising campaign cost by the number of clicks received, and used to determine the efficiency and return of your digital advertising expenditures.

16// Inventory Holding Cost

🎯 The total cost of carrying inventory in your business, including costs associated with storage and handling, obsolescence and spoilage, waste and inefficiencies, theft, insurance and also financing costs as part of a credit facility.

17// Accounts Payable Carrying Cost

🎯 The total cost of carrying a balance in your supplier accounts, mostly related to the cost of foregone early payment discounts offered.

These can easily annualize to more than the annual interest costs than would otherwise have been incurred borrowing to settle the AP early.

18// Accounts Receivable Carrying Cost

🎯 The total cost of extending credit to your customers, including costs associated with staff processing and collecting AR, financing costs incurred to borrow the funds owed by your customers in order to settle supplier payments and operating business expenses, and bad debt costs associated with uncollectible accounts.

19// Average Cost of Debt

🎯 The total interest expense associated with borrowing money, averaged across all your credit facilities and weighted based on their relative proportion in your total borrowed capital.

20// Average Cost of Equity

🎯 The Cost of Equity is a function of the risk free rate offered in your market, as well as the risk premium that would be required by an investor to accept the risk of investing in your business.

Note that additional risk premiums are typically added and further increase the average cost of equity calculated for small companies, companies in volatile industries, or companies with a weak management team and products nearing the end of their lifecycle.

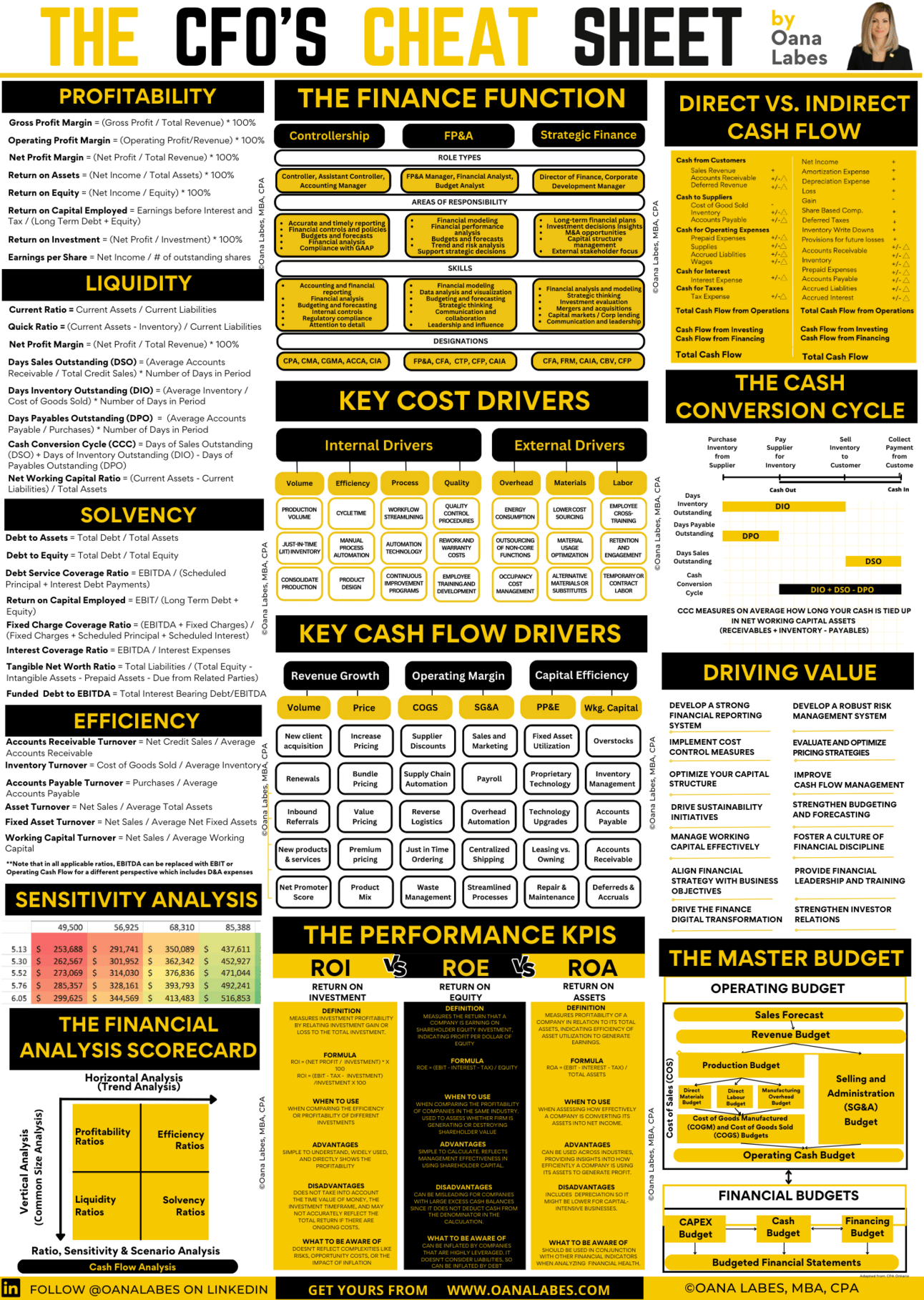

The CFO Cheat Sheet

The CFO role is taxing.

They must hold their ground with the CEO.

They must oversee the company’s health, wealth and future.

They must align the vision and the mission with financial objectives.

They must also shape the company culture and enhance productivity.

Here' s the CFO Cheat Sheet to help you on your way to financial leadership.

⚫⚫⚫Here’s what’s included in the CFO’s Cheat Sheet:

🎯 The Finance Function

🎯 Key Cost Drivers

🎯 Key Cash Flow Drivers

🎯 The Financial Analysis Scorecard

🎯 Key Profitability Ratios

🎯 Key Liquidity Ratios

🎯 Key Solvency Ratios

🎯 Key Efficiency Ratios

🎯 Sensitivity Analysis

🎯 The Performance KPIs

🎯 Direct vs. Indirect Cash Flow

🎯 The Cash Conversion Cycle

🎯 Driving Value

🎯 The Master Budget

Use this CFO Cheat Sheet to stay close to these critical financial leadership concepts, and help improve your company's profitability and sustainability.

Download a FREE PDF copy here. Or Buy it from my store to support my work.

How did you enjoy this week's newsletter?

Want more strategic finance insights?

Upgrade your strategic finance skills with The Cash Flow Masterclass. Leverage my unique on-demand video course to improve your knowledge, elevate your decision making and accelerate your career. For customized team training please apply here.

Sponsor a future issue of The Finance Gem 💎and get your brand in front of an exceptional audience of strategic finance, accounting, sales and technology professionals and executives.

Train your team in strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana