WELCOME TO ISSUE NO #71

Webinar | Masterclasses | Shop | Newsletter | Speaking | Training

THIS WEEK’S ISSUE AT A GLANCE

This issue’s finance Gems 💎 vote your favorite at the end of the newsletter.

The 3 Cash Flow Drivers

20 EBITDA Adjustments to Know

12 Root Causes for Business Failures for Leaders

1. The Finance Gem has gone bi-weekly

Thousands of you reached out and answered polls over the past few months to suggest the length and frequency of the newsletter could be revised. I’ve listened and now The Finance Gem is published 2x per month or bi-weekly. You will also find more custom content, expanded topics and practical examples included in every issue, to help you both understand and apply concepts better.

2. Check out the results of some of this week’s polls and share your votes and comments below:

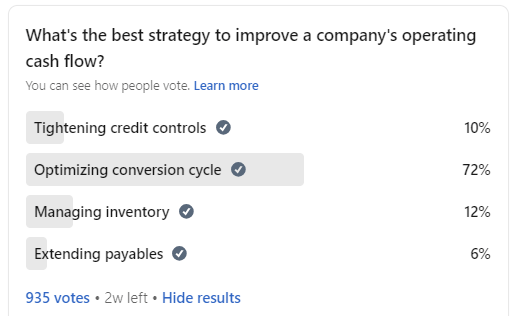

Poll #1 - what’s your take?

What’s the best strategy to optimize a company's cash flow ?

Here’s my take: the first, third and fourth options are incomplete by-products of the second one. Optimizing the cash conversion cycle implicitly requires:

➡️ Effective receivables management by issuing invoices immediately, carefully managing credit payments, enforcing payment terms, and electronic payment methods to reduce transaction times

➡️ Effective payables management by negotiating extended payment terms with suppliers and scheduling payments strategically to maintain a healthy cash reserve

➡️Efficient inventory levels by implementing just-in-time systems or similar methods to reduce holding costs and free up cash

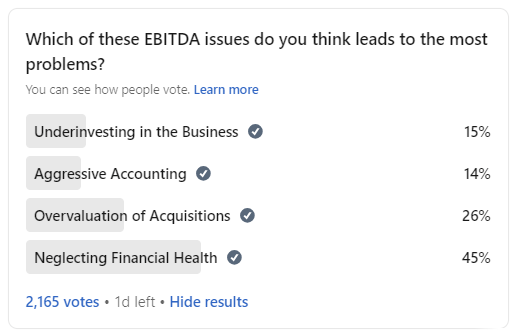

Poll #2 - what’s your take?

Which of these EBITDA issues do you think leads to the most problems?

Here’s my take: all these issues are the result of misusing EBITDA, and they’re all interconnected.

➡️ Overemphasis on EBITDA frequently obscures underlying profitability and cash flow challenges, leading companies to neglect their financial health. This oversight may lead to ineffective management of operations and investments, potentially resulting in liquidity crises, higher leverage, inability to service debt obligations and a substantially weakened financial standing.

➡️ When acquisitions are overvalued based on inflated EBITDA projections or aggressive EBITDA adjustments, it risks depleting resources, distracting from core operations, significant goodwill write-downs, higher leverage and reduced debt servicing capacity.

➡️ When EBITDA becomes the central metric for assessing company performance, management may feel pressured to adopt aggressive accounting tactics to enhance this figure artificially. This manipulation can mislead stakeholders about the company's actual economic condition, fostering decisions that aren't aligned with its financial reality. Needless to say that results in poor decision-making and potential legal and regulatory repercussions when the true financial state of the company is revealed.

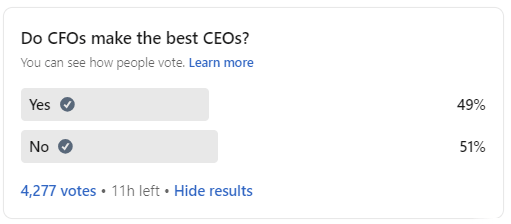

Poll #3 - what’s your take?

Are you enjoying The Finance Gem? Let’s make sure I’m only in your inbox when you want to hear from me.

Upgrade to continue reading.

Become a paying subscriber of The Finance Gem to get access to this post and the entire archive of past posts, indexed by topic. Enjoy additional exclusive benefits like access to masterclass courses, webinars and Q&A sessions.

Upgrade