Welcome to this week's edition of The Finance Gem 💎 where I bring you my unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter edition is brought to you by chatGPT for Finance, a one-of-a-kind chatGPT Artificial Intelligence Guide for Finance Professionals authored by one of Linkedin’s top creators in this space, Nicolas Boucher.

Nicolas has spent more than 14 years in Finance. He also trained and coached hundreds of finance and accounting professionals through his other courses, so he has a keen understanding of the needs and daily demands of these roles. His fantastic 92 page guide on chatGPT for finance professionals will show you how to:

-How to start using ChatGPT with a step-by-step instruction

-How to use ChatGPT to create Excel Formulas

-How to use ChatGPT to analyse figures

-How to use ChatGPT to write emails

-How to use ChatGPT to write SOP

-What ChatGPT can do to help you

-And much more

Nicolas’s guide is unique and incredibly well done, and you will not find it anywhere else. It currently has an incredible introductory price of only $27. Get it today! Learn how to use ChatGPT to boost your career, become much more efficient, and prevent AI from one day potentially replacing you.

If you’ve been following me for a while, you know I started posting my finance insights on Linkedin in late August 2022.

As of Feb 28, 2023, 5 months later, I now have the privilege of counting over 100,000 incredible followers like you on Linkedin.

Thank you! I'm also really happy to have you as a highly valued subscriber of The Finance Gem 💎 and a critical part of the incredible professional community we’ve built on Linkedin and beyond.

This week's strategic finance & accounting highlights:

Without further ado, let's begin:

It will also help you unlock your full Profit potential.

CVP is an extremely valuable management accounting tool used to analyze the relationship between your company's sales volume, costs, and profits.

⚫ 𝐁𝐚𝐬𝐢𝐜 𝐂𝐕𝐏 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

🎯 The underlying assumption of CVP is that costs can be either fixed or variable, depending on whether they vary with changes in sales volumes or not.

🎯 The CVP Analysis relies on 2 concepts: Contribution Margin and Break Even.

1️⃣ 𝐓𝐡𝐞 𝐂𝐨𝐧𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐠𝐢𝐧 (𝐂𝐌) 𝐢𝐬 𝐭𝐡𝐞 𝐬𝐚𝐥𝐞𝐬 𝐩𝐫𝐢𝐜𝐞 𝐨𝐟 𝐲𝐨𝐮𝐫 𝐩𝐫𝐨𝐝𝐮𝐜𝐭 𝐨𝐫 𝐬𝐞𝐫𝐯𝐢𝐜𝐞, 𝐥𝐞𝐬𝐬 𝐚𝐥𝐥 𝐢𝐭𝐬 𝐯𝐚𝐫𝐢𝐚𝐛𝐥𝐞 𝐜𝐨𝐬𝐭𝐬

Contribution Margin = Sales Revenue - Variable Costs

Contribution Margin Ratio = Contribution Margin / Sales Revenue

2️⃣ 𝐘𝐨𝐮 𝐁𝐫𝐞𝐚𝐤 𝐄𝐯𝐞𝐧 𝐨𝐧𝐜𝐞 𝐲𝐨𝐮 𝐚𝐫𝐞 𝐚𝐛𝐥𝐞 𝐭𝐨 𝐮𝐬𝐞 𝐭𝐡𝐞 𝐂𝐨𝐧𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐠𝐢𝐧 𝐞𝐚𝐫𝐧𝐞𝐝 𝐟𝐫𝐨𝐦 𝐲𝐨𝐮𝐫 𝐬𝐚𝐥𝐞𝐬 𝐭𝐨 𝐜𝐨𝐯𝐞𝐫 𝐚𝐥𝐥 𝐲𝐨𝐮𝐫 𝐅𝐢𝐱𝐞𝐝 𝐂𝐨𝐬𝐭𝐬

Break-Even Point (in units) = Fixed Costs / Contribution Margin per Unit

Break-Even Point (in dollars) = Fixed Costs / Contribution Margin Ratio

🎯 After covering fixed costs, each new dollar of Contribution Margin will become straight-up profit, because fixed costs for the period have already been covered.

⚫ 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐝 𝐂𝐕𝐏 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

3️⃣ 𝐓𝐨 𝐞𝐚𝐫𝐧 𝐚 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐚𝐦𝐨𝐮𝐧𝐭 𝐨𝐟 𝐏𝐫𝐨𝐟𝐢𝐭, 𝐚𝐝𝐝 𝐭𝐡𝐚𝐭 𝐭𝐨 𝐭𝐡𝐞 𝐭𝐨𝐭𝐚𝐥 𝐟𝐢𝐱𝐞𝐝 𝐛𝐮𝐫𝐝𝐞𝐧 𝐭𝐨 𝐜𝐨𝐯𝐞𝐫 𝐰𝐢𝐭𝐡 𝐲𝐨𝐮𝐫 𝐜𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐞𝐝 𝐂𝐨𝐧𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐠𝐢𝐧 𝐑𝐚𝐭𝐢𝐨.

Profit Target = (Fixed Costs + Target Profit) / Contribution Margin Ratio

4️⃣ 𝐓𝐨 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐡𝐨𝐰 𝐦𝐮𝐜𝐡 𝐲𝐨𝐮𝐫 𝐬𝐚𝐥𝐞𝐬 𝐯𝐚𝐥𝐮𝐞 𝐜𝐚𝐧 𝐝𝐞𝐜𝐥𝐢𝐧𝐞 𝐛𝐞𝐟𝐨𝐫𝐞 𝐲𝐨𝐮 𝐬𝐭𝐚𝐫𝐭 𝐥𝐨𝐬𝐢𝐧𝐠 𝐦𝐨𝐧𝐞𝐲, 𝐜𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐞 𝐲𝐨𝐮𝐫 𝐌𝐚𝐫𝐠𝐢𝐧 𝐨𝐟 𝐒𝐚𝐟𝐞𝐭𝐲 (𝐝𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞 𝐭𝐨 𝐲𝐨𝐮𝐫 𝐛𝐫𝐞𝐚𝐤 𝐞𝐯𝐞𝐧 𝐩𝐨𝐢𝐧𝐭).

Margin of Safety = Expected or Actual Sales - Break-even Point

Margin of Safety % = (Margin of Safety / Expected or Actual Sales) x 100

5️⃣ 𝐓𝐨 𝐩𝐞𝐫𝐟𝐨𝐫𝐦 𝐂𝐕𝐏 𝐨𝐧 𝐦𝐮𝐥𝐭𝐢𝐩𝐥𝐞 𝐩𝐫𝐨𝐝𝐮𝐜𝐭𝐬

>> determine your contribution margin per product

>> determine your sales mix

>> determine your weighted average contribution margin

>> calculate your break-even point in units and allocate it by product based on your sales mix

Cost- Volume - Profit Analysis - Oana Labes, MBA, CPA

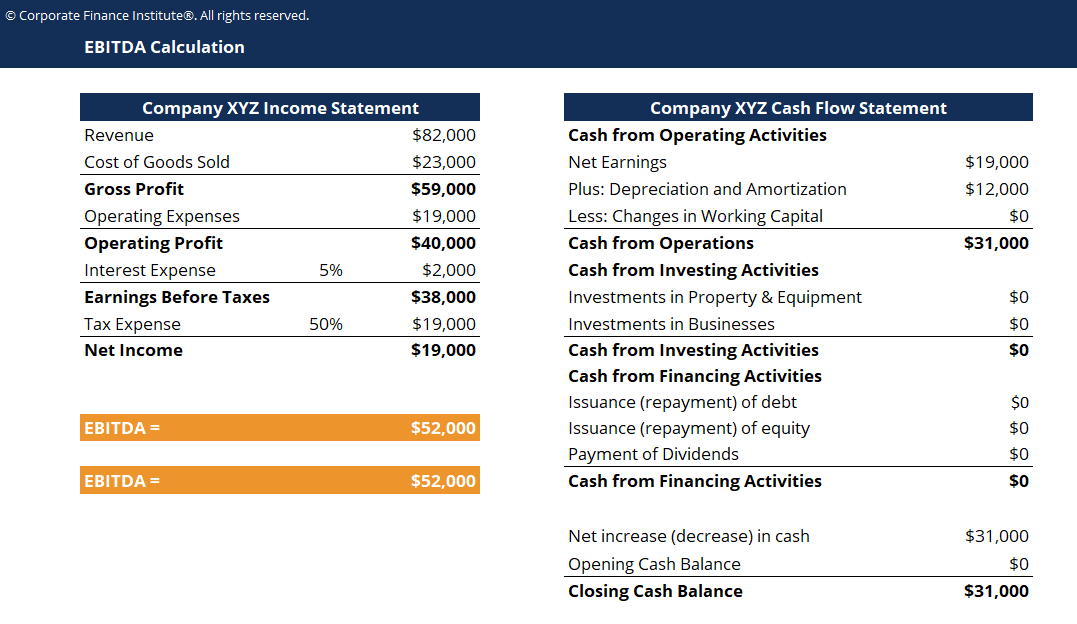

You can't pay your Taxes with EBITDA.

You can’t pay out Dividends with EBITDA.

You can’t buy more Inventory with EBITDA.

You can't pay for new Equipment with EBITDA.

You can't grow Sales, Marketing, R&D with EBITDA.

You can’t pay Principal and Interest obligations with EBITDA.

Why?

𝐁𝐞𝐜𝐚𝐮𝐬𝐞 𝐄𝐁𝐈𝐓𝐃𝐀 𝐢𝐬 𝐧𝐨𝐭 𝐂𝐀𝐒𝐇.

❌ Because cash spent on unsold inventory, or cash not collected from credit sales is not available to pay suppliers, pay taxes, or grow the business.

❌ Because every business requires at least maintenance CAPEX investments to maintain current output levels, and that cash is no longer available to invest in net new assets, or to repay debt obligations.

❌ Because the cash spent on tax payments is not available to invest in growing the sales and marketing team, or to pay for research that will improve the company’s technology or production processes.

𝐒𝐨 𝐢𝐟 𝐲𝐨𝐮 𝐜𝐚𝐧’𝐭 𝐮𝐬𝐞 𝐄𝐁𝐈𝐓𝐃𝐀 𝐭𝐨 𝐩𝐚𝐲 𝐟𝐨𝐫 𝐚𝐧𝐲𝐭𝐡𝐢𝐧𝐠, 𝐰𝐡𝐚𝐭 𝐜𝐚𝐧 𝐲𝐨𝐮 𝐫𝐞𝐚𝐬𝐨𝐧𝐚𝐛𝐥𝐲 𝐝𝐨 𝐰𝐢𝐭𝐡 𝐢𝐭?

🎯 Not much.

✅You can use it to perform trend analysis and track company performance across periods.

✅You can also use it to monitor a Debt Service Charge Ratio (DSCR) if your bank requires you to covenant a minimum level.

✅You might even be able to use it to compare multiple companies, with the caveat that different business models will have inherently different CAPEX and working capital investment requirements.

Every other use for EBITDA requires adjustments, to ensure its short term use doesn’t jeopardize your company’s long term future.

❌You shouldn’t use EBITDA in performance management without adjusting for maintenance CAPEX investments at a minimum.

❌You shouldn’t use EBITDA for valuation purposes without a Quality of Earnings report to understand management approach to expense recognition & asset capitalization, and the working capital investment requirements of the business.

Do you Know the 5 Types of Cash Flow?

They are highly confused, often misunderstood and mostly underutilized.

Here’s what they are and how to use them:

⚫ Represents the net cash generated by your company's core operations

⚫ Calculated by adjusting Net Income for non-cash items & changes in net working capital assets.

⚫ Used to assess:

>> your company's financial health

>> your company's ability to meet its financial obligations

>> if your company is generating sufficient cash to fund ongoing business operations

>> trends in how the business generates cash

⚫ Represents the net cash generated by your company's investments in long-term assets such as property, plant and equipment (PPE).

⚫ Calculated by totaling the net investments in PPE over the period (purchases less sales of PPE)

⚫ Used to assess:

>> your company's investment decisions

>> your company's ability to generate returns from its investments

⚫ Represents the cash generated by your company's net debt and/or equity activity.

⚫ Calculated by totaling net debt and equity proceeds over the period.

⚫ Used to assess:

>> your company's ability to raise capital

>> your company's financing choices and risk profile

⚫ Represents the cash remaining in your business after accounting for cash outflows that support operations (operating expenses + working capital) and cash outflows that maintain the capital asset base (capital expenditures).

⚫ Calculated by adjusting Operating Cash Flow for after tax interest expense and investments in capital assets

⚫ Used to assess:

>> your company's financial strength and ability to generate sufficient cash for growth and reinvestment

>> your company's value based on the discounted cash flow (DCF) valuation methods.

⚫ Represents the cash remaining in your business after accounting for all business expenses, investments in working capital assets, investments in fixed assets, and also all debt obligations.

⚫ Calculated by adjusting Operating Cash Flow for after tax interest expense, investments in capital assets and net debt payments.

⚫ Used to assess:

>> your company's ability to generate cash for distributions to shareholders holders

Absolutely.

But first, let’s talk Value.

What it is:

🎯 Sustainable long-term growth and profitability while providing value to your investors and stakeholders.

How to create:

🎯 Increase revenue, reduce costs, improving operational efficiency, optimize capital structure

How to measure:

🎯 EPS, ROI, Market Cap

Business fundamentals like growth, expansion and innovation are known to be value drivers in your organization.

Meanwhile, reporting, compliance and financial planning are known to be cost drivers, so they’re treated as support functions and subjected to budget constraints and cost-cutting measures.

When used strategically, however, your Finance and Accounting function can singlehandedly drive the stability and success of your company.

Or it can destroy all the value built by your growth, expansion and innovation.

Here are 10 strategies to maximize business value creation by strategically leveraging your Finance and Accounting functions:

1️⃣ Develop your financial reporting system

Provide accurate financial information to your stakeholders to improve transparency and build trust with your lenders and investors.

2️⃣ Implement cost control measures

Identify inefficiencies and waste in your company's operations to increase profitability and drive up value.

3️⃣ Optimize your capital structure

Manage your debt-to-equity ratio and other financial metrics to optimize your capital structure, manage risk, reduce your cost of capital, improve profitability and increase your financial flexibility.

4️⃣ Invest in technology

Improve your operating and reporting efficiency to reduce costs and improve both the quality and the speed of your financial reporting.

5️⃣ Manage working capital effectively

Improve your liquidity position to reduce the need for external financing, and to improve your ability to meet short-term obligations.

6️⃣ Develop your risk management system

Reduce your exposure to financial risks such as credit risk, market risk, and operational risk, to optimize your cost of capital and increase future cash flows.

7️⃣ Evaluate and optimize pricing strategies

Optimize your pricing to increase profitability and improve your business valuation.

8️⃣ Improve cash flow management

Reduce your need for external financing, improve your liquidity, and reduce your risk of insolvency.

9️⃣ Develop your budgeting and forecasting

Improve your ability to plan and allocate resources effectively to reduce waste and improve your profitability.

🔟 Foster a culture of financial discipline

Align organizational stakeholders on the same measures of financial performance to drive those behaviors that consistently improve your key valuation drivers.

From Cost Center to Value Drive - Oana Labes, MBA, CPA

A strong Business Cash Flow Culture starts at the top.

It starts with CEOs and CFOs making cash and capital efficiency metrics a top company priority, on an equal footing with profitability and P&L metrics.

➡️ Good cash management helps companies navigate downturns.

➡️ It also helps them maximize growth opportunities like expansions or M&A activity.

➡️ So here's my improved recommended CFO KPI dashboard, tracked across 3 critical areas:

✅ working capital

✅ expenditures

✅ financial health

➡️ Use it to advance your organization's strategic objectives, around:

✅cash flow

✅profitability

✅financial health

Get a copy of the Excel file below and start customizing your own Cash Flow and Health Dashboard.

EBITDA is Not Cash Flow.

🎯 It is however a necessary evil, and whether you like it or not, it’s here to stay.

🎯 EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) is calculated just as the name implies:

E >> Earnings

B >> Before (add back)

I >> Interest expense

T >> Tax expense

D >> Depreciation expense

A >> Amortization expense

🎯 Here are 3 Benefits of EBITDA to know:

1️⃣ It is easy to calculate.

As opposed to Operating Cash Flow (OCF), Free Cash Flow (FCF) or Economic Value Added (EVA).

2️⃣ It has become universally used as the language of (proxy) Profitability.

Or Cash Flow, depending on who you talk to, and what they use it for.

☑️ Your company likely uses it to manage internal performance.

☑️ Your bankers use it to measure your ability to repay debt.

☑️ Your M&A firm will use it to value your business.

3️⃣ It allows you to compare financial performance results across businesses and industries.

It (presumably) levels the playing field by removing the impact of several variables from the financial analysis:

☑️ the company’s capital structure (removes the interest)

☑️ the company’s operating leverage (removes depreciation & amortization expense)

☑️ the company’s tax circumstances (removes the tax expense)

➡️ And here are 10 Critical Flaws of EBITDA:

1. It is not a GAAP metric.

Which means there is no standardized formula to calculate it, and companies will choose to calculate it however it benefits them most.

Such as in the case of Earnings per Share, when a company may exclude stock based compensation from its GAAP earnings while another may not.

2. It implies that all net income translates into cash the same way.

For example, using EBITDA as a proxy for cash flow ignores the required investment into working capital assets to support the business future growth.

3. It does not consider the amount of required capital reinvestment.

While Depreciation and Amortization may be non-cash items, every business has CAPEX investment needs which aren’t captured in EBITDA.

4. It does not account for the amount of cash absorbed into working capital assets.

Changes in receivables, payables and inventory balances can mean that an EBITDA of $1 million disguises the reality of an operating cash flow deficit of $2 million.

5. It implies that loan repayment will be prioritized.

In fact, a company may choose other uses for its cash, such as investing in growth, acquisitions or plant capacity expansions, and leave no residual capital left to repay loans.

6. It doesn’t say anything about the quality of earnings.

Which means earnings and EBITDA may be inflated with deferred expenses, aggressive accounting policy choices, or underfunded pension liabilities.

7. It is a poor measure of profitability.

For example, GAAP revenue recognition criteria differs around the world which can overstate earnings; meanwhile, interest and taxes are usually real cash outflows which reduce earnings in practice.

EBITDA’s ability to proxy for cash is also distorted in all instances where revenue recognition doesn’t correlate with the receipt of cash, such as percentage of completion in long term contracts. In those instances, customers are billed in accordance to contractual terms, while the company recognizes revenue based on costs incurred, and the true profitability of the contract could be wildly overstated until it is actually completed.

8. It is an inadequate comparison for acquisition multiples.

EBITDA doesn’t capture industry specific capital investment requirements nor company specific underlying strength in operating earnings.

It is trying to level the playing field and strip out so-called noise from the profitability picture of a company, but when the noise is inherent in the make up of an entire industry, stripping out critical components like CAPEX maintenance results in a distorted image of the earnings potential of that entity.

9. It can be severely misleading when used as a measure of cash flow.

EBITDA ignores several real cash outflows as well as understates the future expected increase of those cash outflows.

10. It can easily be manipulated through aggressive accounting policies.

There are numerous financial reporting areas where management can manipulate company earnings and artificially inflate EBITDA, such as with percentage of completion revenue recognition, deferred expenses, pension liabilities, or depreciation assumptions.

EBITDA is not Cash Flow - Oana Labes, MBA, CPA

Some next steps for you to consider:

Sponsor this newsletter - reply to this email with subject line "Sponsorship" to partner with me and bring your business in front of a highly engaged professional community made up of CFOs, CEOs, CPAs, MBAs, FMVAs, Controllers, Finance Managers, Presidents, Business Owners, and upcoming leaders.

Forward this newsletter - to help your network enjoy it the way you do. Your friends and colleagues will appreciate your thoughtfulness and will respect your deep knowledge of finance.

Subscribe to The Finance Gem - to receive my newsletter directly next week, in case this email was forwarded to you by one of your thoughtful friends or colleagues.

Thanks so much for reading. See you next week.