Welcome to this week's edition of The Finance Gem 💎 where I bring you unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter issue is brought to you by JotForm - a powerful online form builder that makes it easy to create robust forms and collect important data. Jotform is trusted by over 20M users worldwide, such as nonprofits, educational institutions, small businesses, and enterprises. Use my affiliate link to try Jotform for free up to 5 forms, and experience the power of smart automated workflows and automation. This helps support my work at no cost to you, keeping this valuable newsletter free for yourself and over 28,000 readers.

And speaking of smart, how would you like to own every meeting room you walk into?

EBITDA and Revenue Growth can only carry a company so far, and Cash Flow always prevails.

The sooner you can understand your cash flow drivers, analyze inflows and outflows, and optimize the cash conversion cycle, the faster your business will grow and the healthier it will be.

Upgrade of your strategic finance skills, accelerate your career & grow your business with my on-demand video course: The Cash Flow Masterclass.

Enjoy 2.5 hours of on-demand video lessons, 190 downloadable course slides, 50+ Video Lessons, 10+ Excel Models, 10+ Infographics & Lifetime Access Anywhere Anytime on Any Device.

The Cash Flow Masterclass is so much more than just a course.

It’s a strategic tool to get you closer to your next promotion.

Your next insightful board presentation.

Your next successful financing.

But don't just take my word for it. Here's what some of my 100+ students have to say:

Bhavik Arora, Finance Analyst

Are you ready for your cash flow transformation?

Click the button below and I look forward to seeing you in class!

News this Week:

This week’s Linkedin posts were viewed by over 6.5 million professionals on Linkedin.

Favikon announced the Top 200 Worldwide Content Creators Ranking and guess who’s #11 in this all star list, plus #1 in Corporate Finance #1 in the Worldwide Female Ranking, and #2 in Canada?

If you haven’t already, add your name to the list to get notified when I schedule the next complementary finance webinar.

Now on to this week's strategic finance insights:

The CRO Checklist

Accounting vs. Finance

Accounting vs. Finance Careers

Your Adjusted EBITDA is Still Not Cash Flow

The COO Checklist

The Finance and Accounting Professional Designations Cheat Sheet

Do you want to own full size, print-ready PDFs of my strategic finance infographics, checklists and cheat sheets for your personal use? Visit my store and find your favorites!

The CRO Checklist

The Chief Revenue Officer (CRO) partners closely with the CEO and CFO.

They bridge the gap between sales revenues and financial management.

They align the revenue growth strategy with the business growth strategy.

➡️ Here is a strategic checklist across 13 key areas of the CRO role, to help you stay on track.

➕ Bonus KPIs selection to monitor and measure the CRO performance.

1. Revenue Strategy: Develop and execute strategic plans to drive revenue growth.

2. Sales Management: Oversee sales processes and manage sales teams to achieve targets.

3. Customer Acquisition and Retention: Strategize and implement methods for customer growth and retention.

4. Pricing and Revenue Optimization: Conduct pricing analyses and create dynamic models for revenue optimization.

5. Channel Partnership Management: Identify and establish strategic partnerships to enhance revenue.

6. Sales Forecasting and Analytics: Use historical data and market trends for accurate sales prediction.

7. Revenue Operations: Streamline sales operations and integrate technology for optimized workflow.

8. Sales Enablement and Training: Implement training programs to enhance the sales team skills and knowledge.

9. Sales Performance Management: Implement performance management frameworks to track and improve sales performance.

10. Revenue Growth Strategies: Identify opportunities and strategize for revenue growth.

11. Portfolio Management: Evaluate product/service portfolio, develop strategies for expansion, monitor portfolio performance.

12. Key Account Management: Identify key accounts, build stakeholder relationships, develop account growth plans, monitor account performance.

13. Revenue Risk Management: Identify and mitigate revenue-related risks, ensure compliance with regulatory requirements, monitor risk indicators.

Download a free copy of the CRO checklist here.

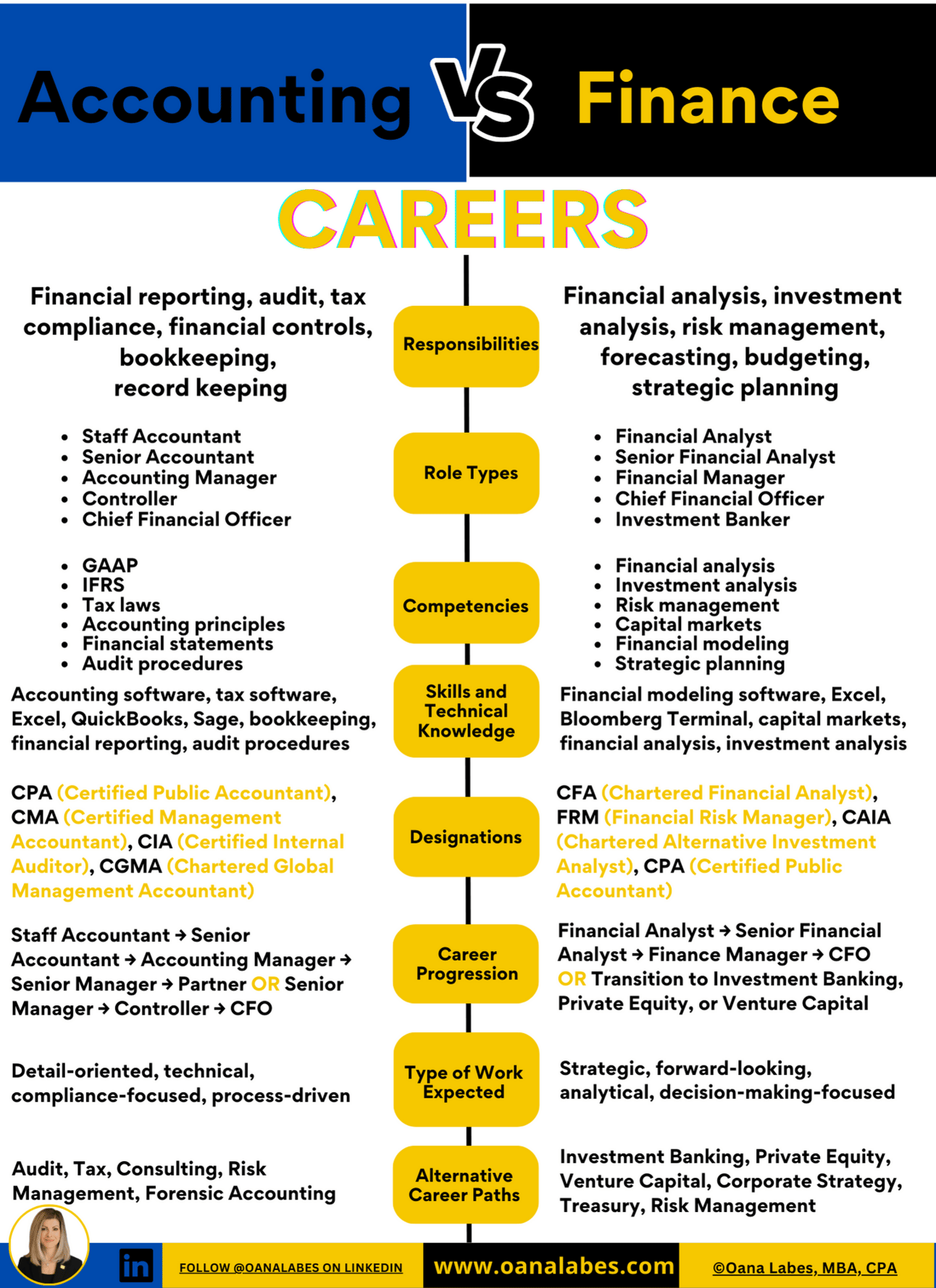

Accounting vs. Finance Careers

🎯Accounting and Finance are not the same.

They are distinct functions within a company.

And they each require a different focus and set of skills.

Accounting focuses on reporting, compliance, and record keeping.

Finance looks forward strategically focusing on analysis & decision-making.

Both play critical & complementary roles in the company's financial success.

🎯Accounting Roles include: Staff Accountant, Senior Accountant, Accounting Manager, Controller, Chief Financial Officer

🎯Finance Roles include: Financial Analyst, Senior Financial Analyst, Financial Manager, Chief Financial Officer, Investment Banker

⚫Accounting designations include: CPA (Certified/Chartered Professional Accountant), CMA (Certified Management Accountant), CIA (Certified Internal Auditor), CGMA (Chartered Global Management Accountant)

⚫Finance designations include: CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), CAIA (Chartered Alternative Investment Analyst), CPA (Certified/Chartered Professional Accountant)

➡️ Key Soft skills in Accounting include: Detail oriented, Conservative thinking, Analytical and Organized, Process driven, Business acumen, Problem solving and Critical thinking

➡️ Key Soft skills in Finance include: Research Oriented, Analytical and Collaborative, Risk-taking, Innovative thinking, Results driven, Business acumen, Communication, Problem solving and Negotiation

Your Adjusted EBITDA is Still Not Cash Flow

Here are 10 sneaky EBITDA Adjustments to be aware of. Depending on the side you're playing for, you may find yourself arguing pro or against these

1️⃣ Provisions

⚫ Guarantees. Future tax obligations. Asset Retirement Obligations. Asset impairment. Losses. Pensions. Severance costs.

The traditional view is that these aren’t actual obligations and should be added back to EBITDA, especially when a lot of management assumptions which could later be provide incorrect are involved in determining the provisioned amounts.

2️⃣ Non-operating income

⚫ This is usually passive income which isn’t related to the company’s core operations.

Most parties will agree that if the company isn’t actively in the business of generating that income, it shouldn’t be part of the company’s EBITDA.

3️⃣ Unrealized gains or losses

⚫ The typical view is that paper gains and losses don’t belong in EBITDA.

4️⃣ One-time revenue or expenses

⚫ These are the result of non-recurring transactions.

The typical view is that because they aren’t repeatable they do not belong in EBITDA.

5️⃣ Foreign exchanges gains or losses

⚫ These are the result of incidental transactions outside the company’s core operations.

If the company isn’t an FX boutique or exchange, FX gains and losses typically aren’t part of the company’s EBITDA.

6️⃣ Goodwill impairment

⚫ This is a decrease in the value of goodwill reported following an acquisition. It is still typically considered a “paper loss” that doesn’t belong in EBITDA.

7️⃣ Asset write-downs

⚫ These are decreases in the value of an asset, usually following non-recurring events and the usual consensus is that because they’re non-cash, they don’t belong in EBITDA.

8️⃣ Litigation or insurance expenses outside the regular course of business.

⚫ These are the result of non-recurring transactions such as one-time lawsuits, large financing deals or outlier commercial contracts.

Most will argue that if they aren’t repeatable, they don’t belong in EBITDA.

9️⃣ Owner compensation over/under market value

⚫ In private companies, owners often don’t pay themselves a fair salary, or they pay themselves more than a comparable executive role would pay an employee.

🔟Share-based compensation

⚫ Some will argue that share-based compensation isn’t actual cash outflows while others will maintain that they are real expenses incurred to attract and retain executive level talent.

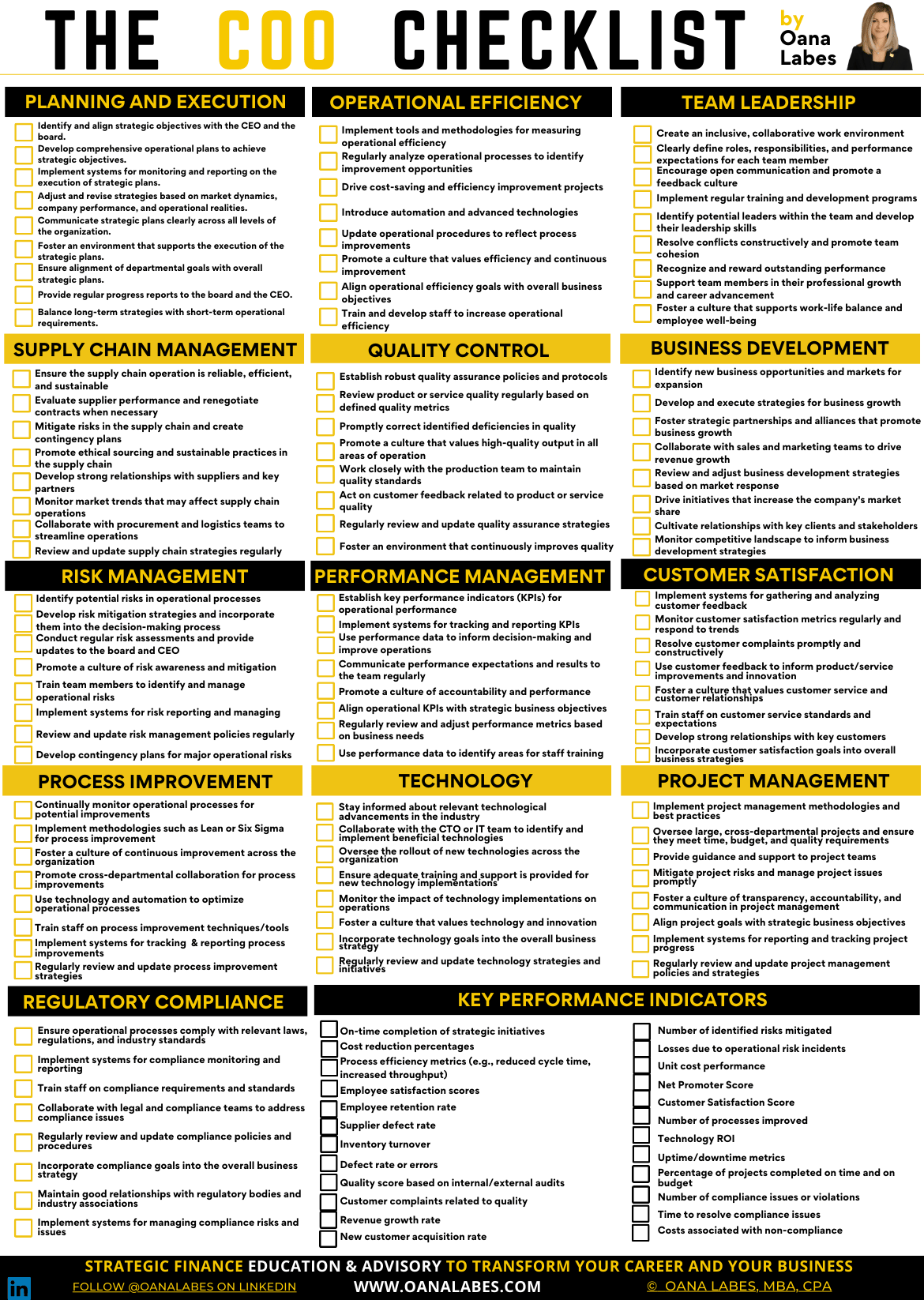

The COO Checklist

🎯This is the ultimate COO toolkit.

Because being a COO is demanding.

It requires strategic thinking, a solid understanding of daily company operations, and a relentless focus on efficiency.

And mastering Operations Management is essential.

🎯𝐇𝐞𝐫𝐞 𝐚𝐫𝐞 𝐭𝐡𝐞 15 𝐤𝐞𝐲 𝐚𝐫𝐞𝐚𝐬 𝐚 𝐂𝐎𝐎 𝐬𝐡𝐨𝐮𝐥𝐝 𝐟𝐨𝐜𝐮𝐬 𝐨𝐧 𝐭𝐨 𝐞𝐧𝐬𝐮𝐫𝐞 𝐬𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐩𝐞𝐚𝐤 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞:

1. Strategic Planning and Execution

2. Operational Efficiency

3. Team Leadership and Staff Development

4. Financial Management

5. Supply Chain Management

6. Quality Control and Assurance

7. Business Development

8. Risk Management

9. Performance Metrics

10. Customer Satisfaction

11. Process Improvement

12. Technology Implementation

13. Project Management

14. Regulatory Compliance

15. Corporate Culture

Download a free copy of the COO checklist here.

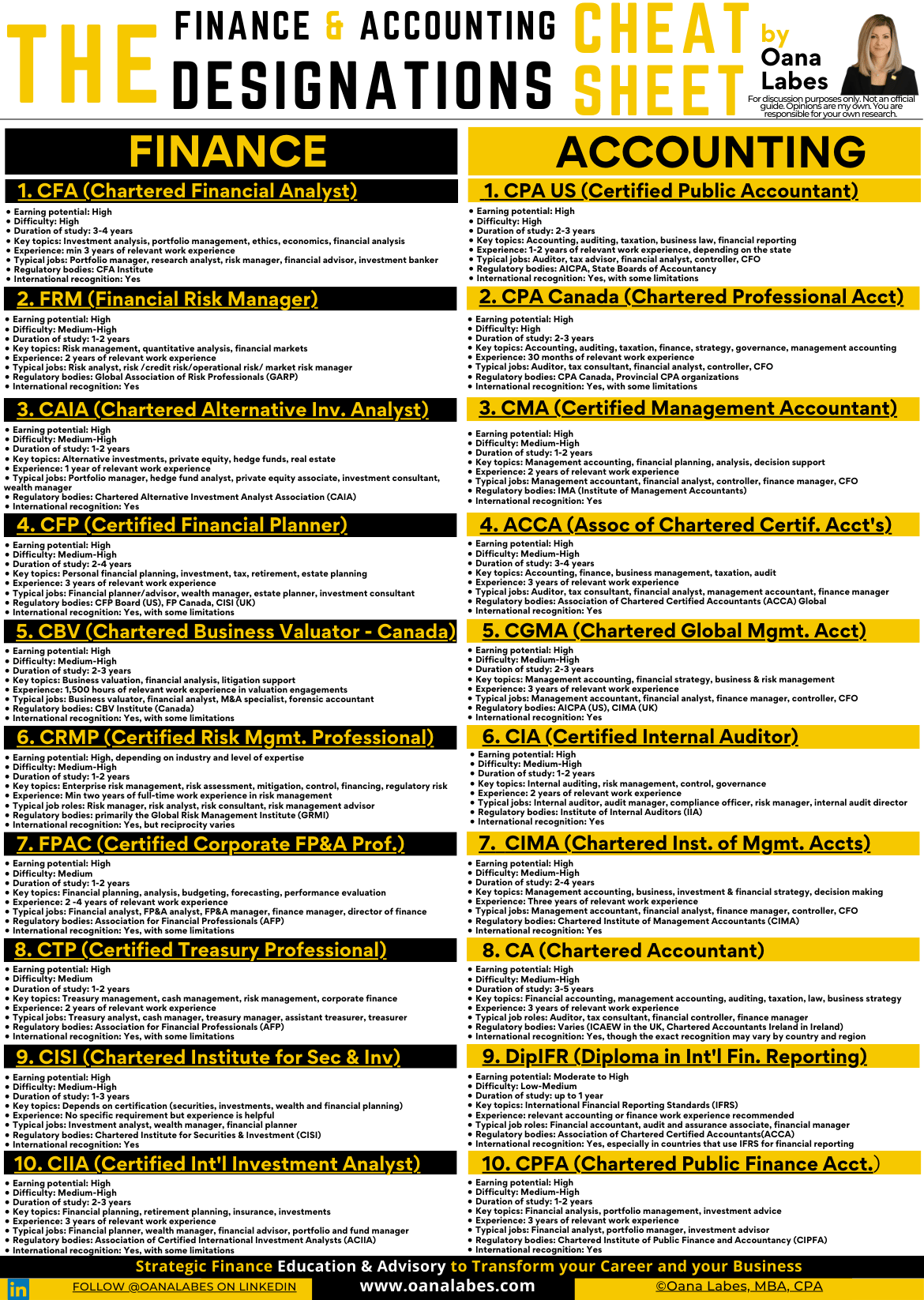

The Finance and Accounting Designations Cheat Sheet

👉 Professional Designations run deep in Finance & Accounting.

And our world is saturated with acronyms.

So it can be challenging to choose.

👉 Here are 20 of the most respected and well known Finance and Accounting designations worldwide to help you stay ahead of the curve.

🎯Finance Designations:

1. CFA (Chartered Financial Analyst)

2. FRM (Financial Risk Manager)

3. CAIA (Chartered Alternative Inv. Analyst)

4. CFP (Certified Financial Planner)

5. CBV (Chartered Business Valuator - Canada)

6. CRMP (Certified Risk Mgmt. Professional)

7. FPAC (Certified Corporate FP&A Prof.)

8. CTP (Certified Treasury Professional)

9. CISI (Chartered Institute for Sec & Inv)

10. CIIA (Certified Int'l Investment Analyst)

🎯Accounting Designations:

1. CPA US (Certified Public Accountant)

2. CPA Canada (Chartered Professional Acct)

3. CMA (Certified Management Accountant)

4. ACCA (Assoc of Chartered Certif. Acct's)

5. CGMA (Chartered Global Mgmt. Acct)

6. CIA (Certified Internal Auditor)

7. CIMA (Chartered Inst. of Mgmt. Accts)

8. CA (Chartered Accountant)

9. DipIFR (Diploma in Int'l Fin. Reporting)

10. CPFA (Chartered Public Finance Acct.)

Download a free copy of the cheat sheet here.

When you need help making better strategic finance decisions here are 3 ways I can help you

Upgrade your (or your team’s) strategic finance skills with The Cash Flow Masterclass. Leverage my unique on-demand video course to improve your knowledge, elevate your decision making and accelerate your career. For customized team training please apply here.

Enjoy full size, print-ready PDFs of my strategic finance infographics and cheat sheets for your personal use. Buy here.

Apply to sponsor a future issue of The Finance Gem.

The mother of Cash and EBITDA - compliments of Nicolas Boucher

Thanks so much for reading. See you next week.

Oana