Welcome to this week's edition of The Finance Gem 💎 where I bring you my unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter edition is brought to you by Genius Sheets, an AI powered, data-driven, financial planning and analysis (FP&A) platform that helps companies spend less time budgeting while making better decisions.

Genius Sheets provides financial modeling automation by pulling financial data from QuickBooks (other accounting software underway) into Excel and Google Sheets. With Genius Sheets you can generate financial reports by talking to Genius Sheets through text prompts, create live data connections between Excel & Google Sheets and your accounting data, and build full customized consolidated reporting or financial models.

If you're enjoying learning from my strategic finance and accounting posts and insights, I'd love it if you share a quick testimonial. It's fast, easy, and it helps others understand the value of reading my posts and following me on Linkedin. Thank you so much to everyone who already shared their thoughts - find your testimonial featured here!

This week's strategic finance & accounting highlights:

Without further ado, let's begin:

Here’s how:

🎯 Start with a clear and inspiring vision to align, guide and motivate your team.

🎯 Develop your strategy based on a deep understanding of your industry, capabilities, stakeholders, opportunities, threats, strengths and weaknesses.

🎯 Develop clear goals and targets to achieve your objectives

🎯 Define your Key Performance Indicators for each of the four perspectives of the Balanced Score Card (financial, customer, internal processes, and learning and growth)

🎯 Align, Communicate, and Monitor performance

**What is a Balanced Score Card?**

🎯 The BSC is a management system created in 1992 by Robert Kaplan and David Norton at Harvard University

🎯 It inks your organization’s mission and strategy to your strategic and measurable operational objectives.

**How does a Balanced Score Card work?**

🎯 By centralizing all the major elements of your company's strategy and helping answer 4 critical questions about your business:

✅ How do your customers see you? (The Customer Perspective)

✅ What must you excel at? (The Internal perspective)

✅ Are you continuing to learn, innovate and improve? (The Education and Learning perspective)

✅ How do your shareholders see you? (The Financial Perspective)

🎯 By including 1 Lagging and 3 Leading indicators that allow you to measure short term and long term business performance:

The BSC lagging Indicator is made up of financial measures that present the results of actions already taken.

✅ Financial KPIs:

Cash Flow, Profitability, Returns, Efficiency

The BSC leading Indicators are operational measures that will drive future organizational performance

✅ Customer satisfaction KPIs:

Retention, Attraction, Referrals, Satisfaction

✅ Internal Processes KPIs:

Efficiency, Productivity, Capacity

✅ Education and Learning KPIs:

Technology & Innovation, Employee Development

The Balanced Score Card - Oana Labes, MBA, CPA

Cash flow statements have 3 main sections:

➡️ Operating cash flows / Cash flow from operations

➡️ Investing cash flows / Cash flows from investing

➡️ Financing cash flows / Cash flows from financing

⚫ The only difference between the direct and indirect cash flow statements is how you calculate 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐜𝐚𝐬𝐡 𝐟𝐥𝐨𝐰𝐬.

1️⃣ 𝐇𝐞𝐫𝐞'𝐬 𝐡𝐨𝐰 𝐭𝐨 𝐜𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐞 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐜𝐚𝐬𝐡 𝐟𝐥𝐨𝐰𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐢𝐧𝐝𝐢𝐫𝐞𝐜𝐭 𝐦𝐞𝐭𝐡𝐨𝐝:

✔️ start with net income from the Income Statement, which has been reported using accrual accounting

✔️ because your accrual income statement recognized revenues and expenses when they were incurred not when they were settled, it needs to be de-accrued to convert it into cash

✔️make adjustments for non-cash transactions such as depreciation and amortization, share based compensation, gains or losses from the sale of fixed assets or investments

✔️ make adjustments for non-operating items considered elsewhere in the cash flow statement (e.g. dividend payments received)

✔️ make adjustments for changes in current assets and current liabilities (receivables, payables, inventories, prepaids, accruals)

2️⃣ 𝐇𝐞𝐫𝐞'𝐬 𝐡𝐨𝐰 𝐭𝐨 𝐜𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐞 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐜𝐚𝐬𝐡 𝐟𝐥𝐨𝐰𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐝𝐢𝐫𝐞𝐜𝐭 𝐦𝐞𝐭𝐡𝐨𝐝:

✔️ directly net cash collections and disbursements during the period

✔️ instead of reconciling the accrual income statement, directly consider cash based inflows and outflows from operations

✔️ add:

▪️net cash from customers

▪️cash paid to employees

▪️cash paid to suppliers

▪️cash paid for interest

▪️cash paid for taxes

Remember:

⚫ Accounting frameworks offer you a choice between the indirect and the direct method.

⚫ Investors and analysts frequently prefer the direct method because it provides more transparency into your company's cash flows and shows the actual cash you received and paid out during the period.

⚫ Most companies however choose the indirect method, because it’s faster to get access to the required information, and thus easier to put together.

The Cash Flow Statement - Oana Labes, MBA, CPA

10 EBITDA Questions & Answers

EBITDA is frequently used as a proxy for cash flow, but many people struggle with it.

Here are 🔟 key EBITDA Questions & Answers to keep in mind:

1️⃣ Is EBITDA an accurate measure for net business cash flows? No.

2️⃣ Is EBITDA a standardized GAAP/IFRS metric? No.

3️⃣ How do you calculate EBITDA ? The truth is, to each his own (calculation).

But generally speaking:

⚫ Start with Net (Operating) Income, add back Interest, Taxes, Depreciation and Amortization.

⚫ Continue adding or subtracting depending on your objectives: non operating income and expenses, non cash items, non-recurring expenses, gains and losses, and many more.

4️⃣ How do people use EBITDA ?

⚫ Business Valuation (EBIDTA multiples, EV/EBITDA)

⚫ Management Compensation (EBITDA driven annual bonus)

⚫ Debt Capacity analysis (Total (Funded) Debt / EBITDA , EBITDA/Interest, EBITDA / (Principal + Interest )

⚫ Internal Performance Management (year-over-year EBITDA growth, EBITDA Margin growth)

5️⃣ Why is EBITDA so often Adjusted?

⚫ Because people are tweaking it to serve their needs. Then they try to convince you their formula makes more sense than yours.

6️⃣ How closely does EBITDA connect with Free Cash Flows (FCF)?

⚫ There are 3 main degrees of separation between EBITDA and FCF, so not closely.

⚫ Free Cash Flows = EBITDA - Cash Taxes - Changes in Working Capital - Cash Capital Expenditures

7️⃣ Why does EBITDA eliminate Depreciation and Amortization Expenses?

⚫ Because it's trying to make it easy to compare the financial performance of different companies by eliminating the impact of their capital asset financing choices and the accounting assumptions behind any depreciation expense (depreciation approach, useful life, residual value).

8️⃣ Why does EBITDA eliminate Interest Expense? Because it's trying to make it easy to compare the financial performance of different companies by removing the impact of their chosen capital structure from the analysis.

9️⃣ Why does EBITDA eliminate Other Income? Because it's trying to establish a baseline proxy for stable and recurring business Cash Flow. Passive rental income from real estate or bond coupons from excess cash investments are assumed to be temporary and not resulting from the company's business strategic choices, policies and investments.

🔟 Can EBITDA be manipulated?

Absolutely. Some common ways to manipulate earnings and subsequently EBITDA include:

⚫ Aggressive revenue recognition where estimates are involved

⚫ Delaying the recording of customer returns to a future period

⚫ Omitting provisions for obsolete inventory items

⚫ Understating provisions for bad debt

10 EBITDA Q&A - Oana Labes, MBA, CPA

Knowledge is Power, so learn the basics of financial analysis and empower yourself to make better decision in the world of Finance and Accounting.

☑️If you’re an accountant or finance professional, this will help you understand the key underlying drivers to monitor and manage as you analyze financial performance results

☑️If you're a manager, this will help you better understand your organization’s investment criteria, which will help you align individual and organizational goals across your team and maximize your effectiveness.

☑️If you’re an employee, this will help you better understand the priorities and performance drivers of your organization, so you can make better decisions for your own professional and career goals.

☑️If you’re an investor, this will help you better understand the level of aggressiveness behind management decisions, the drivers and sustainability of the business cash flows, and whether an investment aligns with your strategic objectives.

☑️If you’re an owner, this will help you make more informed decisions and allocate resources in your company more effectively.

Here are my recommended 4 Simple Steps to Assess the Financial Health of a Business:

1️⃣ Analyze the Balance Sheet

**Objectives**: evaluate liquidity, solvency and asset values to determine the business ability to use its assets efficiently to generate cash flow, meet short-term and long-term obligations, and invest in growth

2️⃣ Analyze the Income Statement

**Objective**: evaluate operating performance to determine the business ability to sustainably generate sufficient revenue to cover its expenses and earn a profit, across individual lines of business and product lines

3️⃣ Analyze the Cash Flow Statement

**Objective**: evaluate sources and uses of cash to assess the business ability to generate sufficient operating cash flow to finance operations, fund debt repayment and invest in growth.

4️⃣ Perform a Full Ratio Analysis

**Objective**: use in conjunction with trend (horizontal) and vertical analysis, to understand business profitability, liquidity, solvency, efficiency, debt servicing capacity, and cash flow generation ability to meet strategic objectives.

🎯 Remember that context can fundamentally alter how the financial analysis tells the story:

➡️ Identify the ratios that fit your business objectives, both internal and external.

➡️ Tailor financial analysis and benchmarking to the business and its individual situational factors (industry, geography, size, etc.).

➡️ Track ratios over time to identify trends and inform strategic planning.

4 Steps to Assess Business Financial Health - Oana Labes, MBA, CPA

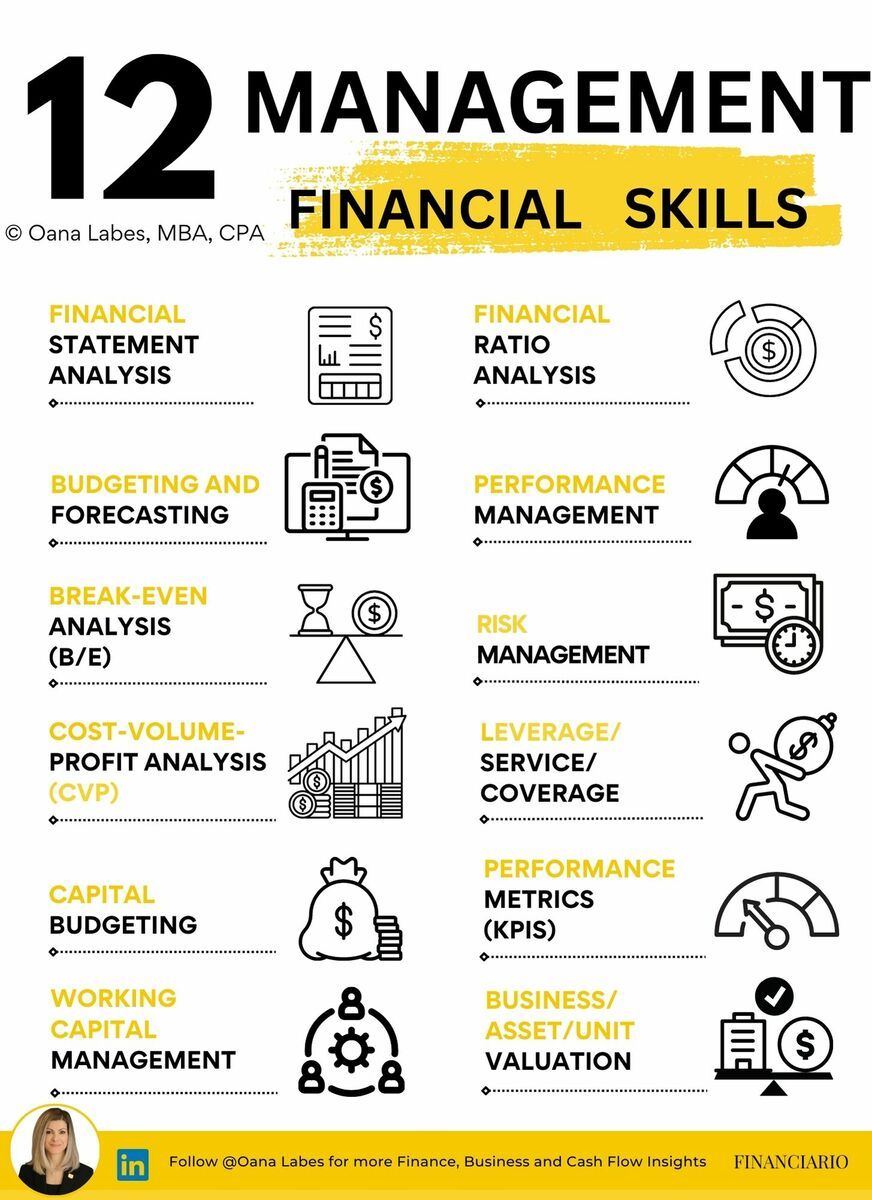

1// Financial Statement Analysis

🎯 Understand and examine the basic financial statements (income statement, balance sheet, and cash flow statement) to assess your company's financial performance and position, and to identify relevant trends and patterns.

2// Budgeting and Forecasting

🎯 Create and manage a budget, and forecast future financial performance to anticipate risks and opportunities, make informed decisions and ensure the long-term profitability and sustainability of your company.

3// Break-even analysis (B/E)

🎯 Determine the point at which your company's revenues will equal its costs to identify when the your company will become profitable.

4// Cost-Volume-Profit (CVP) Analysis

🎯 Understand how changes in costs, volume, and price will impact your company's profitability.

5// Capital Budgeting (NPV, ROI)

🎯 Evaluate and select long-term investments in new equipment and facilities to optimize performance and ensure your company's continued growth and profitability.

6// Working Capital Management (W/C)

🎯 Balance collections, inventory stocks and payments to reduce your Cash Conversion Cycle without damaging client and supplier relationships, and without foregoing sales opportunities.

7// Financial Ratio Analysis

🎯 Calculate and interpret critical financial ratios (liquidity ratios, profitability ratios, debt service ratios and solvency ratios) to get insight into different aspects of your company's financial health.

8// Performance management

🎯 Establish goals, monitor progress, and provide feedback to align employee and organizational goals and increase your management effectiveness.

9// Risk Management

🎯 Identify and manage financial risks (credit risk, market risk, and liquidity risk) and their impact on your company performance to ensure its long-term stability and profitability.

10// Leverage/Service/Coverage

🎯 Make informed decisions about both debt and equity financing to ensure your company has the appropriate funding and capital structure to support growth.

11// Performance Metrics (KPIs)

🎯 Monitor and manage profitability and cash alongside other relevant metrics like production efficiency, quality costs or customer net promoter score to improve your decision making in support of the strategic objectives of your business.

12// Business/Unit/Asset Valuation

🎯 Understand valuation drivers at the asset, unit/division and business levels to impact them effectively and improve your ability to achieve desired results.

12 Financial Skills for Managers - Oana Labes, MBA, CPA

1// Not having a rolling cash flow forecast

Forecasted cash flows show your company’s projected operating, investing and financing cash flows for the next fiscal period (and beyond, for rolling cash flows), based on year-to-date results, fiscal year plans, and the ongoing effects of current strategic initiatives.

2// Not securing access to a short term working capital line of credit

Short term lines of credit for the financing of working capital assets are critical for growing companies or those with seasonal or irregular cash flow patterns.

3// Not negotiating sufficient access to short term working capital financing

A line of credit with an insufficient limit will be of little use for a growing company faced with a large sale opportunity.

A line of credit with a sufficient limit but which cannot be accessed due to an insufficient borrowing base of accounts receivable and inventory will pose a similar challenge.

4// Not managing your cash conversion cycle

If the DSO + DIO - DPO is starting to creep up, you should be noticing and proactively investigating to avoid it generating a cash flow deficit.

5// Your suppliers will want to be paid as soon as possible, meanwhile your clients will ask for the exact opposite.

Negotiate with both parties to maximize your cash flow position while also managing your supply chain relationships.

6// Late invoicing

This signals a lack of adequate processes and systems, so consider automation solutions and embed a relevant KPI in the performance metrics of responsible team members.

7//Overstocking inventory

Effective inventory management involves balancing supply and demand, optimizing inventory levels, minimizing costs and avoiding stock outs so you can meet customer needs.

8// Manual and paper based collection process

To maximize cash flow, make it easy for your customers to pay you, so replace manual and paper based processes with electronic payments and digital reporting solutions.

9// Misaligning cash flow sources

Permanent increases in operating assets need to be financed with permanent capital, whether equity or debt (financing cash inflows).

Cash inflows from asset sales (investing cash inflows) for example, are not a sustainable source of financing for operating cash flow deficits

10// Ignoring cash flow quality

Cash absorbed by low quality assets, such as accounts receivable with a low collection probability or obsolete inventory should be properly reflected in your reserves so you can appropriately plan your cash flow financing requirements.

11// Under budgeting debt payments

Debt obligations (principal, interest, bonuses, royalties, warrants, etc) are repayable with cash, so you need to correctly provision both the timing and the amounts in your cash flow forecast to ensure obligations can be met when they come due.

12// Not having a cash flow culture

Thriving cash flow starts with the top executive leaders making cashflow a priority on equal footing with profitability and growth, and establishing appropriate cash flow KPIs to drive the desired performance.

13// Not following up

Effective follow-up relies on systems and procedures that help ensure timely payment collections and disbursements, and it can help identify potential issues early on.

14// Miscalculating the cash flow basis for bank covenant calculations.

Covenant calculations can be based on:

✔️EBITDA

✔️Adjusted EBITDA (individual formula)

✔️Free Cash Flow (FCF)

✔️Operating Cash Flow (OCF)

Understand the specific terms provisioned in your lending agreements to avoid covenant breaches and maintain compliance with contractual obligations.

15// Paying suppliers early

With the exception of attractive early payment discounts and a few other strategic reasons, making early payments to suppliers outside of contractual terms has little benefit for your company while putting unnecessary pressure on your cash flows.

16// Improperly using payment discounts

Cash is king so understandably you will want to accelerate collections.

However, offering early payment discounts which you cannot afford will not be of much help, which is why proper costing is critical to inform your minimum pricing levels.

16 Cash Flow Mistakes to Avoid - Oana Labes, MBA, CPA

Some next steps for you to consider:

Sponsor this newsletter - reply to this email with subject line "Sponsorship" to partner with me and bring your business in front of a highly engaged professional community made up of CFOs, CEOs, CPAs, MBAs, FMVAs, Controllers, Finance Managers, Presidents, Business Owners, and upcoming leaders.

Forward this newsletter - to help your network enjoy it the way you do. Your friends and colleagues will appreciate your thoughtfulness and will respect your deep knowledge of finance.

Subscribe to The Finance Gem - to receive my newsletter directly next week, in case this email was forwarded to you by one of your thoughtful friends or colleagues.

Thanks so much for reading. See you next week.