Welcome to this week's edition of The Finance Gem 💎 where I bring you my unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

The Cash Flow Masterclass

I'm excited to share that The Cash Flow Masterclass is now in Pre-Order! The low introductory pricing will only be available until May 1, 2023, so make sure you enroll before then so you don't miss the deadline.

If you ever feel like you're stuck or unfulfilled in your current role... If you ever feel like you lack confidence in your finance skills and worry about your career progression... If you ever feel like you lack the strategic finance insights required for a promotion...

...then this strategic finance masterclass is for you! Check it out today at oanalabes.com

This week's strategic finance insights:

Without further ado, let's begin:

Auditors take a risk-based approach in planning their audit work.

That means they identify the key risks faced by the business and consider the impact of those risks on the financial statements, and the possibility that those statements would be misstated as a result.

Here are 20 red-flags your auditors would be concerned with, so you can take note and resolve them before they negatively impact your business:

1// Unusual transactions

🎯 Large, non-recurring, or unexplained transactions may indicate potential fraud or accounting irregularities. Investigate and document the rationale for such transactions.

2// High employee turnover

🎯 Frequent changes in key personnel, especially in finance or management roles, may signal internal issues or potential fraud. Review the reasons for turnover and ensure adequate internal controls.

3// Inadequate segregation of duties

🎯 Lack of proper segregation of duties can increase the risk of errors or fraud. Ensure that employees have clearly defined responsibilities and that no one person has control over an entire financial process.

4// Frequent changes in auditors or legal counsel

🎯 Changing auditors or legal counsel regularly may indicate attempts to conceal irregularities. Investigate the reasons for such changes and ensure transparency.

5// Excessive use of manual journal entries

🎯 A high number of manual journal entries, especially those made at period-end or by senior management, can be a red flag for manipulation or fraud. Review and approve all manual entries.

6// Unusual patterns in financial ratios

🎯 Sudden or unexpected changes in financial ratios, such as profitability or liquidity, can indicate issues with financial performance or reporting. Analyze trends and investigate any anomalies.

7// Inconsistent revenue recognition

🎯 Inconsistent application of revenue recognition policies may lead to revenue manipulation. Ensure adherence to accounting standards and company policies.

8// Inadequate documentation

🎯 Insufficient documentation of transactions or processes can make it difficult to detect errors or fraud. Maintain thorough records and review them regularly.

9// Reluctance to provide information

🎯 Resistance to providing information to auditors or other stakeholders may signal potential issues. Encourage open communication and ensure timely access to necessary information.

10// Persistent negative cash flow

🎯 Negative cash flow over an extended period may indicate financial distress or mismanagement. Analyze cash flow trends and address any underlying issues.

11/ High debt levels

🎯 Excessive debt can hinder a company's ability to generate positive cash flow and increase risk. Monitor debt levels and develop strategies to manage and reduce debt.

12// Overreliance on a single customer or supplier

🎯 Overdependence on one customer or supplier increases the risk of financial instability. Diversify your customer base and supply chain to minimize risk.

13// Declining market share

🎯 A decrease in market share may signal competitive threats or ineffective strategies. Analyze market trends and adjust your strategies accordingly.

14// Overstated assets or understated liabilities

🎯 Inaccurate reporting of assets or liabilities can distort a company's financial position. Ensure that assets and liabilities are accurately recorded and valued.

15// Ineffective internal controls

🎯 Weak internal controls can lead to errors or fraud. Assess and strengthen your internal control environment.

16// Poor corporate governance

🎯 Inadequate governance structures can increase the risk of financial mismanagement or fraud. Strengthen board oversight and ensure clear reporting lines.

17// Conflicts of interest

🎯 Undisclosed conflicts of interest can harm a company's reputation and financial performance. Implement policies to identify, disclose, and manage potential conflicts.

18// Aggressive accounting practices

🎯 Aggressive or creative accounting practices can distort financial performance and mislead stakeholders. Adhere to accounting standards and adopt conservative accounting policies.

19// Inaccurate or delayed financial reporting

🎯 Late or inaccurate financial reporting may signal potential issues or manipulation. Ensure timely, accurate, and transparent reporting to stakeholders.

20// Unexplained variances in budget vs. actual results

🎯 Significant variances between budgeted and actual results may indicate poor financial management or manipulation. Investigate the causes of variances and address any underlying issue

20 Business Finance Red Flags to Avoid - Oana Labes, MBA, CPA

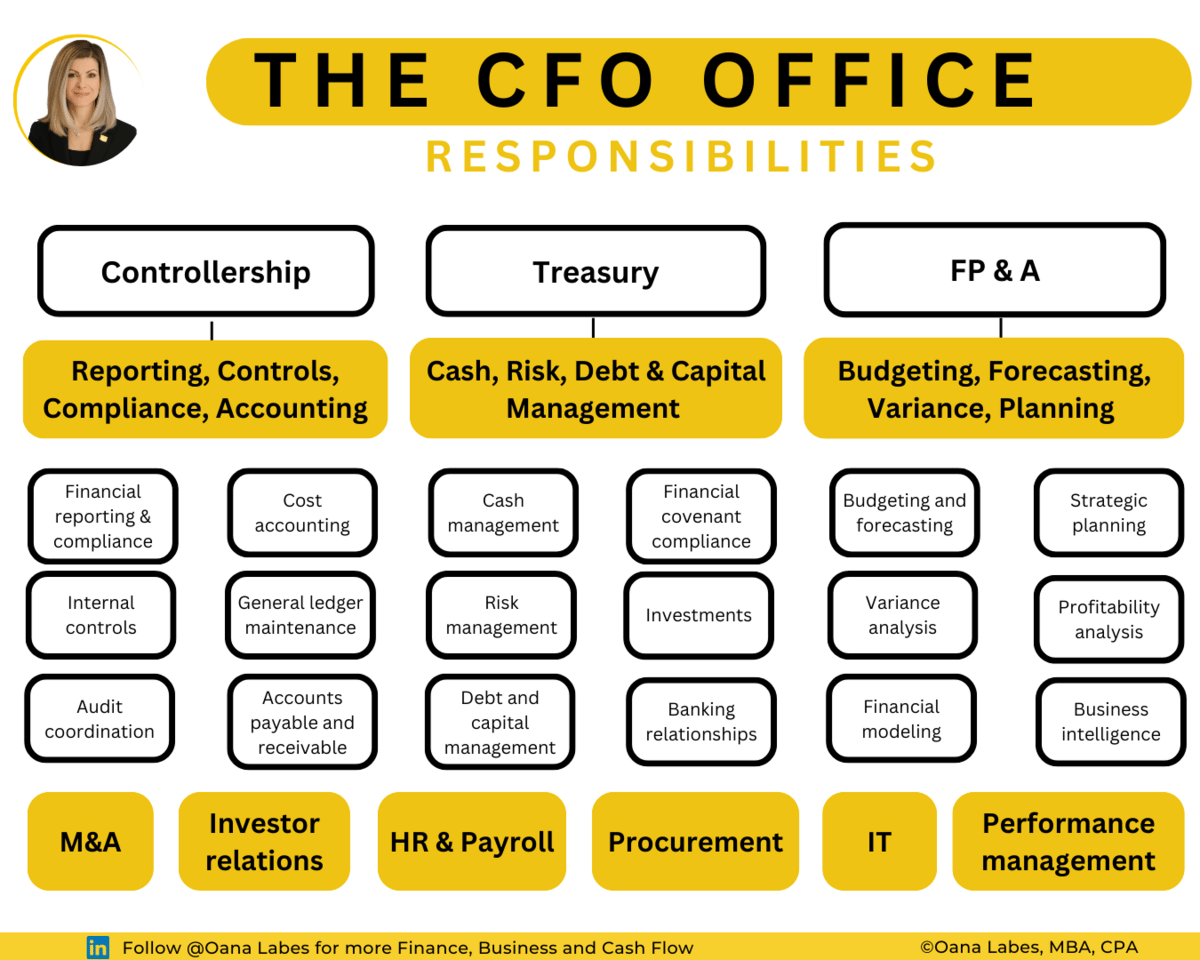

The CFO is responsible for managing your company's financial operations and strategy.

It is a highly demanding role overseeing the Controllership, the Treasury and the FP&A Functions.

🎯 Here are 25 responsibilities of the CFO office you should know:

⚫ Controllership:

1// Financial reporting >> oversee financial statement preparation in compliance with the relevant accounting framework

2// Internal controls >> develop and maintain an appropriate internal control framework to ensure data integrity and regulatory compliance

3// Tax compliance >> manage tax planning, filing, and regulatory compliance

4// Coordination with external accountants >> liaise with external accountants and ensure a smooth and efficient annual assurance engagement process

5// Accounts payable and receivable >> oversee AP and AR to ensure timely processing, contractual compliance and effective supply chain management

6// General ledger maintenance >> ensure the accuracy and timeliness of general ledger entries and account reconciliations.

⚫ Treasury:

7// Cash management >> monitor and manage cash flow, ensuring sufficient liquidity to meet operational and strategic needs

8// Risk management >> identify, assess, and manage financial risks (foreign exchange risk, interest rate risk, credit risk)

9// Debt and capital management << manage the capital structure (the mix of debt and equity financing), optimizing the cost of capital and maintaining financial flexibility

10// Investments >> oversee excess cash investment, ensuring alignment with risk appetite and return objectives

11// Banking relationships >> develop and maintain strong relationships with banks and other financial institutions to support favorable financing terms and access to capital as needed

12// Financial covenant compliance >> monitor and ensure compliance with financial covenants outlined in credit agreements

⚫ Financial Planning and Analysis (FP&A):

13// Cost accounting >> analyze costs to support management decision-making around profitability and and cost control management

14// Budgeting and forecasting >> lead the annual budgeting process and develop rolling forecasts to support ongoing decision-making and resource allocation.

15// Variance analysis >> monitor and analyze financial performance against budget and forecast, identifying trends and areas for improvement

16// Financial modeling >> build and maintain financial models to support strategic decision-making, including scenario analysis, valuation, and capital budgeting

17// Profitability analysis >> analyze product, customer, and channel profitability to support margin improvements and optimize resource allocation

18// Business intelligence >> develop and maintain financial dashboards, reports, and key performance indicators to provide actionable insights to management

19// Strategic planning >>enable the development and execution of the company's long-term strategic plan in alignment with financial goals and objectives

⚫ Additional responsibilities and functions within the CFO office may include:

20// Mergers and acquisitions (M&A) >> evaluate and execute M&A transactions (due diligence, valuation, reporting, integration)

21// Investor relations >> manage the transparent and accurate communication with shareholders and analysts

22// Human resources and payroll >> oversee payroll and benefits

23// Information technology (IT) >> support the implementation and maintenance of efficient financial reporting and data security systems

24// Procurement >> ensure cost-effective purchasing and management of key vendor relationships

25// Performance management >> establish and monitor performance metrics for the finance team, focused on key organizational financial and non-financial KPIs (financial results, customer satisfaction metrics, continuous improvement, professional development)

The CFO Office - Oana Labes, MBA, CPA.png

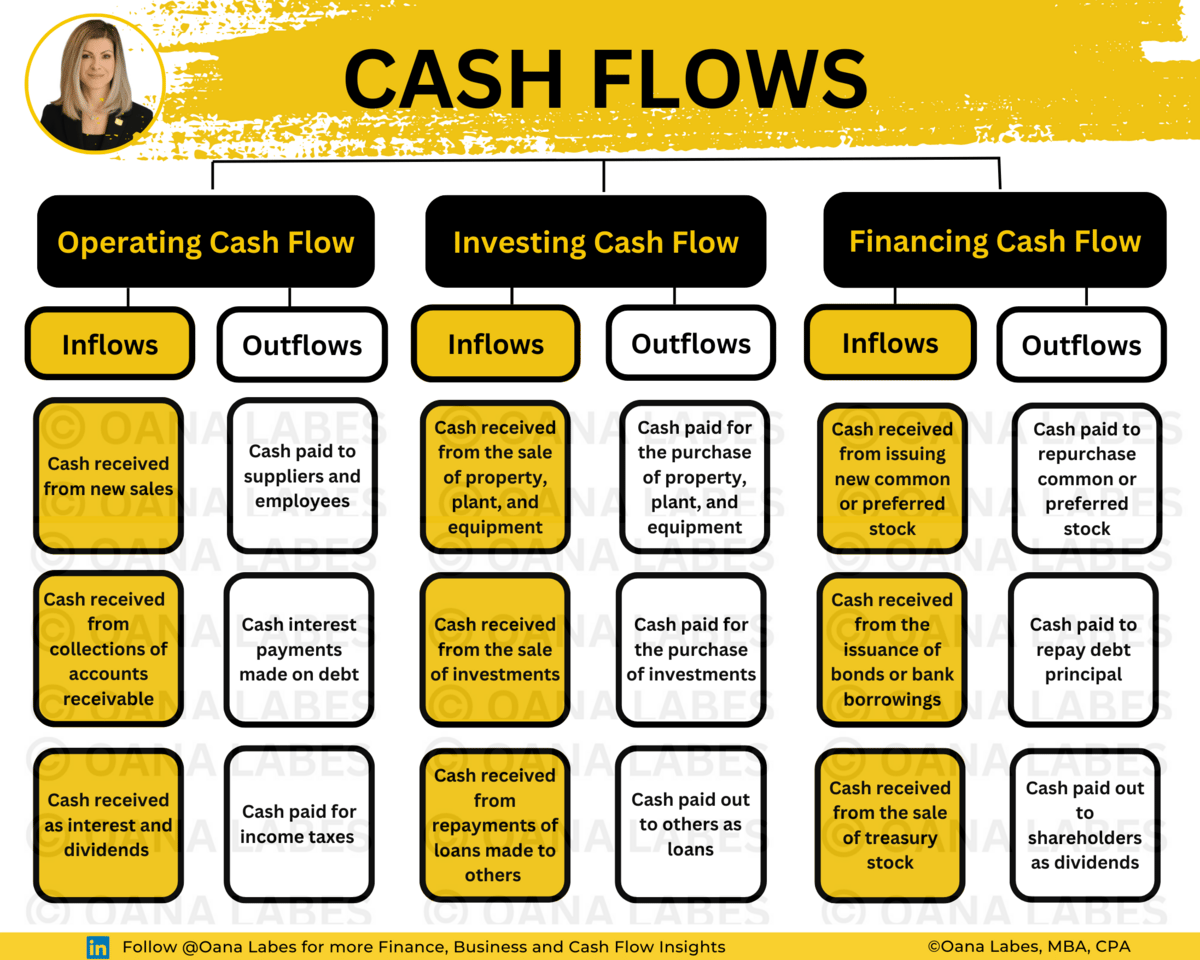

Regardless whether you’re a professional, an executive or a business owner, cash flow mastery will transform your future.

There are 3 types of business activities and each of them can absorb or release cash into a business.

1️⃣ Operating Activities

🎯 the primary sources and uses of cash in a company's day-to-day business operations

🎯 include cash generated from sales, cash paid for purchases and cash paid for operating expenses

Key sources of cash in this section include:

♦️ Cash received from new sales in the period

♦️ Cash collected from accounts receivable (sales in prior periods)

♦️ Cash received as interest and dividends

Key uses of cash in this section include:

♦️ Cash payments to suppliers and employees (includes cash paid for current COGS and OPEX as well as those owing from a prior period, extracted from changes in Inventory and AP balances)

♦️ Cash interest payments made on debt

♦️ Cash payments made for income taxes

***Depending on the accounting framework followed, dividends and interest paid/received may be classified into financing cash flows

How to Master your Operating Cash Flow:

☑️ Monitor and analyze your cash conversion cycles to identify inefficiencies in receivables, payables, and inventory management.

☑️ Perform sensitivity analyses to evaluate the impact of changes in key variables, such as sales, costs, and credit terms, on Operating Cash Flow

2️⃣ Investing Activities

🎯 involve the acquisition and disposal of long-lived assets, such as property, plant, equipment, and investments.

🎯 represent your investment in the future growth of your business

Key sources of cash in this section include:

♦️ Cash received from the sale of property, plant, and equipment

♦️ Cash received from the sale of investments (stocks, bonds, etc.)

♦️ Cash received from repayments of loans made to others

Key uses of cash in this section include:

♦️ Cash paid for the purchase of property, plant, and equipment

♦️ Cash paid for the purchase of investments (stocks, bonds, etc.)

♦️ Cash paid out to others as loans

How to Master your Investing Cash Flow:

☑️ Use capital budgeting techniques, such as net present value (NPV) and internal rate of return (IRR), to evaluate, rank and prioritize investment decisions.

☑️ Analyze the correlation between Investing Cash Flows and Operating Cash Flows to determine the effectiveness of your investment strategies in ultimately driving your cash flow growth.

3️⃣ Financing Activities

🎯 include transactions with the company's owners and creditors

Key sources of cash in this section include:

♦️ Cash received from the issuance of common stock or preferred stock

♦️ Cash received from the issuance of debt (bonds, loans, etc.)

Key uses of cash in this section include:

♦️ Cash paid to repurchase common stock or preferred stock

♦️ Cash paid for the repayment of debt (bonds, loans, etc.)

♦️ Cash paid out to shareholders as dividends

How to Master your Financing Cash Flow:

☑️ Determine your optimal capital structure by analyzing the trade-off between debt and equity financing in terms of cost, risk, and cash flow implications.

☑️ Evaluate the impact of your dividend payment policy on cash flow, leverage, debt coverage and shareholder value creation.

Cash Inflows and Outflows - Oana Labes, MBA, CPA

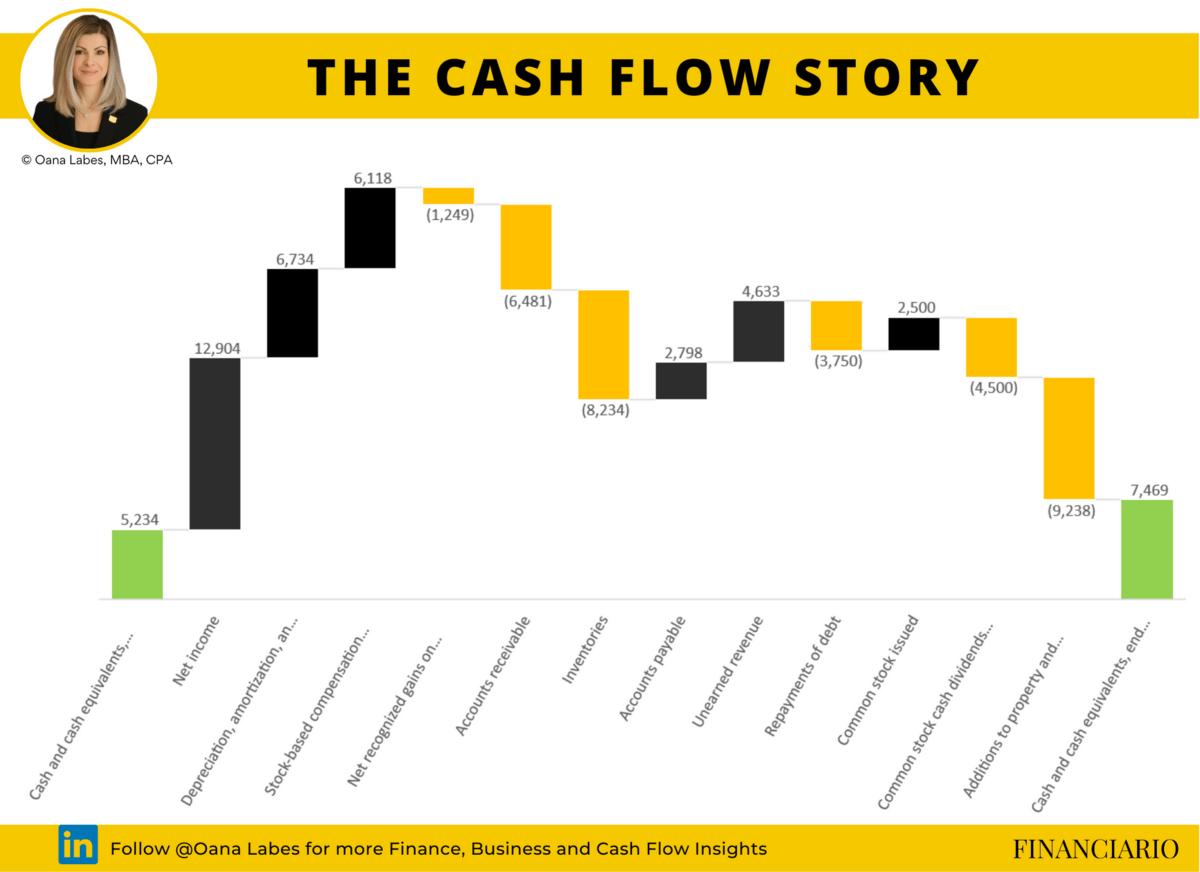

Let’s tell the story of the cash in this waterfall chart:

⚫ At the beginning of the period, this company had $5,234 in cash and cash equivalents.

⚫ During the period, the company generated a Net Income of $12,904.

⚫ Because non-cash expenses like depreciation, amortization, stock-based compensation expenses were deducted to arrive at that Net Income, they were added back.

⚫ Because a non-cash gain on investments and derivatives of $1,249 was also included to arrive at that Net Income, it was now deducted.

⚫ Because not all revenues were collected from customers, and not all expenses were paid cash to suppliers during the period, some more adjustments were necessary to link Net Income with Cash Flow from Operations.

⚫ The company adjusted for the fact Accounts receivable had increased by $6,481, and inventories had increased by $8,234, both of which had reduced cash. Conversely, accounts payable had increased by $2,798, and unearned revenue had increased by $4,633, both contributing positively to cash.

⚫ In total, operating assets and liabilities consumed $7,284 of cash during the period, and after all adjustments, at the end of the period the company had generated $17,223 in cash.

⚫ It went on to use $3,750 of cash to repay debt obligations. It also issued common stock of $2,500, and paid cash dividends $4,500, using up a total of $5,750 of its cash balances.

⚫ The company also made some significant investments in fixed assets during the period, with total additions to PPE of $9,238.

⚫ At the end of the period, after operating, financing and investing activities, this company had generated a net $2,235 in cash. Added to its opening cash balance of $5,234, it allowed it to close its books with a cash balance of $7,469.

And that’s the story of how $7,469 ended up on this company’s balance sheet at the end of the period.

The Cash Flow Story - Oana Labes, MBA, CPA

Here’s How to Connect the Three Main Financial Statements:

➡️The Balance Sheet uses information from the Income Statement for its reporting.

and

➡️The Income Statement uses the assets, liabilities, and equity from the Balance Sheet in its activity.

and

➡️ The Cash Flow Statement acts as a bridge between the Income Statement and Balance Sheet by showing the amount of cash that was generated in, and used by, the business.

🎯 Here’s how to integrate them in a dynamic model.

1️⃣ Net Income flows from the Income Statement to the Balance Sheet (through Retained Earnings) and to the Cash Flow Statement (through Operating Cash Flow).

2️⃣ Changes in Current Assets and Liabilities from the Balance Sheet are aggregated to calculate Changes in operating Assets and Liabilities in the Cash Flow Statement (Operating Cash Flow).

3️⃣ Depreciation Expense is added back into the Operating Cash Flow section of the Cash Flow Statement. In the Investing Cash Flow section, the Depreciation Expense is then deducted from the opening Fixed Assets balance and any changes in Fixed Assets are accounted for to calculate the net Investing Cash Flow.

4️⃣ The opening balance of Long Term Debt is deducted from the ending balance to calculate Financing Cash Flows.

5️⃣ The prior period’s closing cash balance plus the current period’s sum of cash flows from operations, investing, and financing becomes the closing cash balance for the period on the Balance Sheet.

🎯 Remember:

☑️ To put together a Cash Flow Statement you only need 2 balance sheets and the income statement covering the period of time between the two balance sheets.

☑️ Use it to understand how cash moved in and out of the business during the period and draw critical insights on the business, its health and its risk profile

☑️ Positive cash flows aren’t always a positive indicators and negative cash flows aren’t always negative indicators.

Accounting Factsheet - CFI

Three next steps for you to consider:

Pre-Order The Cash Flow Masterclass to benefit from a low introductory price available only until May 1, 2023. Check it out at oanalabes.com

Sponsor this newsletter - reply to this email with subject line "Sponsorship" to partner with me and bring your business in front of a highly engaged professional community made up of CFOs, CEOs, CPAs, MBAs, FMVAs, Controllers, Finance Managers, Presidents, Business Owners, and upcoming leaders.

Forward this newsletter - to help your network enjoy it the way you do. Your friends and colleagues will appreciate your thoughtfulness and will respect your deep knowledge of finance.

Subscribe to The Finance Gem 💎- to receive my newsletter directly next week, in case this email was forwarded to you by one of your thoughtful friends or colleagues.

Thanks so much for reading. See you next week.