Welcome to this week's edition of The Finance Gem 💎 where I bring you unabbreviated Linkedin insights you loved - so you can save them, and those you missed - so you can enjoy them.

This newsletter issue is brought to you by Beehiiv - the newsletter platform engineered for growth which just raised $12.5MM to become best in class in this high-growth space. Beehiiv offers an incredibly flexible editor, a suite of world-class growth tools to help you scale your audience and advanced features for understanding your readers. Use my affiliate link and get your or your company’s newsletter started for free today! Experience for yourself the amazing platform that powers this very newsletter you’re reading: The Finance Gem 💎.

And speaking of smart, if you want to own every meeting room you walk into, learn to frame your points in terms of strategic cash flow impact.

EBITDA and Revenue Growth can only carry a company so far, and Cash Flow Management always prevails.

The sooner you learn how to understand your cash flow drivers, forecast cash inflows and outflows, and optimize your cash conversion cycle, the faster your business will grow and your career will take off.

I’ve created The Cash Flow Masterclass to help you master cash flow and upgrade your strategic finance skills, so you can accelerate your career & grow your business.

Enjoy 2.5 hours of on-demand video lessons, 190 downloadable course slides, 10+ Video Lessons, 10+ Excel Models, 10+ Infographics & Lifetime Access Anywhere Anytime on Any Device.

Here's what some of my 100+ students have to say:

Are you ready for your cash flow transformation?

Click the button below and I look forward to seeing you in class!

News this Week:

Happy Canada Day (1st of July) and Happy Independence Day (4th of July)!

To celebrate I am running a limited time 20% Off Sale on all my digital products. Check out my store and turn your favorite finance checklists and cheat sheets into posters! Enter coupon code happybirthday at checkout for min orders of $75. Hurry before this Sale ends!

Now on to this week's strategic finance insights:

Gross Margin is Not Contribution Margin

Basic Finance vs. Advanced Finance

Accounting Basics vs. Advanced

What’s it really like being a CFO?

The KPI Cheat Sheet

Gross Margin is Not Contribution Margin

Gross Profit is also not Contribution Margin.

⚫ Gross Profit is often used interchangeably with Gross Margin, through one is an absolute difference (amount) and the other is a relative difference (percentage).

⚫ The real comparison is between Gross Profit and Contribution Margin.

They may seem alike, but they are distinct metrics with unique insights for profitability analysis.

🎯 Gross Profit is the revenue from the sales of all units of a product or service, less all direct costs (COGS or COS)

☑️ Formula: Gross Profit (GP) = (Revenue - COGS)

☑️ Considers: direct materials, direct labor, and manufacturing fixed and variable overheads.

☑️ Excludes: variable costs unrelated to production, such as sales commissions or shipping costs.

☑️ Used to understand a company's overall operational efficiency, identify areas for cost management improvement, and determine the profitability of the entire product or service portfolio

🎯 The Contribution Margin (CM) is the sales price of one units of a product or service, less all unit variable costs (direct materials, direct labor, and indirect product costs).

☑️ Contribution Margin (CM) is (despite its name which suggests a ratio) a measure of absolute value calculated in currency units ($).

☑️ Formula: Contribution Margin (CM) = (Sales Price per unit - Variable Cost per unit)

☑️ Considers: direct materials, direct labor, variable manufacturing overhead, variable selling and variable marketing.

☑️ Used to: make decisions related to individual product or service pricing, production levels, and sales mix, because it highlights the incremental profit generated by each additional unit sold.

Basic Finance vs. Advanced Finance

Are you asking the right questions?

⚫ They help answer different questions.

⚫ They require different depths of expertise.

⚫ They impact organizations at totally different levels.

Here’s how to think about them:

🎯 Basic level corporate finance focuses on understanding fundamental concepts and evaluating simple financial scenarios.

🎯 Advanced level corporate finance delves into intricate financial strategies, sophisticated analytical methods, and complex decision-making processes.

➡️ Basic level corporate finance

- Primarily involves understanding key concepts like time value of money, risk and return, and the basics of capital structure

- Involves basic application of analytical methods such as NPV and IRR for capital budgeting, interpreting financial ratios for statement analysis, and understanding the management of working capital components

- Provides an introduction to mergers and acquisitions, including their purpose and process

- Requires an elementary understanding of financial principles and tools

🎯Answers:

1. What is the current financial health of our company?

2. What is the return on investment if we invest in a specific project?

3. How should we manage the day-to-day financial operations?

4. What is the basic structure of our company's capital (debt and equity), and what is its cost?

5. What is the purpose and process of M&A, and how can it potentially benefit our company?

➡️ Advanced level corporate finance

- Incorporates risk assessments into capital budgeting decisions to estimate expected returns, measure systematic risk, and simulate various financial scenarios to inform strategic decisions

- Employs advanced ratio analysis, financial forecasting, and company valuation techniques for financial statement analysis

- Strategically manages working capital to optimize the trade-off between liquidity and profitability

- Involves strategic decisions regarding optimal capital structure, including the application of theories such as trade-off, pecking order, and signaling

- Evaluates and executes mergers and acquisitions using advanced valuation techniques and thorough due diligence

🎯Answers:

1. How can we use financial statement analysis to drive strategic decisions and our company valuation?

2. How can we strategically manage our working capital to balance liquidity and profitability?

3. How can we optimize our investment risk and return profile?

4. What is our optimal capital structure that minimizes our company's cost of capital?

5. How should we evaluate and execute M&A deals to maximize their potential benefits?

Accounting Basics vs. Advanced

⚫ They carry distinct responsibilities.

⚫ They require different depths of expertise.

⚫ They are easily mistaken and misunderstood by outsiders.

Here’s how to think about them:

🎯 Basic level accounting focuses on the daily operational accounting tasks and ensures financial transactions are accurately recorded.

🎯 Advanced level accounting focuses on more complex accounting activities, like strategic tax planning, internal auditing, and financial statement preparation.

➡️ Basic level accounting

- Primarily responsible for recording and reconciling transactions, maintaining general ledgers, and assisting in preparing basic financial statements

- Provides essential accounting support, including handling accounts payable and receivable, and preparing basic tax

- Helps ensure compliance with basic accounting principles and regulations

- May assist with internal and external audits by providing necessary documentation and explanations

- Often an internal-facing role that requires strong attention to detail and basic understanding of accounting principles

➡️ Advanced level accounting

- Takes a leadership role in complex accounting activities such as financial reporting, strategic tax planning, and internal auditing

- Uses advanced accounting knowledge to analyze financial data, improve financial processes, and guide strategic financial decisions

- Ensures compliance with complex accounting regulations and standards, and may interact with external auditors and regulatory bodies

- Often involved in developing and improving accounting systems and processes

- Plays a critical role in ensuring the financial health of the organization, often serving as a key advisor to management

What’s it really like being a CFO?

🎯 If you’re a CFO in a small and medium sized company, you may also be the OFO (Only Financial Officer).

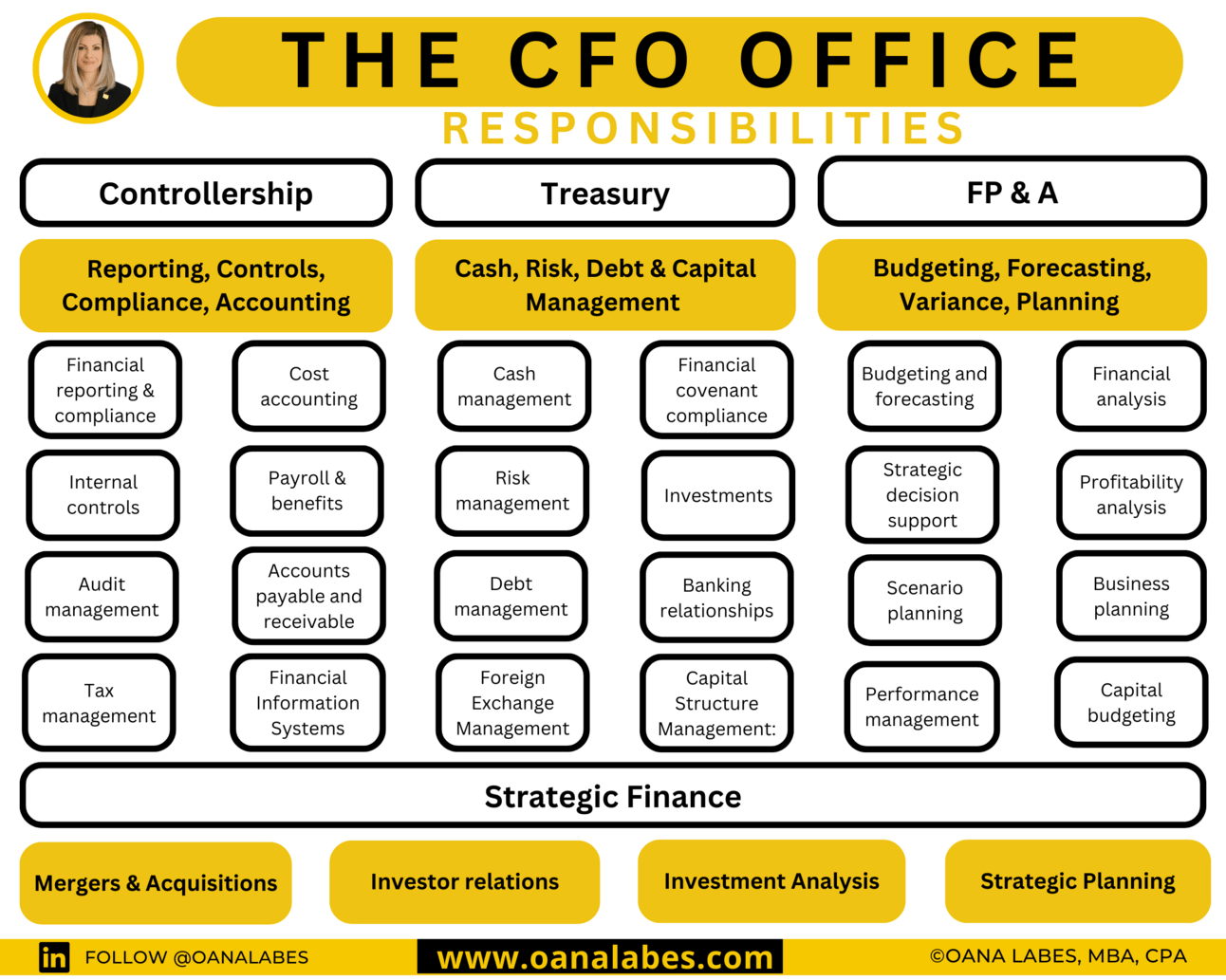

🎯 If you’re a CFO in a large organization, you have an entire CFO Office helping you deliver on your 3 key areas of responsibility:

»Reporting and Compliance (Controllership)

»Treasury (Cash Flow Planning)

»Financial Planning and Analysis (Strategic Planning)

🎯 As the Chief Financial Officer (CFO) you’re the highest-ranking financial professional in the organization.

🎯 You’re like the Physician to the King, responsible for the fiscal health of the business.

🎯 You’re also the bridge between Finance and Operations and you enable your organization to achieve 3 critical objectives:

⚫ make informed decisions

⚫ allocate resources effectively

⚫ achieve its strategic objectives

Here are Your Top 10 responsibilities as a CFO:

1️⃣ Attest to the accuracy of financial reports

2️⃣ Build/Scale the finance and accounting team

3️⃣ Develop and manage financial systems and policies

4️⃣ Craft/Oversee financial plans, budgets, and forecasts

5️⃣ Perform/Oversee FP&A (financial planning & analysis)

6️⃣ Enable/Drive mergers and acquisitions (M&A) activity

7️⃣ Plan, negotiate, secure, and manage business financing

8️⃣ Ensure compliance with applicable laws and regulations

9️⃣ Communicate with internal and external company stakeholders

🔟 Support the Board and CEO in setting and executing business strategy

And here are the Top 3 skills you would probably like to have as a CFO:

1️⃣ Background in accounting or finance

🎯 As a CFO you are relied upon to provide strategic guidance and leadership in these areas.

🎯 You may not be required to have a CPA designation, but one would give you the breadth and depth of knowledge to make the job 10x easier.

2️⃣ An advanced business degree, generally including an MBA

🎯 As a top-level executive of the company, you are responsible for setting and managing business strategy, as well as effective communication, conflict management and negotiations.

3️⃣ Advanced knowledge and working experience in financial technology

🎯 As CFO, you need to keep up with the evolving fintech solutions available to support financially sound decisions about business IT infrastructure investments.

The KPI Cheat Sheet

Over 300 KPIs broken down by C-Suite role.

The Ultimate KPIs Cheat Sheet.

Both Financial & Non-Financial KPIs.

Because what gets measured gets managed.

and

What you measure is what you get.

Here's what's included in the Ultimate KPIs Cheat Sheet:

🎯 57 CEO KPIs

🎯 54 CFO KPIs

🎯 57 COO KPIs

🎯 48 CRO KPIs

🎯 55 CHRO KPIs

🎯 43 CMO KPIs

Choose the metrics that work for you, your business and your executive team, and use this framework:

⚫ to help align individual goals with organizational objectives

⚫ to help drive the individual performance for each role

⚫ to help improve your organizational performance

How did you enjoy this week's newsletter?

Whenever you’re ready, here are a few more ways I can help:

Upgrade your (or your team’s) strategic finance skills with The Cash Flow Masterclass. Leverage my unique on-demand video course to improve your knowledge, elevate your decision making and accelerate your career. For customized team training please apply here.

Enjoy full size, print-ready PDFs of my strategic finance infographics and cheat sheets for your personal use. Get Your Favorites Here.

Sponsor a future issue of The Finance Gem 💎.

Thanks so much for reading. See you next week.

Oana