SPONSORED BY

WELCOME TO ISSUE NO #53

weekly strategic finance gems to accelerate your career and grow your business

Webinar | Masterclass | Shop | Newsletter | Speaking | Training

THIS WEEK’S STRATEGIC FINANCE INSIGHTS

20 Rates you Should Know

EBITDA vs. EVA vs. RI

10 Financial KPIs for CEOs

The wrong rate could cancel your project

20 Rates you Should Know

Here are 20 rates you should know, to help you contextualize finance a bit better.

Interest Rate: The cost of borrowing money or the return on invested funds. Includes prime rates, SOFR, and treasury rates.

Exchange Rate: The value of one currency in terms of another, vital for international business operations.

Inflation Rate: Measures the rate at which the general level of prices for goods and services is rising.

Discount Rate: Used in discounted cash flow (DCF) analysis to present value future cash flows.

Capitalization Rate (Cap Rate): Common in real estate, representing the rate of return on a property investment.

Internal Rate of Return (IRR): The rate at which a project or investment breaks even, used in capital budgeting.

Annual Percentage Rate (APR): Reflects the annual cost of borrowing money, including fees and interest.

Effective Annual Rate (EAR): The actual annual return on an investment or cost of a loan, considering compounding.

Dividend Yield: A financial ratio showing how much a company pays out in dividends relative to its stock price.

Risk-Free Rate: Theoretical return on investment with no risk, often represented by government bonds.

Hurdle Rate: The minimum rate of return required on an investment for it to be considered acceptable.

Tax Rate: The percentage of Net Income paid out to the government in the form of Income Tax.

Return on Investment (ROI): Measures the gain or loss generated on an investment relative to the amount of money invested.

Return on Equity/Assets ROE/ROA: Indicates the profitability of a company in generating profits from its shareholders' equity or from its total assets.

Depreciation Rate: The percentage rate at which an asset's value decreases over time, reflecting its wear and tear, usage, or obsolescence.

WACC (Weighted Average Cost of Capital): Represents a firm's blended cost of capital across all sources, including debt and equity.

Growth Rate: Used to measure the increase in a company's revenue or earnings, critical for future projections and valuations.

Lease Rate: In equipment finance or real estate, this rate determines the periodic payment amount for the use of an asset.

Coupon Rate: The interest rate paid by bond issuers on the bond's face value.

Yield to Maturity (YTM): The total return anticipated on a bond if held until it matures.

EBITDA vs. EVA vs. RI

EBITDA vs. EVA vs. RI

How are you measuring profitability?

And is your profitability sufficient to cover

» the opportunity cost of equity?

» the opportunity cost of debt?

» or both?

🎯 If your measure of profit is

❌EBITDA, you're not considering for the opportunity cost of any capital financing sources

❌ Residual Income (RI), you're only considering the opportunity cost of equity

✔️ Economic Value Added (EVA), you're finally considering both the opportunity cost of equity and that of debt

🎯 Why is this important?

➡️ To operate and grow sustainable, companies need to generate returns above the opportunity cost of all resources used, not just cover the costs recorded on the books.

🎯 Here’s what you need to know:

1️⃣ Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

>> Formula: EBITDA = EBIT + Depreciation + Amortization

>> EBITDA does not consider the cost of capital (debt or equity) and might also provide a distorted picture of financial health, especially for companies with high levels of debt or substantial capital investment needs

2️⃣ Residual Income (RI)

- Formula: RI = EBIT - Interest - Tax - (Equity Capital * Cost of Equity)

- Caveat: The accuracy of RI is highly dependent on the cost of equity estimation plus it does not expressly consider the cost of borrowing, making it less suitable for companies with significant levels of debt.

3️⃣ Economic Value Added (EVA)

>> Formula: EVA = EBIT x (1-Tax Rate) - (Total Invested Capital * Cost of Capital)

>> Only EVA accounts for the opportunity cost of both debt and equity capital.

>> Consider that EVA might however be less relevant for companies whose value primarily comes from internally generated intangible assets (like intellectual property or brand recognition), as these are not traditionally recognized on the balance sheet or factored into the cost of capital

🎯 Which one of these 3 profit measures should you use?

Ideally, EVA at the company level, RI at the divisional level.

🎯 And what about EBITDA?

Just don’t use it to measure value creation.

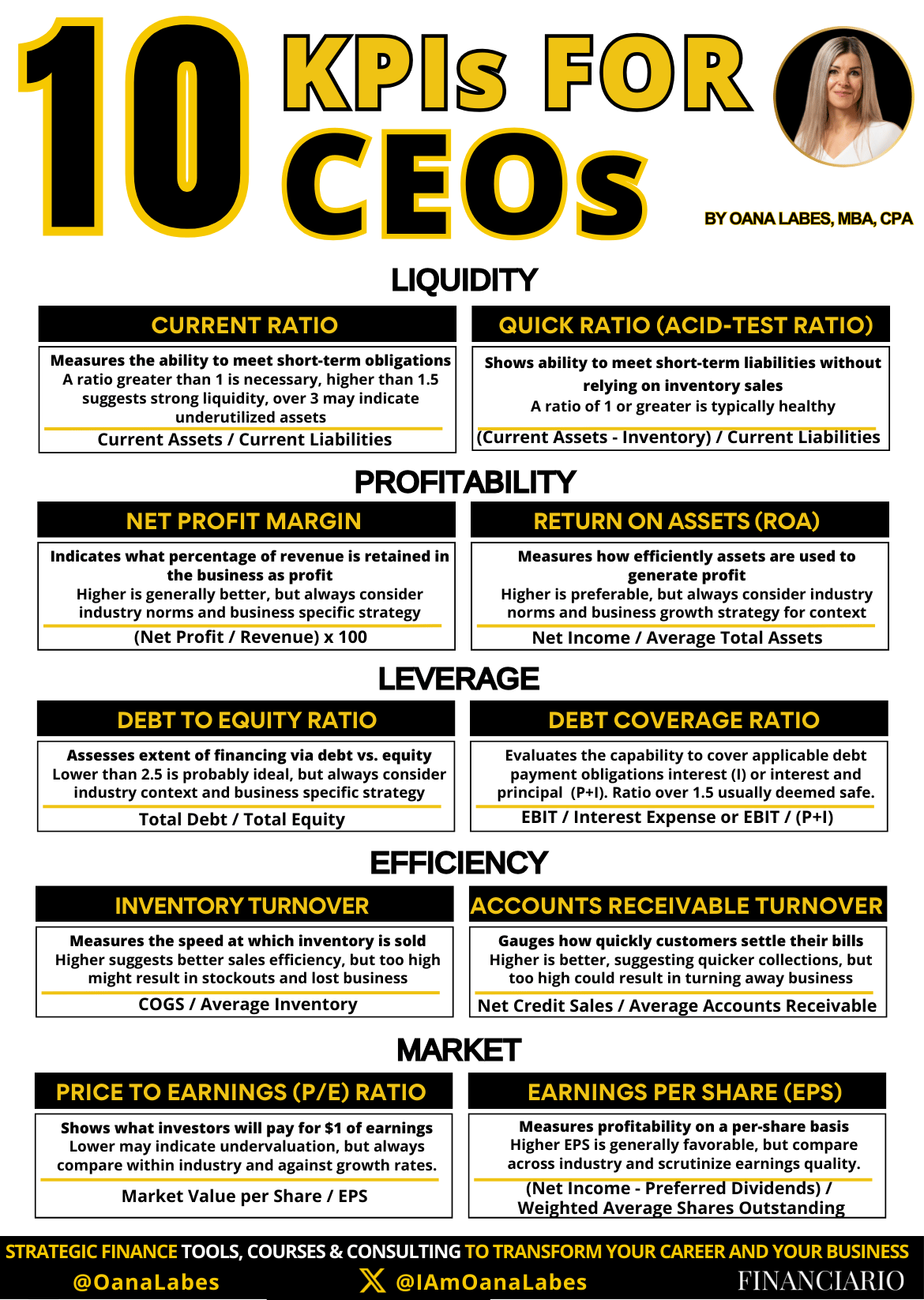

10 Financial KPIs for CEOs

CEOs are Busy.

Which is why they need these 10 KPIs.

To track Liquidity, Profitability, Leverage, Efficiency, and Market performance.

Every CEO should be able to answer 10 basic questions about their business financial health and performance:

1. Quick Ratio: Can our company meet its short-term liabilities without selling inventory?

2. Current Ratio: Is our company capable of covering its short-term obligations with its current assets?

3. Return on Assets (ROA): How effectively are our company's assets being used to generate profits?

4. Net Profit Margin: What percentage of our company's revenues is being converted into profits?

5. Debt Coverage Ratio: Can our company comfortably cover its debt payments with its earnings?

6. Debt to Equity Ratio: How healthy is the balance between debt and equity in our company's financing structure?

7. Accounts Receivable Turnover: How efficiently is our company collecting debts from its customers?

8. Inventory Turnover: How quickly is our company selling its inventory?

9. Earnings Per Share (EPS): What is the profitability of our company on a per-share basis?

10. Price to Earnings (P/E) Ratio: How are investors valuing our company's earnings?

WHAT WILL YOU DO WITH ALL YOUR NEWFOUND KNOWLEDGE?

5* Reviews for The Cash Flow Masterclass

s⭐⭐⭐⭐⭐

“Fantastic course and inspired learning experience! The simplicity of conveyance and follow up with infographics instigate learned absorption and assimilation to the complex matter. Thank you Oana for the motivation and satisfaction in your lessons. Learning is infinite!”

“This course is engaging and well-organized. Oana has put in extra effort to make it concise and effective. I highly recommend it to non-finance professionals who want to broaden their knowledge, or experienced individuals who want to improve their understanding of Cash Flow.”

“I recently completed the Cash Flow Master Class online, and I must say it was an incredibly valuable experience.”

The wrong rate could cancel your project

The wrong discount rate could cancel your project.

Here are 10 strategic insights to negotiate the right rate.

🎯 Risk vs. Reward:

➡️ Understand that a higher discount rate suggests higher risk, reducing NPV and IRR.

➡️ Tailor the rate to the project's unique risk profile.

🎯 Strategic Perspective:

➡️ Prioritize long-term strategic benefits that may warrant accepting a lower NPV.

➡️ Look beyond immediate financial returns.

🎯 Accurate Cash Flows:

➡️ Present realistic cash flow projections.

➡️ Clear and credible forecasts can mitigate the effects of a higher discount rate.

🎯 Cost of Capital:

➡️ Ensure the discount rate reflects your company's actual cost of capital.

➡️ Overstated rates can unfairly disadvantage good projects.

🎯 Opportunity Cost:

➡️ Consider what might be lost by not pursuing the project.

➡️ Sometimes, the benefits outweigh the risks suggested by a high discount rate.

🎯 Sensitivity Analysis:

➡️ Use this tool to show how various discount rates affect project viability.

➡️ Demonstrating robustness under different scenarios.

🎯 Risk-Adjusted Phases:

➡️ Propose varying discount rates for different project stages.

➡️ Align rates with the varying risk levels of each phase.

🎯 Historical Data Utilization:

➡️ Leverage past project data to argue for a realistic rate.

➡️ Especially relevant when previous projects have shown success.

🎯 Non-Financial Value:

➡️ Account for intangible benefits like brand enhancement or sustainability impacts.

➡️ These benefits don't directly figure into NPV calculations but are valuable.

🎯 Flexible Rate Review:

➡️ Advocate for periodic reassessments of the discount rate.

➡️ Adjust as the project advances and uncertainties diminish.

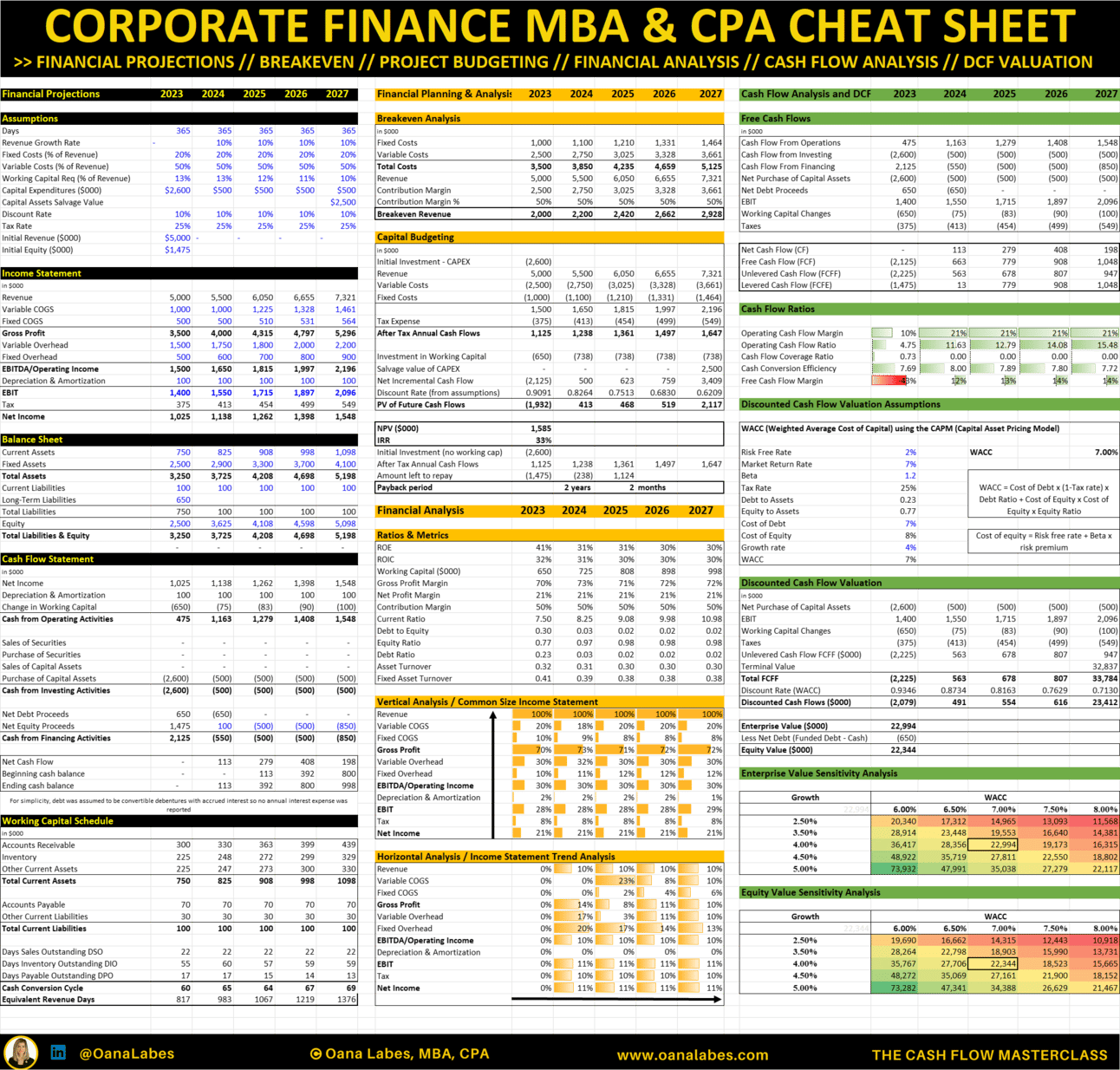

To model many of these rates directly, purchase my viral 16-in-1 Corporate Finance Cheat Sheet Excel Model. Visit my website or click below.

As promised in Chris Donnelly’s post, you can download a full resolution copy of the EBITDA Cheat Sheet here.

Get my cheat sheet and check lists bundles here.

Read Chris’s Full Post Here.

THANK YOU FOR THE LOVE!

JOIN MY UPCOMING WEBINARS

Join me for deep cash flow insights and actionable strategies in a power-hour designed for ambitious professionals, executives and business leaders.

Learn how to master cash flow, enhance your strategic decision-making, and compound your impact and influence in boardrooms and beyond.

GIVE TO GET PROGRAM

If you’re enjoying this newsletter, please forward it to your friends & colleagues. It only takes 3 seconds. Writing this took 4 hours.

🎯Refer 1 person and get my exclusive eBook 10 Essential Strategic Finance Concepts that link Accounting, Finance and Strategy

🎯Refer 10 people and get to pick your favorite infographic from my digital store.

POLL TIME

How did it feel reading this week's issue?

What was your favorite topic to read about this week?

As always, if you have suggestions or feedback, simply reply to this email.

How can I help you?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on-demand video course.

Train your team or engage your audience with strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here for training and here for speaking.

Grow your business with short, medium and long term financial planning, and big-picture financial models so you’re always finance-ready. Reach out here.

Sponsor a future issue of The Finance Gem 💎

Thanks so much for reading.

Oana