Welcome to a new edition of The Finance Gem 💎

Read the unabbreviated Linkedin strategic finance insights you loved this week, and catch up on those you missed.

This week’s issue is brought to you by Upflow. If you’re tired of late-paying customers hindering your growth, check out Upflow’s cutting-edge Accounts Receivable technology. Unlock your owed cash reserves and use their powerful real-time cash flow analytics to make informed business decisions. Upflow supercharges your cash collection by streamlining your collections process and offering modern payment methods to your customers. They are trusted by thousands of next-level finance leaders to optimize their financial operations. Give them a try by signing up for Discover, their free analytics solution with industry benchmarks, in only 2 clicks. Or visit their website to learn more.

And speaking of Cash…

Cash Flow knowledge is critical regardless if you’re an accountant, an engineer, a lawyer or a sales professional.

The sooner you learn how to understand cash flow drivers, cash inflows and outflows, and the cash conversion cycle, the faster your career will take off.

I’ve created The Cash Flow Masterclass to help you master cash flow and upgrade your strategic finance skills, so you can accelerate your career & grow your business.

Enjoy 2.5 hours of on-demand video lessons, 190 downloadable course slides, 10+ Video Lessons, 10+ Excel Models, 10+ Infographics & Lifetime Access Anywhere Anytime on Any Device.

Professionals just like you and from a variety of backgrounds are loving The Cash Flow Masterclass. Read their reviews here.

Here is what the most recent testimonial said:

I found the course to be extremely valuable. I have completed EMBA last year and currently about to finish Executive Program in Strategic Finance course. I however always felt that I was missing practical guide on managing cash flow. The Cash Flow Masterclass has perfectly filled the gap. The slides, quizzes and infographics are of excellent quality with rich and practical insights that can be easily applied in our day to day life in an organization.

Don’t delay your cash flow transformation!

Click the button below and I look forward to seeing you in class!

Updates this Week

If you’re looking for printable PDF copies of my cheat sheets, checklists and infographics, check out my web store and turn your favorites into posters!

To purchase my on-demand video course with up to 50% off using purchase parity pricing apply here.

To get notified in priority of the next promotion or webinar add your name to this list.

This week’s Strategic Finance Insights

The Power of Cash Flow

The Cash Flow Statement

Learn the 7 Main Cost Drivers

The Business Governance Checklist

The Power of Cash Flow

The Income Statement & The Balance Sheet are the most popular financial statements.

But few appreciate that the Cash Flow Statement is where the true power is.

Because even though a company might be profitable on the P&L.

It may still face bankruptcy without sufficient cash to:

>> cover operating costs

>> invest in growth

>> service debt

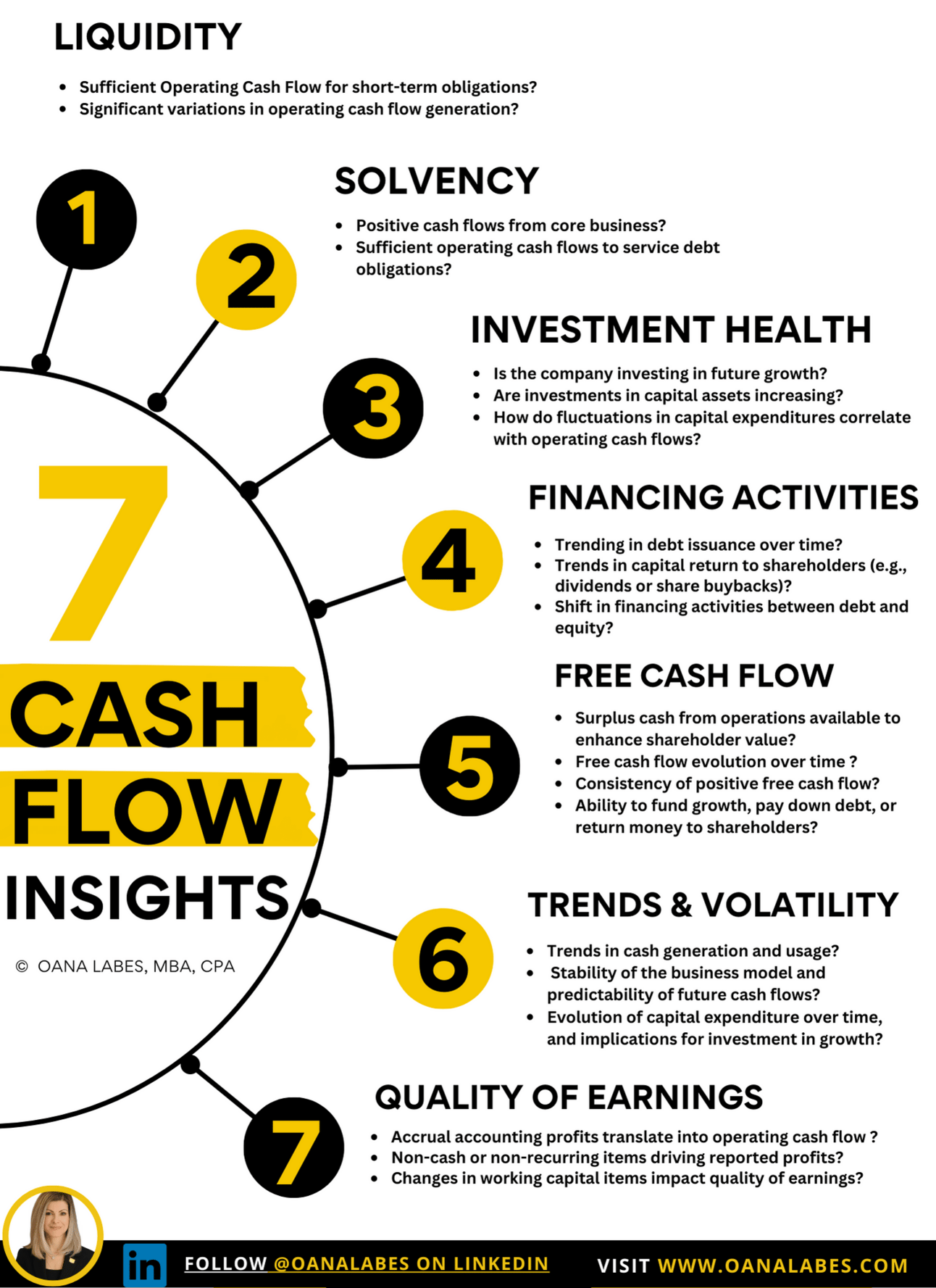

🎯Here are 7 Essential Cash Flow Insights you get from a company’s Cash Flow Statement:

1️⃣ Solvency:

⚫ Whether the company generates sufficient operating cash flows to comfortably service debt obligations.

⚫ Whether their use of operating cash flow for debt payments aligns with industry standards, demonstrating strong solvency and an acceptable risk profile.

2️⃣ Liquidity:

⚫ Whether the company’s operating cash flow reliably covers current liabilities, indicating a strong ability to meet short-term obligations.

⚫ Whether the management of operating cash flow maintains the company’s financial stability and minimizes its liquidity risk.

3️⃣ Free Cash Flow:

⚫ Whether the company's free cash flow has shown positive growth over time, reflecting a robust and flexible business model.

⚫ Whether the company consistently generates positive free cash flow, demonstrating its capacity to self-fund growth, pay down debt, and return money to shareholders.

4️⃣ Financing Activities:

⚫ Whether the company strategically shifts its financing activities towards debt or equity as conditions require, demonstrating a flexible and savvy financial strategy.

⚫ Whether the company demonstrates strong performance and confidence in its future prospects by consistently returning capital to shareholders through dividends or share buybacks.

5️⃣ Investment Health:

⚫ Whether the company is proactively investing in its future growth by increasing capital expenditure over time.

⚫ Whether the company skillfully aligns its capital expenditure with operational cash flows, ensuring financial health and a sound investment strategy.

6️⃣ Trends and Volatility:

⚫ Whether the company's capital expenditure has been progressively increasing over the years, indicating a solid investment in growth.

⚫ Whether the company's revenue and earnings display a consistent pattern, underscoring the predictability of its future performance.

7️⃣ Quality of Earnings:

⚫ Whether the company primarily relies on genuine business activities, to achieve its reported profits vs relying on non-cash or non-recurring items

⚫ Whether the company optimizes working capital items like accounts receivable, inventory, and accounts payable, maintaining a stable cash flow from operations and high quality of earnings.

The Cash Flow Statement

Your Business:

Leans on Equity

Builds on Assets

Thrives on Profit

Navigates with Debt

Survives on Cash Flow.

🎯Here are the basics of the Cash Flow Statement.

➡️ Learn them here for FREE to help your business survive.

➡️ And check out my Cash Flow Masterclass to learn how to thrive.

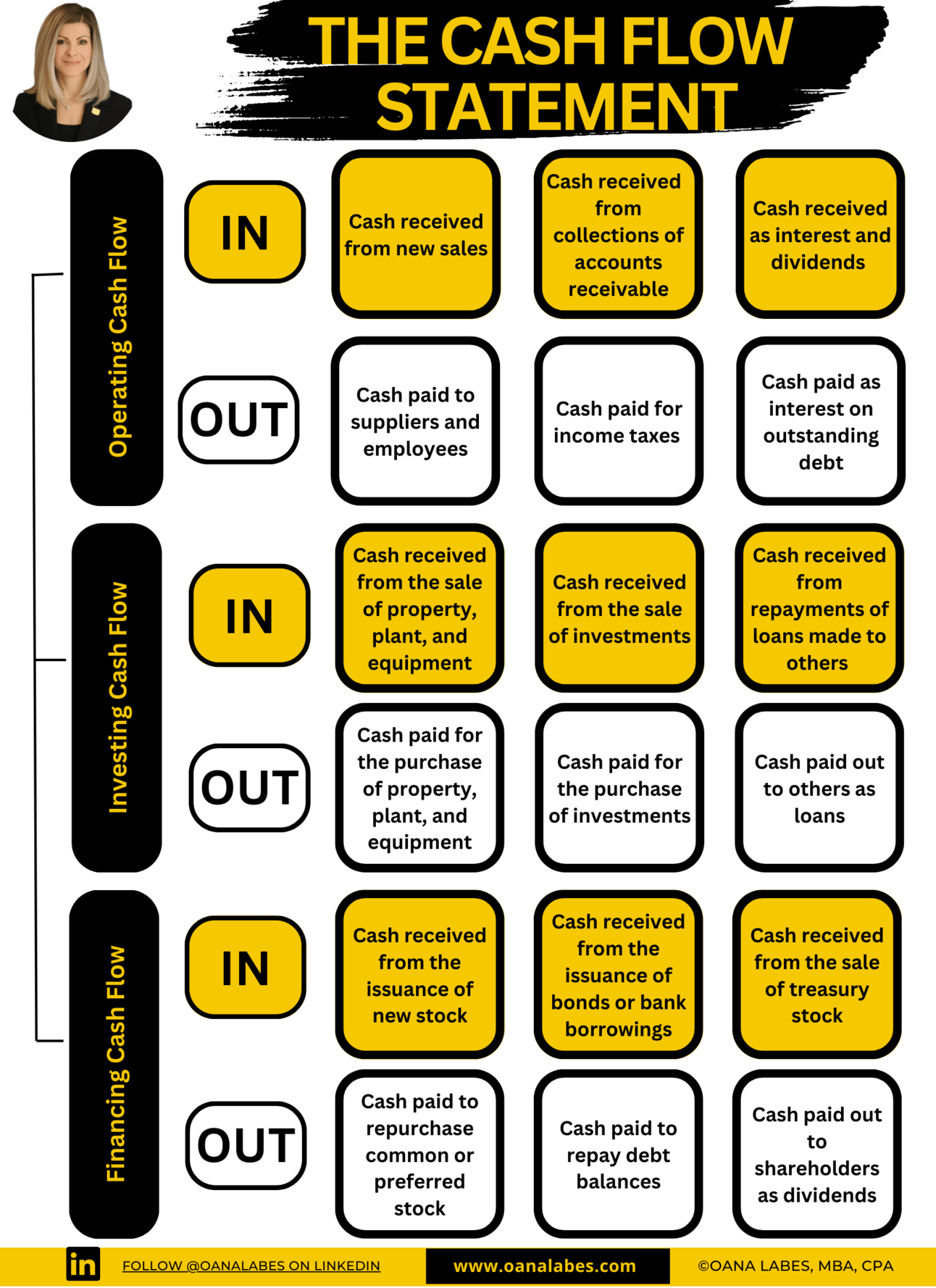

➡️There are 3️⃣ types of business activities and each of them can absorb or release cash into a business.

1. Operating Activities

⚫ The primary sources and uses of cash in a company's day-to-day business operations

🎯 Key sources of cash in this section include:

>> Cash received from new sales in the period

>> Cash collected from sales in prior periods

>> Cash received as interest and dividends

🎯 Key uses of cash in this section include:

>> Cash payments to suppliers and employees

>> Cash interest payments made on debt

>> Cash payments made for income taxes

**dividends and interest paid/received may also be classified into financing cash flows

2. Investing Activities

⚫ Involve the acquisition and disposal of long-lived assets, such as PPE and investments.

🎯 Key sources of cash in this section include:

>> Cash received from the sale of property, plant, and equipment

>> Cash received from the sale of investments (stocks, bonds, etc.)

>> Cash received from repayments of loans made to others

🎯 Key uses of cash in this section include:

>> Cash paid for the purchase of property, plant, and equipment

>> Cash paid for the purchase of investments (stocks, bonds, etc.)

>> Cash paid out to others as loans

3. Financing Activities

⚫ Include transactions with the company's owners and creditors

🎯 Key sources of cash in this section include:

>> Cash received from the issuance of common stock or preferred stock

>> Cash received from the issuance of debt (bonds, loans, etc.)

🎯 Key uses of cash in this section include:

>> Cash paid to repurchase common stock or preferred stock

>> Cash paid for the repayment of debt (bonds, loans, etc.)

>> Cash paid out to shareholders as dividends

Learn the 7 Main Cost Drivers

Why?

To optimize costs.

To improve capital allocation.

To increase profitability and sustainability.

Costs can be within your control (internal) or outside your control (external).

⚫ 𝐘𝐨𝐮𝐫 𝐢𝐧𝐭𝐞𝐫𝐧𝐚𝐥 𝐜𝐨𝐬𝐭 𝐝𝐫𝐢𝐯𝐞𝐫𝐬 are within the control of your business, and you can influence them through your operations and management practices.

🎯 Prioritize these drivers to improve your cost structure and competitiveness

🎯 Internal cost drivers include: volume, efficiency, process improvements, and quality.

⚫ 𝐘𝐨𝐮𝐫 𝐞𝐱𝐭𝐞𝐫𝐧𝐚𝐥 𝐜𝐨𝐬𝐭 𝐝𝐫𝐢𝐯𝐞𝐫𝐬 are outside the direct control of your business, and they are influenced by external market conditions, such as supply and demand, commodity prices, and regulatory requirements.

🎯 Monitor these drivers and adapt your strategy as necessary to respond to market conditions.

🎯 External cost drivers include: material costs, labor costs, and overhead costs.

👉Here are some ideas for how you can use each of these 7 drivers to help reduce your Costs.

👉Not all are applicable to every business and they all come with pros and cons, so choose wisely.

𝐈𝐧𝐭𝐞𝐫𝐧𝐚𝐥 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

1️⃣ Volume

🎯 Increase production volumes to take advantage of economies of scale

🎯 Implement a just-in-time (JIT) inventory system to reduce inventory costs

🎯 Consolidate production facilities to reduce fixed costs

2️⃣ Efficiency

🎯 Reduce cycle time by implementing lean manufacturing processes

🎯 Automate manual processes to increase productivity

🎯 Improve product design to reduce waste and scrap

3️⃣ Process improvements

🎯 Streamline workflows and eliminate non-value-added activities

🎯 Invest in technology to automate manual processes

4️⃣ Quality

🎯 Implement quality control procedures to reduce defects and scrap

🎯 Improve your product design to reduce rework and warranty costs

🎯 Invest in employee training to improve your product quality and performance

𝐄𝐱𝐭𝐞𝐫𝐧𝐚𝐥 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

5️⃣ Material costs

🎯 Optimize material usage through better inventory management and production planning

🎯 Explore alternative materials or substitutes to reduce your costs

6️⃣ Labor costs

🎯 Cross-train your employees

🎯 Use temporary or contract labor

7️⃣ Overhead costs

🎯 Reduce your energy consumption

🎯 Outsource your non-core functions

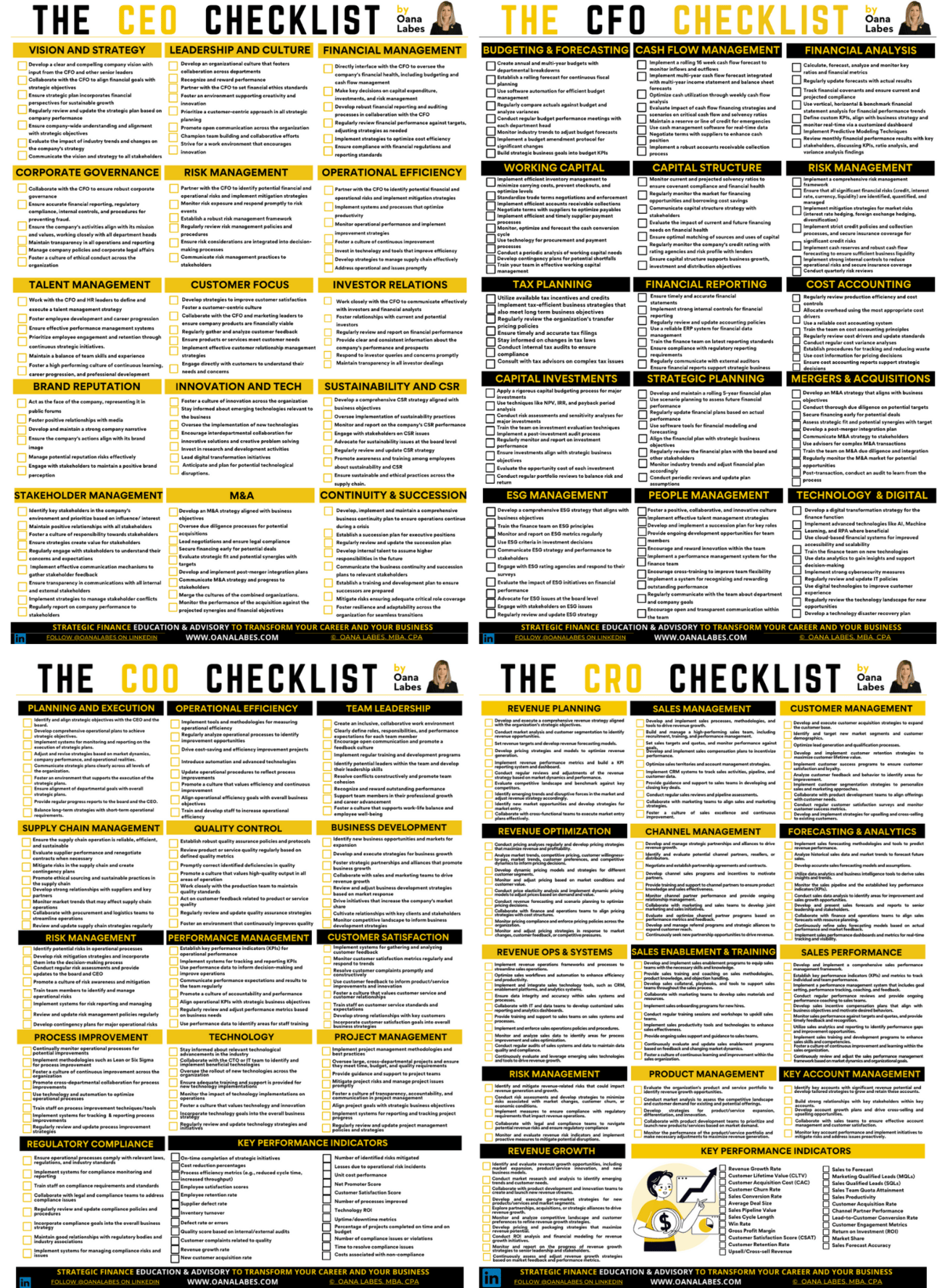

The Business Checklist

The Business Checklist

15 Essential Governance Topics you Need to Control.

Because Good Governance is Good Business.

Rules, Practices, Processes to Direct and Control.

And to Balance the Interests of its many Stakeholders:

Shareholders, Management, Customers, Suppliers, Financiers, Government, and the Community.

🎯🎯🎯Here’s an invaluable Business Checklist covering 15 Essential Business Governance areas to help you stay on track.

⚫ In general, Business Governance is mainly concerned with:

1. Structure: how the Business is set up to operate

2. Policies and Procedures: how the Business operates legally and ethically

3. Accountability and Transparency: how the Business is transparent and accountable for its actions

4. Ethics and Integrity: how the Business is honest and trustworthy in its activities

5. Risk Management: how the Business is managing potential risks

6. Compliance: how the Business is complying with laws, regulations, and standards

7. Stakeholder Rights: how the Business is ensures the rights of all stakeholders are respected and protected

8. Corporate Social Responsibility: how the Business is operating responsibly accounting for the interests of its stakeholders.

⚫ Use this Checklist to help you set up the Governance framework that works for you and your organization.

Download a free PDF copy here. Or purchase it on my website to support my work.

How did you enjoy this week's newsletter?

Want more strategic finance insights?

Upgrade your (or your team’s) strategic finance skills with The Cash Flow Masterclass. Leverage my unique on-demand video course to improve your knowledge, elevate your decision making and accelerate your career. For customized team training please apply here.

Sponsor a future issue of The Finance Gem 💎and get your brand in front of an exceptional audience of strategic finance, accounting, sales and technology professionals and executives.

Thanks so much for reading. See you next week.

Oana