Welcome to a new edition of The Finance Gem 💎

Here are this week’s strategic finance gems to help you accelerate your career and grow your business.

This newsletter edition is brought to you by Shield App. Whether you are growing your LinkedIn account, or you simply want to keep track of your LinkedIn content and be able to search and find your posts in seconds, this tool is going to make your life so much better. Not only will it help you sort your posts by most views, comments or likes, but it also comes with a free trial so you can try it at no risk.

Here are my stats for 2023, powered by Shield App:

And Speaking of what makes Life so much Better…

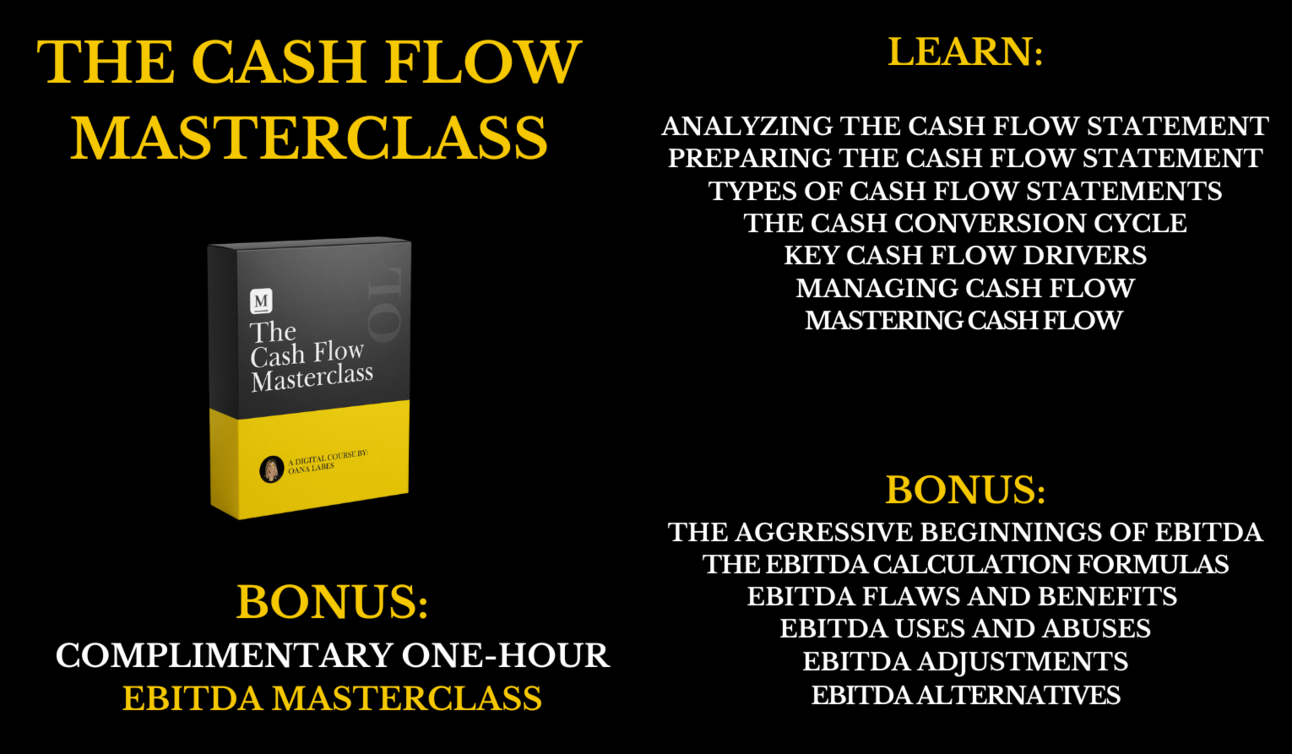

Professionals just like you from a variety of backgrounds are loving The Cash Flow Masterclass.

Here’s what everyone’s saying:

“The slides, quizzes and infographics are of excellent quality

“Practical insights that can be easily applied in our day to day life”

“The Cash Flow Masterclass is amazing.”

“This course is necessary for all finance professionals.”

“The course is excellent.”

“I must say it was an incredibly valuable experience. “

“Great value and both practical skills and strategic knowledge”

“The instructor did an excellent job of explaining these concepts”

For a limited time, when you buy The Cash Flow Masterclass, you will also receive the exclusive recording of my 1-hour EBITDA Masterclass webinar. Don’t miss this exclusive opportunity to gain a deeper understanding of EBITDA, and the practical skills needed to make better strategic decisions when using this critical financial metric. But hurry up - this special offer is only valid until August 12!

Don’t miss out!

Don’t get left behind!

Click below I look forward to seeing you in class!

New this Week

My viral cheat sheets, checklists and infographics are now available in full resolution. Visit my web store and turn your favorites into posters! Or give them as gifts and become the coolest finance buff!

If you’re on Twitter, please follow me there as well and reach out to connect: @IAmOanaLabes

If you’re in San Diego for AFP 2023, let’s connect! I’m speaking on Monday October 23, and would love to meet you there!

This week’s Strategic Finance Insights

IRR vs. ROI

DuPont Analysis

Accounting vs. Finance KPIs

𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 VS. 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

IRR vs. ROI

They’re both financial metrics used to evaluate investment profitability and to compare the profitability of different investments.

🎯 Definition:

⚫ IRR (Internal Rate of Return): The discount rate making the net present value (NPV) of investment cash flows zero.

🟢 ROI (Return on Investment): A financial ratio measuring the profitability of an investment as a percentage of the initial investment.

🎯 How do you calculate them?

⚫ IRR: NPV = ∑(Cash Flow_t / (1 + IRR)^t) = 0

🟢 ROI: (Investment cash flow - cost of investment) / cost of investment

🎯 What drives IRR & ROI?

⚫ IRR: Time value of money, cash flow timing, cash flow amounts, discount rate, project duration, risk.

🟢 ROI: Investment cash flow, cost of investment, project duration, risk.

🎯 How should you use them?

⚫ IRR: Evaluates investment profitability, compares different investments, determines break-even discount rate.

🟢 ROI: Measures investment efficiency, compares different investments, decides where to allocate funds.

🎯 How should you NOT use them?

⚫ IRR: Avoid when investment cash flows are expected to be both positive and negative during project

🟢 ROI: Avoid when time value of money, cash flow timing, and risk are crucial in investment decisions.

🎯 How are they different?

⚫ IRR is more complex, considering the time value of money.

⚫ IRR accounts for cash flow timing and amounts, providing a more accurate profitability picture

⚫ IRR may produce multiple solutions or none, making it difficult to interpret

⚫ IRR considers risk by accounting for the required discount rate to achieve a positive NPV

🟢 ROI is easier to calculate and understand

🟢 ROI ignores the time value of money

🟢 ROI doesn't consider risk

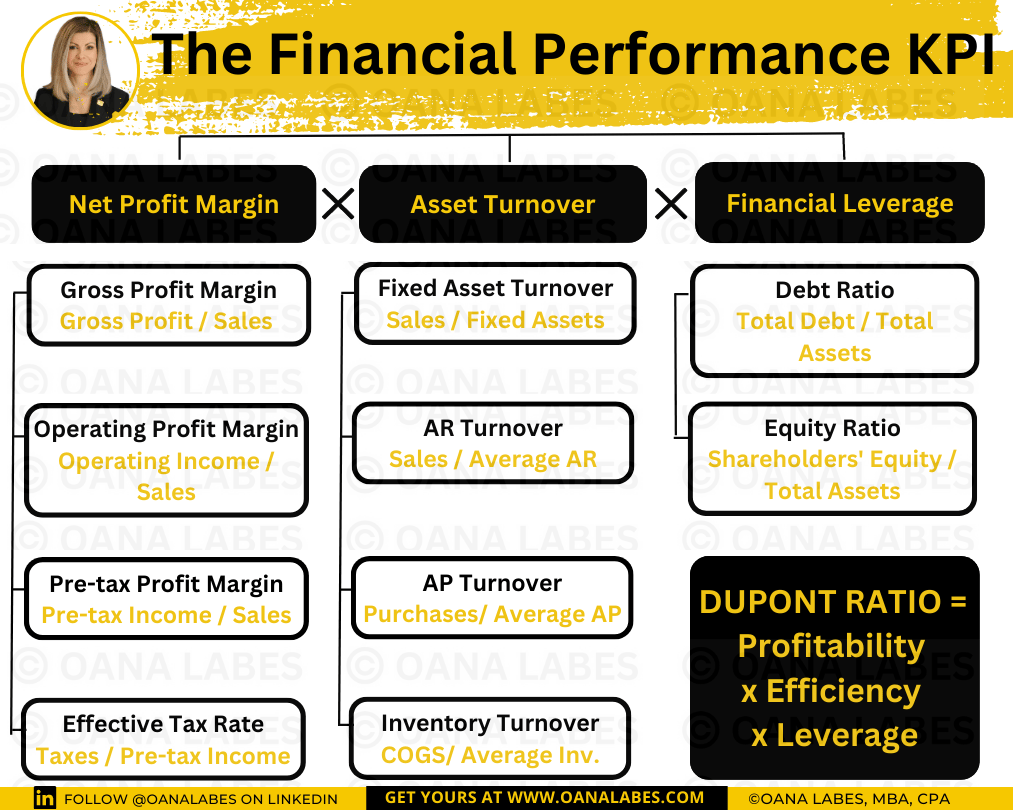

DuPont Analysis

Want to know how to measure overall Financial Performance?

DuPont Analysis will tell you everything you need to know.

What is the Dupont Analysis?

🎯 A financial performance framework that breaks down the key reasons behind your company's return on equity (ROE)

If you track ROE, you probably calculate it with the simple formula:

ROE = Net Income / Shareholders Equity

❌ While this is helpful as an easy to understand profitability ratio comparable across companies, it is also misleading because high ROE could be achieved with high leverage and poor working capital efficiency, which will jeopardize your business long term health and sustainability.

✔️ In contrast, DuPont breaks down ROE to show it as a factor of profitability, asset efficiency and leverage.

🎯 That way, you know exactly what’s driving your ROE.

ROE = Profitability x Efficiency x Leverage

🎯 Here’s the formula:

ROE = Net Profit Margin x Asset Turnover x Financial Leverage

🎯 Let’s break it down on more level:

ROE = [Net Income / Sales] x [Sales / Average Total Assets] x [Average Total Assets / Average Shareholder’s Equity]

🎯 Here’s what DuPont does:

✔️ Helps you drill down into the drivers behind your company's profitability

✔️ Helps bring a deeper understanding of your company's financial performance and the factors that influence its ROE

✔️ Helps identify areas for improvement, optimize resource allocation, and enhance financial performance.

🎯 Here’s how DuPont works:

1️⃣ Net Profit Margin is the proportion of profit generated from revenue after accounting for all expenses, taxes, and interest.

✔️ The Net Profit Margin can be further analyzed into:

a. Gross Profit Margin

b. Operating Profit Margin

c. Pre-tax Profit Margin

d. Effective Tax Rate

2️⃣ Asset Turnover is the efficiency of your company's asset usage to generate sales.

✔️ The Asset Turnover can be further analyzed into:

a. Fixed Asset Turnover

b. Working Capital Turnover

3️⃣ The Equity Multiplier is a measure of financial leverage, showing the proportion of assets financed by debt vs equity.

✔️ The Equity Multiplier can be further analyzed into:

a. Debt Ratio

b. Equity Ratio

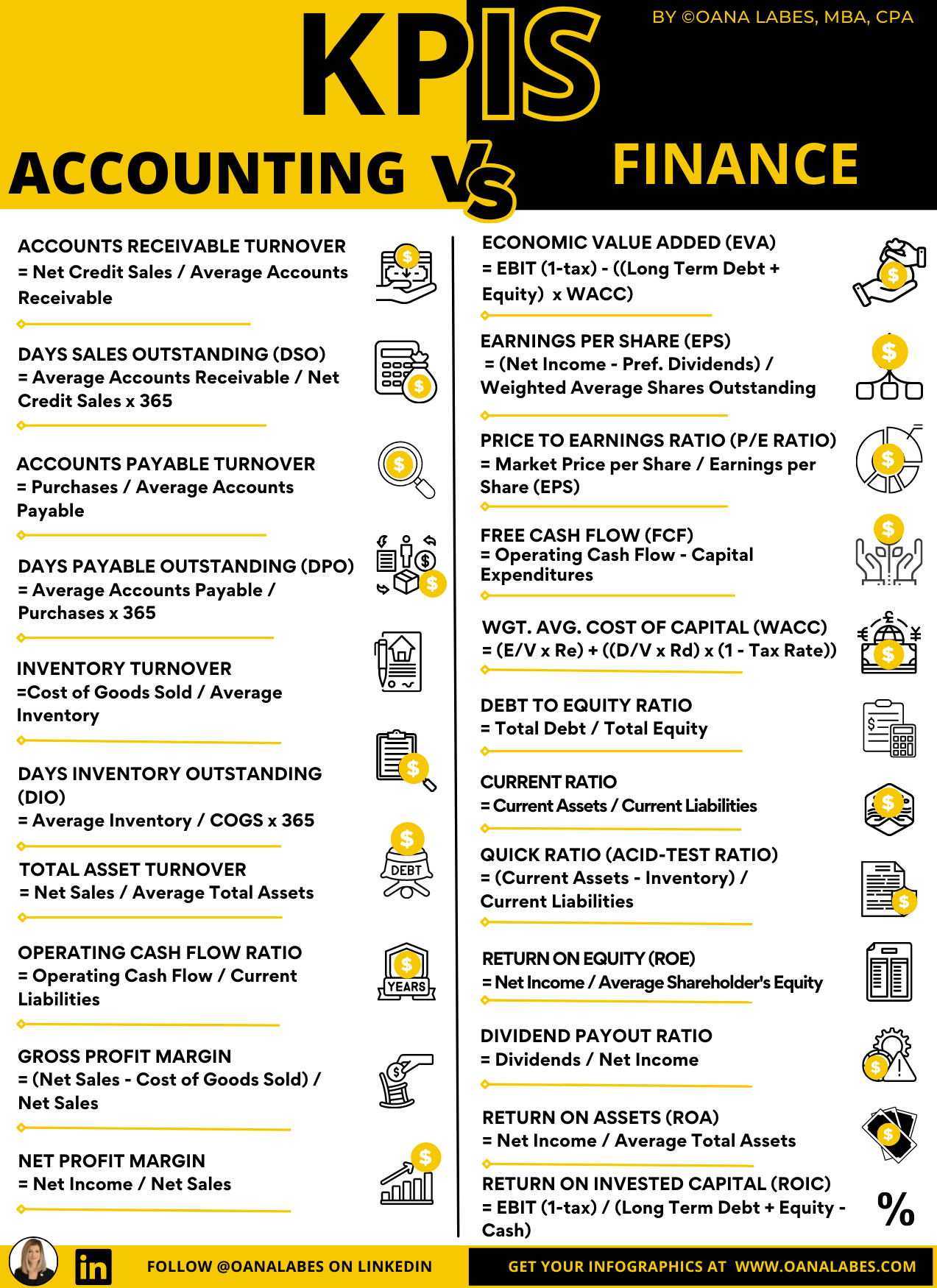

Accounting vs. Finance KPIs

🎯 Finance KPIs focus on the financial performance of a company and help assess value creation by measuring financial health, ability to generate profits and ability to manage capital appropriately

⚫Key Finance KPIs include:

1. Profitability KPIs provide insights into a company's ability to generate profits and create value for shareholders.

2. Cash Flow Management KPIs help assess a company's ability to generate cash from operations, which is critical for growth, reinvestment, and debt repayment.

3. Capital Structure KPIs evaluate a company's capital structure, financing costs, and financial risk, informing decisions on debt and equity financing.

4. Liquidity Management KPIs measure a company's ability to meet its short-term financial obligations, providing insights into its liquidity position and financial stability.

5. Shareholder Value Creation KPIs evaluate the company's ability to generate returns for shareholders and distribute profits through dividends.

6. Asset Management KPIs measure a company's efficiency in generating returns on its assets and invested capital, providing insights into asset utilization and capital allocation.

🎯 Accounting KPIs focus on the day-to-day operations of a company to help measure and monitor financial operation efficiency, and the effectiveness of assets, liabilities, and cash flow management

🟡 Key Accounting KPIs include:

1. Accounts Receivable Management KPIs help assess the effectiveness of a company's credit and collection policies, as well as the efficiency of managing customer payments.

2. Accounts Payable Management KPIs evaluate how efficiently a company manages its payments to suppliers and other creditors.

3. Inventory Management KPIs measure the effectiveness of inventory management, determining how quickly a company sells and replenishes its stock.

4. Asset Utilization KPIs evaluate how effectively a company uses its assets to generate sales, helping identify areas for improvement and better resource allocation.

5. Cash Flow Management KPIs assess the efficiency of a company's cash flow management, providing insights into working capital requirements and cash flow optimization strategies.

6. Profitability and Margins KPIs help determine the effectiveness of a company's pricing strategies, cost control, and inventory management in generating profits.

𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 VS. 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

The Best 50 FREE Resources to Master Them.

Because Finance is NOT Accounting.

Here are the best posts from Top Linkedin Finance and Accounting Content Creators, including yours truly, curated for you.

Hundreds of hours of selfless volunteer work went into preparing these resources for your benefit.

You get them all in one place, ready to be studied and saved, to help accelerate your career and grow your business.

Get your Excel file with links here.

How did you enjoy this week's newsletter?

Want more strategic finance insights?

Upgrade your strategic finance skills with The Cash Flow Masterclass. Leverage my unique on-demand video course to improve your knowledge, elevate your decision making and accelerate your career. For customized team training please apply here.

Sponsor a future issue of The Finance Gem 💎and get your brand in front of an exceptional audience of strategic finance, accounting, sales and technology professionals and executives.

Train your team in strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana

The mother of Cash and EBITDA - compliments of Nicolas Boucher