Welcome to this week's edition of The Finance Gem 💎 where I bring you my unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter edition is brought to you by The SaaS Metrics Foundation Live Course, a one-of-a-kind, 6-week live program for The SaaS CFO community who want to learn how to transform the financial operations of their SaaS business.

This is The SaaS Academy's 7th successful cohort-based course and will be delivered live starting April 6th (early bird rate expires March 17th) with video lessons dripped each week, live sessions held every week, and tons of access to founder and instructor Ben Murray, a 25 year veteran SaaS CFO and founder of the SaaS Metrics Standards Board.

If you're a SaaS founder, executive, finance & accounting business partner, or investor, you need to speak the language of SaaS so that you don’t get lost or left behind. Learn to make better financial decisions, advance your career and your SaaS business with The SaaS Metrics Foundation Live Course. Get the early bird rate and enroll today!

I'm excited to share that I'm currently working on several on-demand digital courses and a live cohort-based course for you over the next few weeks and months. 2023 will be full of exciting surprises, lots of new strategic finance content for you to love, and many opportunities to join me in live sessions on Linkedin. Stay tuned for the pre-sale announcements and vote below for the strategic finance topic(s) you're most excited to learn with me.

Which strategic finance topic are you most excited to learn with me:

This week's strategic finance insights:

Without further ado, let's begin:

Do you know what they are, how to calculate them, and most importantly, when (not) to use them?

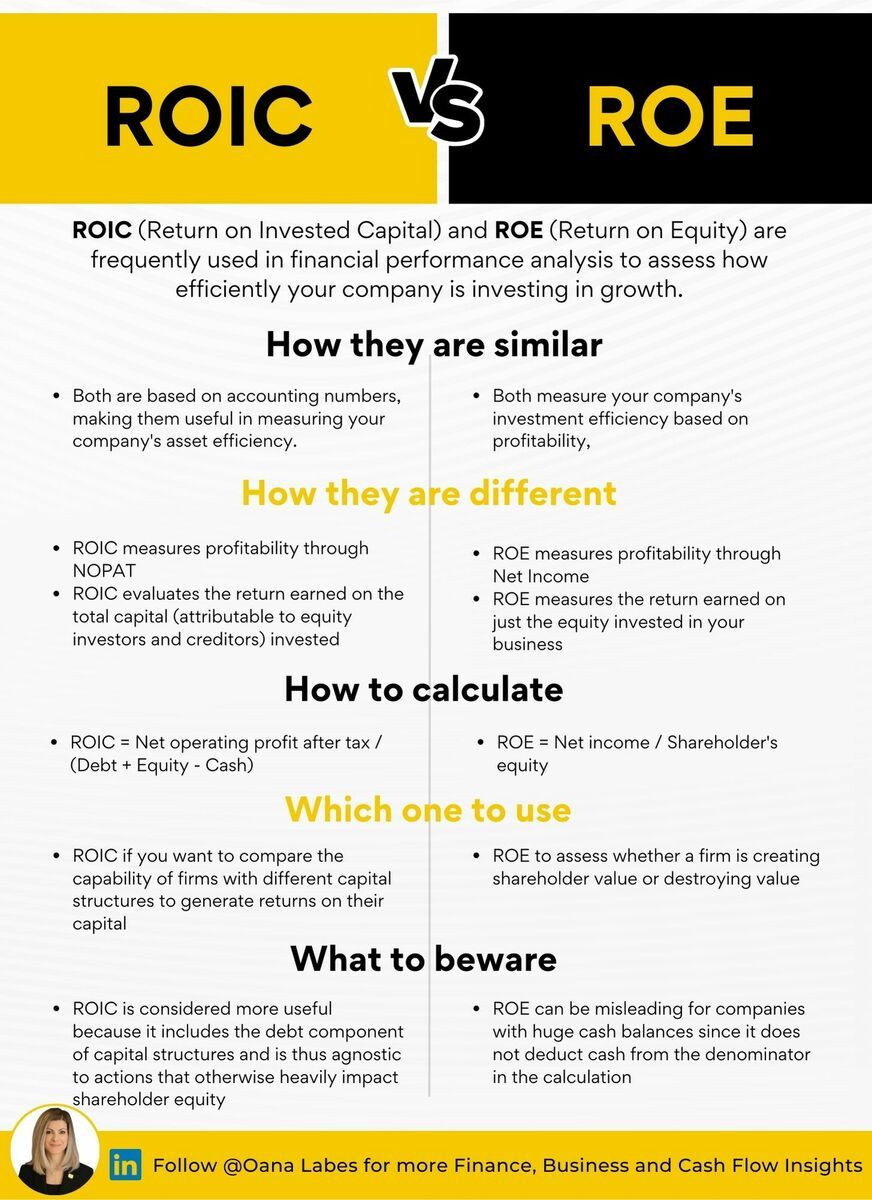

🎯 ROIC (Return on Invested Capital) and 🎯 ROE (Return on Equity) are frequently used to assess how efficiently your company is investing in growth.

🎯 These profitability ratios are often confused because they’re as similar as they are different.

🎯 How they are similar:

⚫ Both are based on accounting numbers, making them useful in measuring a company's asset efficiency.

⚫ Both measure your company's investment efficiency based on profitability

🎯 How they’re different:

⚫ ROE measures profitability through Net Income, ROIC measures profitability through NOPAT

⚫ ROE measures the return on just the equity invested in your business, ROIC evaluates the return earned on the total capital (attributable to equity investors and creditors) invested in your business

🎯 How to calculate them:

⚫ ROE = Net income / Shareholder's equity

⚫ ROIC = Net operating profit after taxes / (Debt + Equity - Cash)

🎯 Which one to use (and potentially compare to WACC):

⚫ ROE to assess whether a firm is generating shareholder value or destroying value

⚫ ROIC if you want to compare the capability of firms with different capital structures to generate returns on their capital

🎯 What to beware:

⚫ ROE can be misleading for companies with huge cash balances since it does not deduct cash from the denominator in the calculation

⚫ ROIC is generally considered more useful because it includes the debt component of a firm and thus becomes insensitive to actions that can heavily impact shareholder equity

ROIC vs. ROE - Oana Labes, MBA, CPA

Most companies understand that managing their working capital translates into higher cash balances.

However, there is a huge gap between understanding and doing.

🎯 Here are 5 strategic benefits of effective working capital management:

✔️help fund business growth

✔️strengthen your balance sheet

✔️improve your operating performance

✔️reduce your reliance on outside capital

✔️increase your ability to navigate a slowdown

🎯 And here are 4 steps to effectively manage your working capital:

➡️ Know your Objectives and Risks for each working capital account

➡️ Identify the critical KPIs you need to measure and monitor

➡️ Standardize Best Practices

➡️ Learn Key Tips & Tricks

Download my "Manage your Working Capital" Carousel here:

Not everyone needs all these at once.

But if you're in leadership today, or aspire to be in a leadership role in the future, your career would greatly benefit from an understanding of these key finance skills.

1️⃣ Financial Statements Basics

🎯 Understanding the basic financial statements (income statement, balance sheet, and cash flow statement), how they are used and how they are related

2️⃣ Financial Ratio Analysis

🎯 Understanding how to calculate common sized statements and critical ratios to track liquidity, profitability, solvency, coverage, returns and efficiency, and to interpret and monitor results over time

3️⃣ Budgeting and Forecasting

🎯 Creating and managing a budget, forecasting future financial performance, understanding key revenue and cost drivers, calculating and analyzing variances

4️⃣ Break-even and Cost-Volume-Profit Analysis

🎯 Understanding fixed and variable costs, contribution vs. gross margin, break-even quantity and revenue, target profit pricing, how changes in costs, volume, and price impact profitability

5️⃣ Capital Budgeting

🎯 Evaluating and selecting long-term investments, such as new equipment or facilities based on criteria that ensures the company's continued growth and profitability

6️⃣ Time Value of Money (TVM)

🎯 Understanding that money is more valuable in the present than the future due to the opportunity for investment returns and risks associated with future cash flows, to support of better business investment and financing decisions

7️⃣ Risk Management

🎯 Understanding, identifying and responding to financial risks such as credit risk, market risk, and liquidity risk, to impact business cash flows and profitability

8️⃣ Financing Decisions

🎯 Making informed decisions about business or asset financing options via debt and equity

9️⃣ Performance Management

🎯 Utilizing key performance metrics to evaluate business, investment, divisional or team member performance against organizational objectives

🔟 Cash Flow Management

🎯 Understanding the cash flow implications of key business decisions, calculating relevant cash flow KPIs and understanding the most important cash flow drivers.

10 Finance Skills for Managers - Oana Labes, MBA, CPA

1️⃣ INDEX-MATCH

⚫ powerhouse combination function that allows you to look up a value in a specific cell within a range and match it with a value in another range.

2️⃣ SUMIFS

⚫ sums values in a range by filtering data based on several criteria.

3️⃣ CHOOSE

⚫ returns a value from a list of values based on a specified index number, to help you create dynamic models when you have multiple input options and you want to select one based on a particular condition or criteria

4️⃣ COUNTIFS

⚫ counts cells within a specified range based on multiple criteria

5️⃣ XNPV

⚫ calculates the net present value of an investment based on a series of irregular cash flows

⚫ useful for evaluating the profitability of investments with uneven cash flows

6️⃣ OFFSET

⚫ helps you create dynamic ranges by returning a reference to a range that is a specific number of rows and columns from a cell or range of cells.

7️⃣ IFERROR

⚫ helps you avoid errors by returns a value you specify in case a formula calculates to an error.

8️⃣ SUMPRODUCT

⚫ multiplies the corresponding components of arrays or ranges of data to return the sum of the products

9️⃣ XIRR

⚫ calculates the internal rate of return of an investment, based on a series of irregular cash flows

⚫ also helps to evaluate the profitability of investments with uneven cash flows

🔟UNIQUE

⚫ helps you remove duplicates by selecting and returning a list of unique values from a specified range.

Download the Excel Formulas Bible here:

A CFO (Chief Financial Officer) is a member of the senior management team, reporting directly to the CEO and/or the Board of Directors.

The CFO’s Office:

🎯 oversees the financial operations of your organization

🎯 ensures your financial resources are managed efficiently and effectively

Here are the 14 Key Responsibilities of the CFO Office you should Know:

1. Financial planning and analysis (FP&A)

🎯 create and manage your company’s financial plan: budget, forecast & analyze financial performance

2. Financial reporting / Controlling

🎯 ensure that your company's financial transactions are recorded accurately and that financial reporting follows accounting standards and regulations

3. Treasury

🎯 manage your company’s cash and liquidity, including cash management, cash flow forecasting, and borrowing and investment strategies

4. Risk management

🎯 identify, assess, and manage financial risks threatening your company such as credit risk, market risk, and operational risk

5. Capital management

🎯 manage your company's capital structure and making decisions related to capital allocation and investment

6. External stakeholder relations

🎯 communicate with investors, capital markets analysts, lenders, and government entities regarding your company's financial performance, strategy, and business outlook

7. Corporate finance

🎯 evaluate and execute mergers, acquisitions, divestitures, capital raises, and other strategic finance transactions

8. Performance measurement

🎯 develop and implement performance metrics and key performance indicators (KPIs) to align, monitor and evaluate your company's financial performance against targets

9. Tax

🎯 manage your company’s tax strategy, including tax planning and compliance with tax laws and regulations

10. Audit

🎯 oversee your company’s external audit process to ensure auditor concerns are appropriately addressed

11. Compliance

🎯 ensure your company is in compliance with financial regulations, laws and contractual obligations

12. Information technology

🎯 oversee your company’s financial systems, technology infrastructure and data security

13. Human resources

🎯 manage your company’s compensation and benefits programs, as well as oversee your human resources function.

14. Strategy

🎯 support the development and execution of your company’s strategy by aligning your financial goals with your critical objectives.

14 Responsibilities of the CFO - Oana Labes, MBA, CPA

Some next steps for you to consider:

Sponsor this newsletter - reply to this email with subject line "Sponsorship" to partner with me and bring your business in front of a highly engaged professional community made up of CFOs, CEOs, CPAs, MBAs, FMVAs, Controllers, Finance Managers, Presidents, Business Owners, and upcoming leaders.

Forward this newsletter - to help your network enjoy it the way you do. Your friends and colleagues will appreciate your thoughtfulness and will respect your deep knowledge of finance.

Subscribe to The Finance Gem 💎- to receive my newsletter directly next week, in case this email was forwarded to you by one of your thoughtful friends or colleagues.

Thanks so much for reading. See you next week.