Welcome to a New Edition of The Finance Gem 💎

weekly strategic finance gems to accelerate your career and grow your business

This Week’s Strategic Finance Insights

The 25 Responsibilities of the CFO Office

CFO vs COO

The CFO Office in the Org Chart

100 Questions for the CFO

Let’s dive in!

But first, allow me to share some seriously amazing Fall Savings.

For a limited time, when you buy The Cash Flow Masterclass, you will also receive the exclusive recording of my 1-hour EBITDA Masterclass webinar. Don’t miss this exclusive opportunity to gain a deeper understanding of EBITDA, and the practical skills needed to make better strategic decisions when using this critical financial metric. But hurry up - this special offer expires October 22!

This newsletter edition is brought to you by Shield App. Whether you are growing your LinkedIn account, or you simply want to keep track of your LinkedIn content and be able to search and find your posts in seconds, this tool is going to make your life so much better. Not only will it help you sort your posts by most views, comments or likes, but it also comes with a free trial so you can try it at no risk.

In case you missed this:

My viral cheat sheets, checklists and infographics are now available in full resolution. Visit my web store and turn your favorites into posters! Or give them as gifts and become the coolest finance buff!

If you’re in San Diego for AFP 2023, let’s connect! I’m speaking on Monday October 23, and would love to meet you there!

I use Thinkific to power up The Cash Flow Masterclass and the several upcoming courses I have in the works. Download the new Thinkific mobile app and access my courses anywhere, anytime — on any device.

For Upcoming Course Launches, Promotions, Private Sales and Free Finance Webinars, sign up here.

Now let’s get into this week’s strategic finance insights:

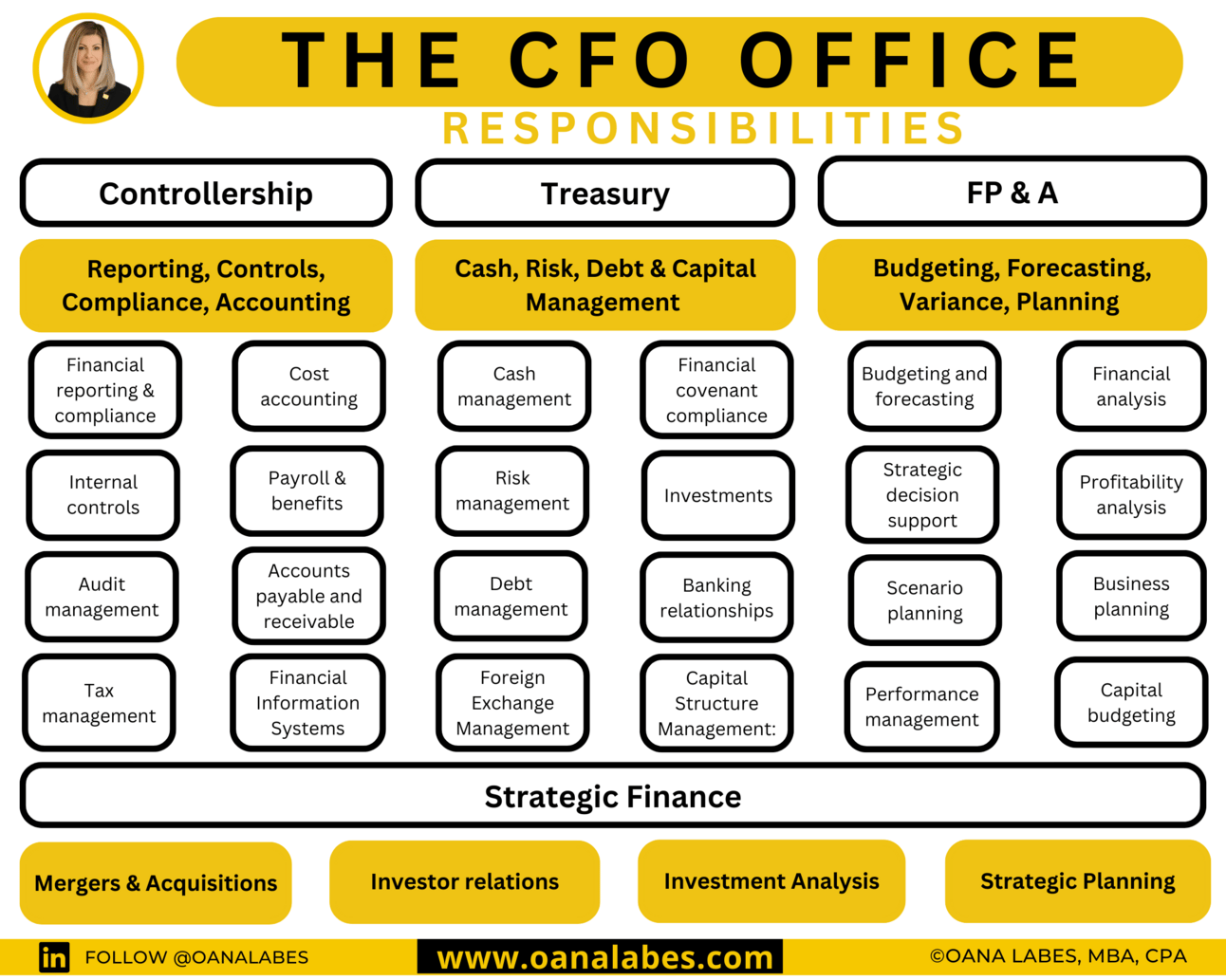

The 25 Responsibilities of the CFO Office

⚫ Controllership:

1// Financial reporting >> oversee financial statement preparation in compliance with the relevant accounting framework

2// Internal controls >> develop and maintain an appropriate internal control framework to ensure data integrity and regulatory compliance

3// Tax compliance >> manage tax planning, filing, and regulatory compliance

4// Audit Management >> liaise with external accountants and ensure a smooth and efficient annual assurance engagement process

5// Accounts payable and receivable >> oversee AP and AR to ensure timely processing, contractual compliance and effective supply chain management

6// Payroll and benefits >>oversee the strategic aspects of payroll and benefits, ensuring they align with the company's financial goals and regulatory compliance

7// Cost accounting >> analyze costs to support management decision-making

8// FIS >> ensure the accuracy and timeliness of general ledger entries and account reconciliations

⚫ Treasury:

9// Cash management >> monitor and manage cash flow, ensuring sufficient liquidity to meet operational and strategic needs

10// Risk management >> identify, assess, and manage financial risks (foreign exchange risk, interest rate risk, credit risk)

11// Capital structure management >> manage capital structure, optimizing cost of capital and maintaining financial flexibility

12// Investments >> oversee investments and align risk appetite & return objectives

13// Banking relationships >> develop and maintain strong relationships with banks and other financial institutions to support favorable financing terms and access to capital as needed

14// Financial covenant compliance >> monitor and ensure compliance with financial covenants outlined in credit agreements

15// FX management >> manage the organization’s exposure to foreign currency risk

16// Debt management >> manage debt presentations, negotiations, closings, renewals, covenant compliance

⚫ Financial Planning and Analysis (FP&A):

17// Budgeting and forecasting >> lead the annual budgeting process and develop rolling forecasts

18// Scenario planning >> prepare for future opportunities and challenges with the help of flexible long term plans

19// Performance management >> establish and monitor performance metrics, focused on key organizational financial and non-financial KPIs (financial results, customer satisfaction metrics, continuous improvement, professional development)

20// Financial analysis >> use financial dashboards, reports, and key performance indicators to analyze and optimize financial performance

21// Business planning >> enable the development and execution of the company's long-term strategic plan in alignment with financial goals and objectives

22// Capital budgeting >>oversee the process of planning and managing the company's long-term investments

23// Profitability analysis >> analyze product, customer, and channel profitability to support margin improvements and optimize resource allocation

24// Management decision support

⚫ Additional responsibilities and functions within the CFO office may include:

25// Strategic Finance

- Mergers and acquisitions (M&A) >> evaluate and execute M&A transactions (due diligence, valuation, reporting, integration)

- Investor relations >> manage transparent and accurate communication with shareholders and analysts

- Investment analysis >> guide investment analysis to align with the company's long-term financial objectives, risk tolerance, and strategic goals

- Strategy & Planning >> develop and execute long-term strategic plans that align with the business strategic objectives

CFO vs. COO

These 2 essential C-Suite roles have essential responsibilities in steering a company's strategic direction and operational success.

However, many companies have these roles comingled as CFO/COO, which can be confusing.

And several others struggle to delineate responsibilities between the COO and CFO roles.

Here’s how to think about them:

🎯 The CFO focuses on managing and strategizing the company's financial health and growth.

🎯 The COO focuses on managing and strategizing the company's operational efficiency and effectiveness.

🎯 Together they focus on balancing financial planning and operational execution to help the organization achieve its strategic objectives

The COO:

- Primarily oversees the organization's day-to-day operations

- Although involved in financial strategies and decisions, focuses mostly on managing only those financial aspects strictly related to operations

- Focuses on how money is spent in the execution of day-to-day operations and works to optimize those expenditures for efficiency and effectiveness

- Typically the second/third-in-command after the CEO and/or CFO depending on organization

- Plays a critical role in ensuring the efficient and effective allocation of resources to enable the organizational strategic objectives

- Mostly internal-facing role focused on operations, production, and departmental performance

CFO:

- Responsible for managing the company's financial strategy

- Broader financial scope than COO, oversees overall financial planning, risk management, record-keeping, financial reporting, and financial data analysis

- Despite operations involvement, main focus is the financial health and fiscal strategy of the company

- Responsible for analyzing the company's financial strengths and weaknesses and implementing effective corrective actions

- Plays a critical role in aligning strategic organizational objectives with financial strategy

- Often external-facing, interfacing with investors, lenders, and other third party stakeholders

The CFO Office in the Org Chart

Do you know the place and purpose of the CFO Office in your Org Chart?

Think about it like this: if your organization was a building, your org(anizational) chart would be its blueprint.

Here’s what your org chart does in simple terms:

🎯 it outlines the structure of your company

🎯 it shows your different departments and teams

🎯 it provides a plan for organizing your people and resources

🎯 it defines roles and inter-relations, the span of control, and the reporting hierarchies

🎯 it promotes communication and coordination to improve your organizational effectiveness and avoid inefficiencies

Because your organization is different than others, your org chart will also look differently.

And while the design of your org chart may differ from that of other companies, it will still need to perform all the relevant functions necessary to operate your business.

So what is the purpose of the CFO Office in a typical org chart?

In very simple terms, your company’s CFO takes care of your company's money and makes sure that they’re working to support your company’s goals.

The CFO office has 3 main functions reporting to it: controlling, treasury, and FP&A.

🎯 The Controlling function ensures financial reporting complies with internal policies and external regulations.

🎯 The Treasury function ensures that your company has enough funds to meet its financial obligations.

🎯 The FP&A function (financial planning and analysis) ensures that your CFO and senior management have the right support to make informed financial decisions

Let’s break down the structure and work for each of these:

1️⃣ The Controlling function is structured around 6 main sub-functions with different responsibilities

⚫ financial reporting involves the preparation of monthly, quarterly, and annual financial statements in accordance with generally accepted accounting principles (GAAP).

⚫ compliance involves ensuring that the company's financial operations are conducted in accordance with relevant laws, regulations, and internal policies

⚫ risk management involves identifying, assessing, and mitigating financial reporting risk

⚫ audit management involves coordinating and leading the annual audit process, liaising with external auditors, and assessing necessary changes.

⚫ budget oversight involves ensuring the accuracy, completeness, and consistency of the budget data, and its compliance with accounting principles and internal regulations.

⚫ tax management involves ensuring the compliance with regulatory reporting requirements and tax filings.

2️⃣ The Treasury function is structured around 6 main responsibilities

⚫ cash management involves forecasting daily cash requirements and managing short term liquidity

⚫ banking management includes ensuring the efficient operation of the company's banking and cash management systems.

⚫ currency risk management involves managing the company's foreign currency exposure and devising strategies to minimize risk.

⚫ risk management involves the assessment, management, and mitigation of key threats to the corporation's treasury operations (liquidity, credit, interest rate).

⚫ financing involves the coordination of long-term and short-term funding needs and strategies.

⚫ investment management involves identifying the most suitable investment opportunities for the company's excess cash, in line with its financial strategy and risk appetite.

3️⃣ The FP&A function is structured around 6 main responsibilities

⚫ budget management involves leading the process of creating the budget, including working with various departments to develop their individual budgets, analyzing those budgets for alignment with company strategic goals, and making adjustments as necessary

⚫ financial analysis involves interpreting the company financial information and providing updates and information as needed to the CEO, the executive team, and the board of directors.

⚫ forecasting involves providing accurate and timely financial and operational trend analysis including forecast vs. budget.

⚫ scenario analysis involves creating and using financial models to analyze aggregate sets of assumptions and their potential impact on the company's financial health and future performance.

⚫ strategic planning involves providing assistance for decision-making such as tracking performance by product, customer or region, evaluating major capital expenditure plans, and negotiating contracts.

⚫ performance management involves establishing and monitoring performance indicators, highlighting trends and analyzing variances.

If you’re still unsure if my Cash Flow Masterclass is for you, consider this:

☑️ It’s GOOD: you will learn from one of the best coaches - a CPA, MBA with unique expertise in corporate and commercial finance, financial and managerial accounting, business management and business strategy.

☑️ It’s VALIDATED: your peers are giving The Cash Flow Masterclass 5*, join them so you don’t miss out!

☑️ It’s FAST: it takes less than 2 hours to breeze through the course on any device, and you can pause anytime

☑️ It’s PRACTICAL: you get dynamic financial models included in the course and you will be applying what you learn for the rest of your career

☑️ It’s VALUABLE: the course cost is nominal compared to the value it provides for your career, and there are several payment plans available

☑️ It’s YOURS: you get lifetime access on any device (audio mode available in the app)

☑️ It’s EXPENSIBLE: your employer or business can reimburse you, making this a win-win purchase for you and your organization.

ENROLL TODAY - your Career and your Organization will thank you!

100 Questions for the CFO

Do you want revenue growth, maximized profit & optimal capital allocation?

Strategic finance insights for competitive advantage & market leadership?

Investor support from transparent and strategic financial management?

A future-proofed company through proactive and resilient planning?

Regulatory compliance to protect from legal and compliance risks?

Quick decision-making that allows agile and informed choices?

Strategic alignment between your business and finance goals?

Efficiency in budgeting, forecasting, and financial operations?

Robust financial risk mitigation to manage uncertainties?

Alignment between finance and operations teams?

☑️ Then you need your CFO to be able to answer these critical 100 questions.

Click on the image below to download a pdf copy.

Give to Get Program

If you’re enjoying this newsletter, please forward it to a friend. It only takes 3 seconds. Writing this took 4 hours.

🎯Refer 5 people and get my exclusive eBook 10 Essential Strategic Finance Concepts that link Accounting, Finance and Strategy

🎯Refer 10 people and get an exclusive $10 Off coupon for your favorite infographic in my digital store.

Thank you for the love - today’s featured review

Poll Time

What was your favorite topic to read about this week?

How did it feel reading this week's issue?

As always, if you have suggestions or feedback, simply reply to this email.

Looking for More ?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on-demand video course.

Work with me. Tap into my 20+ years of strategic finance & business intelligence, and get coaching for your own career. Availability is very limited. Book here.

Get growth business advisory for your organization with short, medium and long term financial planning, and big-picture financial models so you’re always finance-ready. Reach out here.

Sponsor a future issue of The Finance Gem 💎 or hire me to train or guest speak in your events and webinars.

Train your team on strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana

: