Welcome to this week's edition of The Finance Gem 💎 where I bring you my unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter edition is brought to you by Beehiiv, an all-in-one newsletter platform designed to help content creators build and monetize their audience. It enables you to create, distribute, and track email newsletters. Created by the same team that built and scaled Morning Brew to millions of subscribers, Beehiiv boasts an expansive feature suite worth checking out!

Before we get on with this week's newsletter, I'm excited to introduce The Cash Flow Masterclass - my one-of-a-kind, on-demand, video course which will teach you to master cash flow full cycle, from Accounting to Finance and finally, to Strategic Business decision making.

This unique masterclass features unique course materials and strategic finance insights not available anywhere else, which will give you a real competitive edge.

With over 20 years of experience as an entrepreneur, a banker, and a CPA, I have demystified the most critical cash flow concepts to help you fundamentally transform the way you think and act on cash flow.

Until May 1, 2023, I’m offering the Cash Flow Masterclass for an exclusive introductory price you won't want to miss. Hurry and get this promotional price before the offer ends. Pre-Order The Cash Flow Masterclass Today, and transform your business, your career and your earnings potential!

This week's strategic finance insights:

Is EBITDA the same as Free Cash Flow?

Are your financial statements being manipulated?

Looking to analyze a company’s profitability? Don't just use ROE.

20 Finance & Accounting KPIs - with Free Excel Template & Dashboard

Without further ado, let's begin:

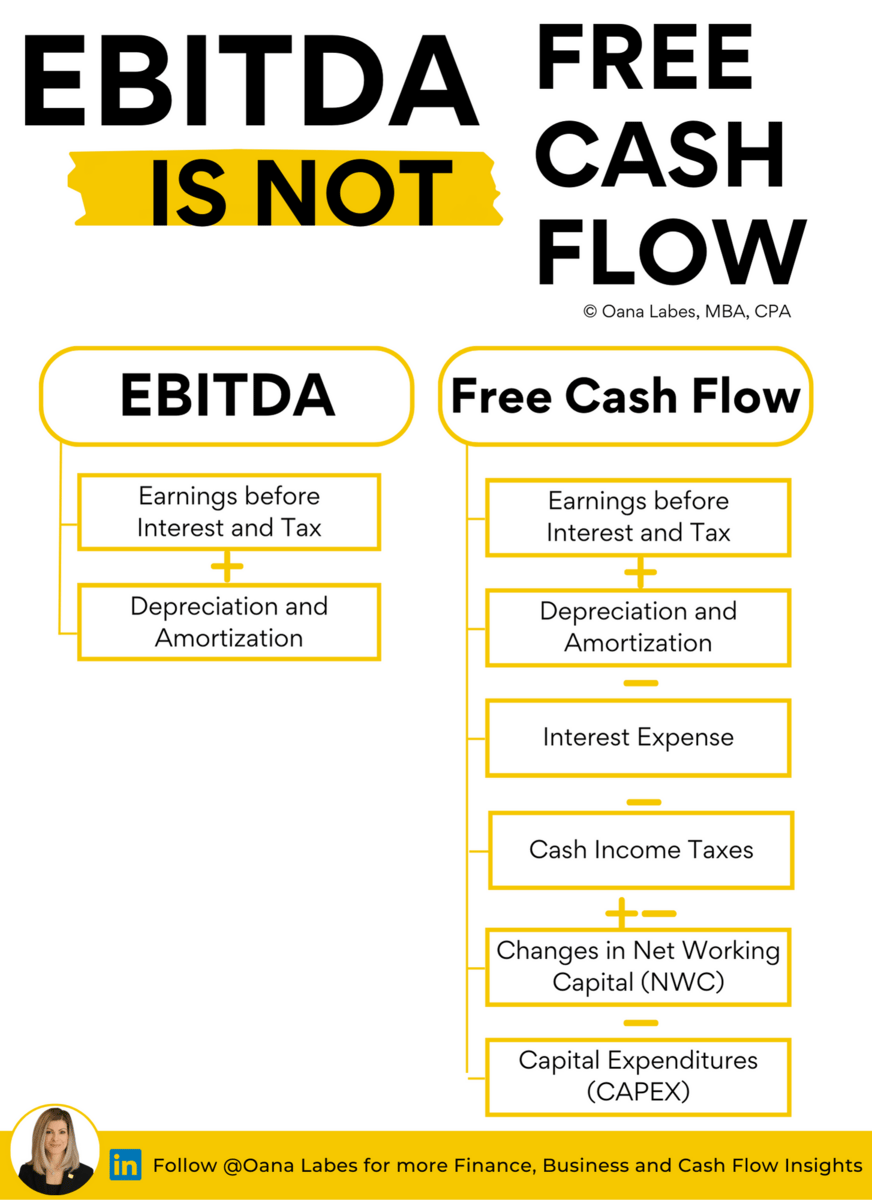

Is EBITDA the same as Free Cash Flow?

Not at all.

1️⃣ EBITDA is not a GAAP metric so everyone calculates it however they like.

Then they try to persuade you to buy into their formula.

2️⃣ EBITDA implies that all net income translates into cash the same way, ignoring non cash expenses and working capital changes.

3️⃣ EBITDA does not consider the amount of required reinvestment in fixed assets.

At a minimum these should cover maintenance CAPEX and roughly match non-cash depreciation expense.

4️⃣ EBITDA implies that the company will first use available cash flows to repay debt.

In fact it could distribute it all to the shareholders before any debt payments are made.

5️⃣ EBITDA doesn’t say anything about the quality of earnings, which could be poor due to aggressive revenue and expense recognition policies.

🎯 If EBITDA is flawed and so far off cash flow, we need cash flow metric to replace it.

What about 𝗙𝗿𝗲𝗲 𝗖𝗮𝘀𝗵 𝗙𝗹𝗼𝘄 (𝗙𝗖𝗙)?

☑️ This is the cash remaining in the business after considering cash outflows that support operations (OPEX + working capital) and maintain its fixed capital assets (CAPEX).

☑️This is also the cash flow available for the payment of debt obligations (hence why it's called Unlevered Cash Flow or Free Cash Flow to the Firm FCFF).

☑️ Free Cash Flow (FCF) Formula

= Operating Cash Flow +/- Changes in Fixed Assets

or

=EBITDA - Interest - Taxes - Working Capital - CAPEX

☑️ Advantages of Free Cash Flow:

✅ Easy to calculate

✅ Available to both capital providers and borrowers

✅ Resolves some important EBITDA flaws and accounts for both CAPEX and cash consumed by sales growth or working capital efficiency losses

☑️ Limitations of Free Cash Flow:

❌Assumes all CAPEX is a required investment, despite the fact most companies have an annual mix of replacement and growth CAPEX

❌Overstates CAPEX in the year of acquisition and understates it in subsequent years

❌There is no standardized calculation of Free Cash Flow so it’s important to check with your banks or investors for their definitions

❌ Can be manipulated just like so many other accounting metrics. A company that wants to increase free cash flow can simply under-invest in fixed assets.

EBITDA is not Free Cash Flow - Oana Labes, MBA, CPA.png

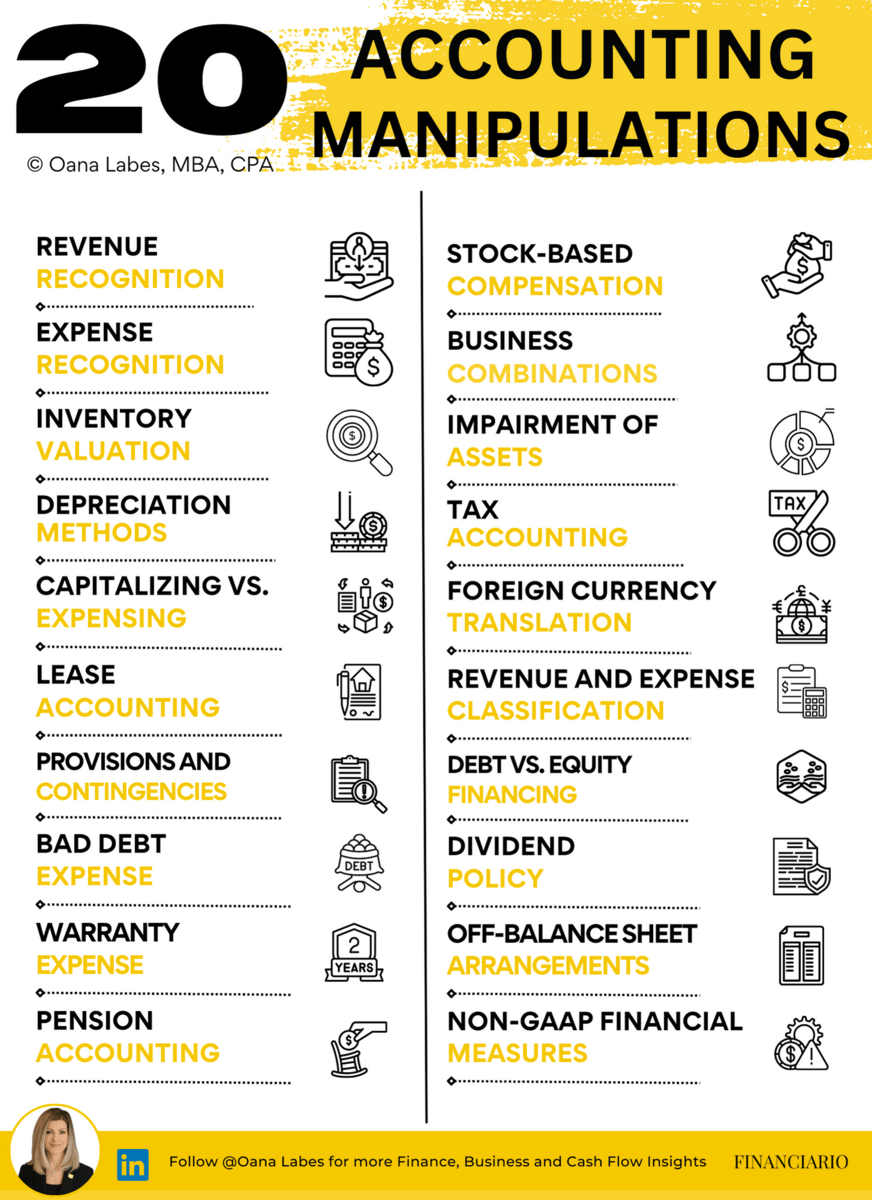

Are your financial statements being manipulated?

🔴 Some management decisions can impact the financial statements very significantly.

🔴 These decisions can ultimately affect reported financial results and, in some cases, lead to aggressive accounting or even financial statement manipulation.

🔴 Accounting manipulations refer to the intentional misrepresentation or distortion of a company's financial statements through:

- Aggressive, misleading, or fraudulent practices

- Misuse of accounting policies or estimates

🔴 Why do this?

- To present a more favorable financial position/performance

- To mislead investors, creditors, or stakeholders

- To meet specific performance targets or goals

🎯 Here are 20 accounting engineering areas us to be aware of:

1// Revenue Recognition

Management may choose to recognize revenue earlier or later than required, affecting the timing and amount of the revenue reported on the income statement.

2// Expense Recognition

Management may choose to recognize expenses earlier or later than required, impacting the income statement net income.

3// Inventory Valuation

Different inventory valuation methods (FIFO, LIFO, weighted average) can lead to significant differences in the reported cost of goods sold and the inventory value on the balance sheet.

4// Depreciation Methods

Management can select different depreciation methods (straight-line, double-declining balance, units of production) that will affect the depreciation expense, the accumulated depreciation on the balance sheet and the reported profitability of the entity.

5// Capitalizing vs. Expensing

Management can decide whether to capitalize or expense certain costs, impacting the balance sheet's asset value, the income statement expenses and ultimately the profitability of the entity

6// Lease Accounting

The classification of leases as operating or finance leases can significantly affect the balance sheet and income statement.

7// Provisions and Contingencies

Management estimates of timing and amounts for provisions and contingencies can impact the reported liabilities on the balance sheet and related expenses on the income statement.

8// Bad Debt Expense

Management estimates of timing and amounts for bad debt expense recognition and the associated allowance for doubtful accounts can affect the income statement expenses, balance sheet accounts receivable, and the profitability of the entity

9// Warranty Expense

Management estimates for warranty expenses can impact the income statement expenses, the balance sheet warranty liability and the reported profitability

10// Pension Accounting

Management assumptions for discount rates, expected return on plan assets, and other factors can impact pension expenses and liabilities on the financial statements.

11/ Stock-Based Compensation

The choice of valuation methods and assumptions for stock-based compensation can affect the reported compensation expense and equity on the balance sheet.

12// Business Combinations

The accounting choices in business combinations, such as the allocation of the purchase price or the valuation of contingent considerations, can impact the financial statements and reported earnings.

13// Impairment of Assets

Management assumptions and estimates for impairment tests can affect the reported asset values and impairment losses on the income statement.

14// Tax Accounting

Management tax planning strategies and estimates for deferred tax assets and liabilities can impact the income statement tax expense and balance sheet accrued tax accounts.

15// Foreign Currency Translation

The choice of translation methods for foreign subsidiaries can affect the balance sheet asset and liability values and the income statement gains or losses.

16// Revenue and Expense Classification

Management can decide how to classify certain revenues and expenses as operating, non-operating, or extraordinary, impacting the income statement presentation and comparability across periods.

17// Debt vs. Equity Financing

The choice of debt or equity financing can impact the balance sheet capital structure, the income statement interest expense, EBITDA and return on equity among others.

18// Dividend Policy

Management decisions on dividend policy affect the income statement, retained earnings and equity, as well as numerous ratios such as leverage and return on equity.

19// Off-Balance Sheet Arrangements

Management may use off-balance sheet arrangements such as special purpose entities or variable interest entities, which can distort a company’s true financial position and performance.

20// Non-GAAP Financial Measures

Management may present non-GAAP financial measures, such as adjusted EBITDA or pro forma earnings, which can create comparability issues and potentially mislead users of financial statements.

Remember:

🎯 impacting the financial statements changes the perceived financial performance of the company and the decisions users will make based on those statements

🎯 as a user of financial statements you need to be aware of these potential management biases and to critically analyze the financial statements and accompanying disclosures

20 Accounting Manipulations - Oana Labes, MBA, CPA

Looking to analyze a company’s profitability? Don't just use ROE.

If you track ROE, you probably calculate it with the simple formula:

ROE = Net Income / Shareholders Equity

While this is helpful as:

⚫️ a profitability ratio that’s simple and easy to understand

⚫️ a tool for investors to easily assess the efficiency of management’s use of capital

⚫️ a metric that’s easily comparable across companies

It is also misleading because:

🔴 a company can achieve a high ROE with high leverage, increasing its risk profile and jeopardizing its ability to continue operating as a going concern in the future

🔴 a company with significant intangibles (such as goodwill after an acquisition) will have a distorted and irrelevant ROE

🔴 high earnings behind a high ROE could be the result of accounting policy choices and poor earnings quality

🔴 different industries may have different CAPEX requirements and different profitability levels, making it difficult to compare ROE

🔴 a high growth company could have a low ROE despite significant potential for future returns

So, if ROE is misleading, we need better, more insightful metrics to use for a more complete picture of a company's financial health.

How about:

1️⃣ The DuPont analysis ?

ROE = Net Profit Margin x Asset Turnover x Financial Leverage

where:

Net Profit Margin = Net Income / Total Revenue

Asset Turnover = Total Revenue / Average Total Assets

Financial Leverage = Average Total Assets / Average Shareholder's Equity

✔️ allows a better understanding of the contribution of leverage to ROE

❌ doesn’t address the issues of earnings quality, growth prospects or comparability across industries

2️⃣ Return on capital employed (ROCE) ?

ROCE = EBIT / (Total Assets - Current Liabilities)

✔️ incentivizes the reduction of financial leverage

❌ doesn’t address the issues of earnings quality, growth prospects or comparability across industries

Therefore, if you want to analyze profitability and investor returns

🎯 ROE isn’t going to tell you everything you need to know

🎯 No ROE alternative metric addresses all ROE flaws

🎯 A combination of ROE, DuPont Analysis and ROCE will provide a more comprehensive understanding of a company's financial performance and potential

ROE - Oana Labes, MBA, CPA

20 Finance & Accounting KPIs - with Free Excel Template & Dashboard

⚫ Current Ratio: measures your company’s ability to meet its short-term obligations by comparing its current assets to its current liabilities.

⚫ Quick Ratio: measures your company’s ability to meet its short-term obligations, but it excludes inventory from current assets.

⚫ Cash Conversion Cycle (days): measures the average number of days it takes for your company to convert investment in inventory and accounts receivable into cash from sales.

➡️ Days Sales Outstanding (DSO) (days): measures the average number of days it takes your company to collect payment from customers after completing a sale.

➡️ Days Inventory Outstanding (DIO) (days): measures the average number of days your company holds inventory before selling it.

➡️ Days Payable Outstanding (DPO) (days): measures the average number of days it takes your company to pay its suppliers after receiving an invoice

⚫ Gross Profit Margin: measures your company’s profitability by comparing its gross profit to its revenue.

⚫ Operating Profit Margin: measures your company’s profitability by comparing its operating income to its revenue.

⚫ EBITDA Margin: measures your company’s profitability by comparing its EBITDA to its revenue.

⚫ Net Profit Margin: measures your company’s profitability by comparing its net income to its revenue.

⚫ Return on Assets (ROA): measures your company’s profitability by comparing its net income to its total assets

⚫ Return on Equity (ROE): measures your company’s profitability by comparing its net income to its shareholder equity.

⚫ Asset Turnover Ratio: measures your company’s efficiency in using assets to generate revenue, comparing its revenue to its total asset base.

⚫ Inventory Turnover Ratio: measures your company’s efficiency in managing its inventory by comparing its cost of goods sold to its average inventory.

⚫ Accounts Receivable Turnover Ratio: measures your company’s efficiency in collecting accounts receivable by comparing its annual credit sales to its average accounts receivable.

⚫ Accounts Payable Turnover Ratio: measures your company’s efficiency in paying its supplier accounts by comparing annual purchases to its average accounts payable.

⚫ Funded Debt / EBITDA Ratio: measures your company’s leverage by comparing its long-term debt to its EBITDA.

⚫ Debt Service Ratio: measures your company’s ability to meet its debt obligations by comparing its operating income to its total debt service payment obligations.

⚫ Fixed Charge Coverage Ratio: measures your company’s ability to cover its fixed charges, such as interest and lease payments, by comparing its EBITDA before the fixed charges to those payment obligations.

⚫ Interest Coverage Ratio: measures your company’s capacity to cover the interest expense on its outstanding debt by comparing its EBITDA to its interest expenses.

⚫ Debt to Equity Ratio: measures your company’s financial leverage, showing the proportion of debt used to finance the company's assets.

⚫ Debt to Tangible Net Worth Ratio: measures your company’s leverage by comparing total liabilities with tangible net worth (shareholder’s equity - intangible assets).

⚫ Interest Coverage Ratio: measures your company’s ability to pay its interest expense from EBITDA.

🎯 Note that formulas can vary, and model target values for each ratio are provided as samples only; you will need to source your own industry benchmarks or historical performance data to establish appropriate targets for each ratio.

Click the button below to download a copy of the Financial Analysis Spreadsheet Template

Next steps for you to consider:

Pre-Order The Cash Flow Masterclass to benefit from a low introductory price available only until May 1, 2023. Check it out at oanalabes.com

Looking for 1-1 coaching? - Book my calendar directly here

Sponsor this newsletter - partner with me and bring your business in front of a highly engaged professional community made up of CFOs, CEOs, CPAs, MBAs, FMVAs, Controllers, Finance Managers, Presidents, Business Owners, and upcoming leaders. Book directly here.

Forward this newsletter - to help your network enjoy it the way you do. Your friends and colleagues will appreciate your thoughtfulness and will respect your deep knowledge of finance.

Subscribe to The Finance Gem 💎- to receive my newsletter directly next week, in case this email was forwarded to you by one of your thoughtful friends or colleagues. Click here to sign up

Thanks so much for reading. See you next week.

The mother of Cash and EBITDA - compliments of Nicolas Boucher