Welcome to a New Edition of The Finance Gem 💎

weekly strategic finance gems to accelerate your career and grow your business

This Week’s Strategic Finance Insights

Strategic Cash Flow Quiz Answers

10,000 Pennies for your Thoughts - That’s $100 if you’re counting…

Share your valuable insights in this short survey and unlock an exclusive $100 discount for The Cash Flow Masterclass. Limited time offer.

In case you missed this

My viral cheat sheets, checklists and infographics are available in full resolution. Visit my web store and turn your favorites into posters! Or give them as gifts and become the coolest finance friend or mentor!

I use Thinkific to power up The Cash Flow Masterclass and the several upcoming courses I am working on. Download the new Thinkific mobile app on your mobile device, and grow your strategic finance skills and insights from anywhere, anytime — on any device.

For Upcoming Course Launches, Promotions, Private Sales and Free Finance Webinars, sign up here. Make sure you add [email protected] to your address book, or you might miss out because my emails to you may not get delivered.

Now let’s get into this week’s strategic finance insights

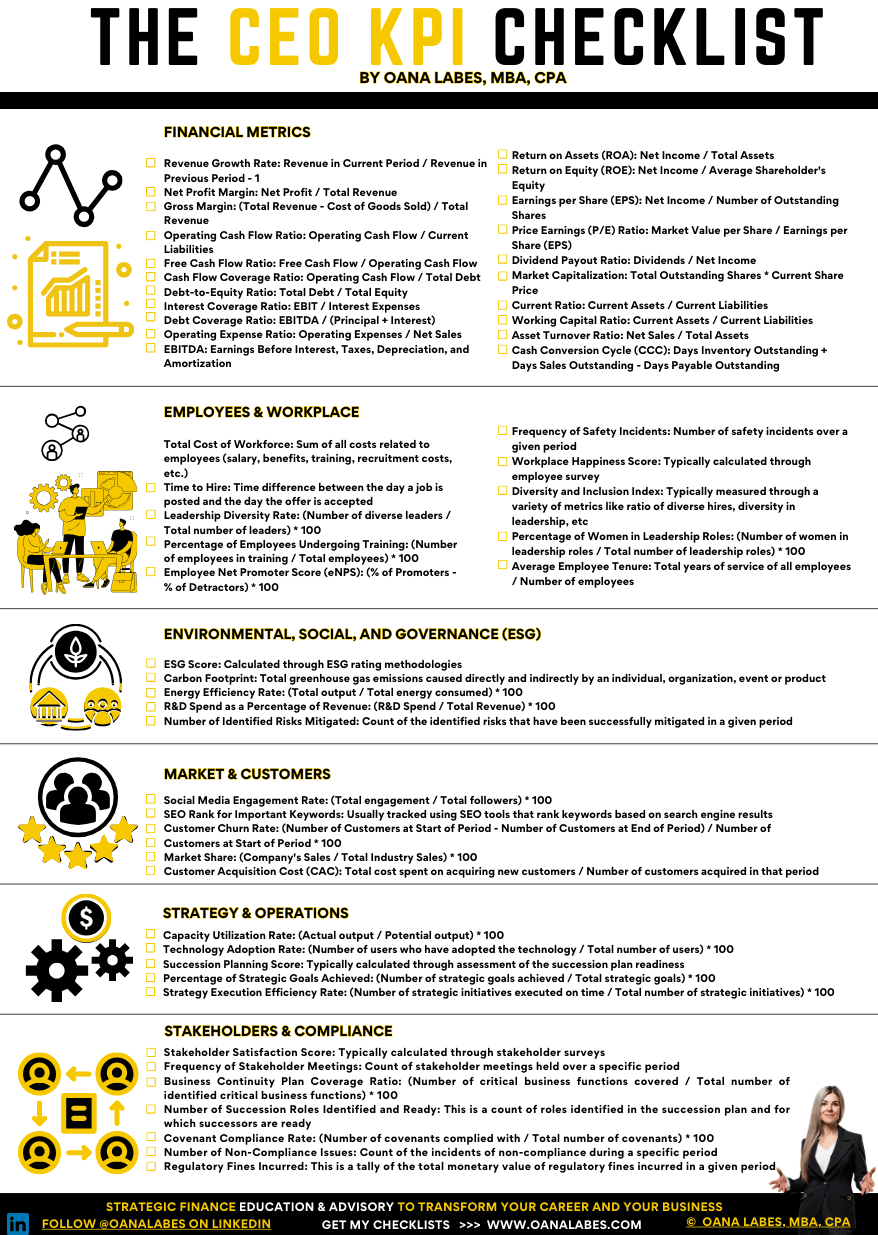

The CEO's KPI Checklist

How do you know if you’re successful as a CEO?

Your every decision impacts financial health, employee morale, and stakeholder satisfaction.

So to succeed, you’ll need to measure and monitor performance across all these areas.

And you’ll need to measure, monitor and target what you want to impact.

Financial and Non-Financial Metrics.

🎯Here are 6 key areas that a CEO should monitor and manage alongside the most essential 5 KPIs in each area.

Financial Metrics:

1. Revenue Growth Rate

2. Net Profit Margin

3. Gross Margin

4. Operating Cash Flow Ratio

5. Free Cash Flow Ratio

Non-Financial Metrics: Employees & Workplace

1. Employee Engagement Score

2. Frequency of Stakeholder Meetings

3. Business Continuity Plan Coverage Ratio

4. Number of Succession Roles Identified and Ready

5. Covenant Compliance Rate

Non-Financial Metrics: Environmental, Social, and Governance (ESG)

1. ESG Score

2. Carbon Footprint

3. Energy Efficiency Rate

4. R&D Spend as a Percentage of Revenue

5. Number of Identified Risks Mitigated

Non-Financial Metrics: Market & Customers

1. Social Media Engagement Rate

2. SEO Rank for Important Keywords

3. Customer Churn Rate

4. Market Share

5. Customer Acquisition Cost (CAC)

Non-Financial Metrics: Strategy & Operations

1. Capacity Utilization Rate

2. Technology Adoption Rate

3. Succession Planning Score

4. Percentage of Strategic Goals Achieved

5. Strategy Execution Efficiency Rate

Non-Financial Metrics: Stakeholders & Compliance

1. Stakeholder Satisfaction Score

2. Number of Non-Compliance Issues

3. Regulatory Fines Incurred

4. Total Cost of Workforce

5. Time to Hire

Click on the image below to download a copy of the full checklist in full resolution PDF.

Notion is an all-in-one workspace which lets you write, plan, collaborate, and organize effectively. Notion AI allows you to analyze meeting notes & generate summaries, improve your writing, translate and edit your voice, and get help writing your blog, article, or social media post. Use my affiliate links to get started for free with Notion and Notion AI and give them a try today!

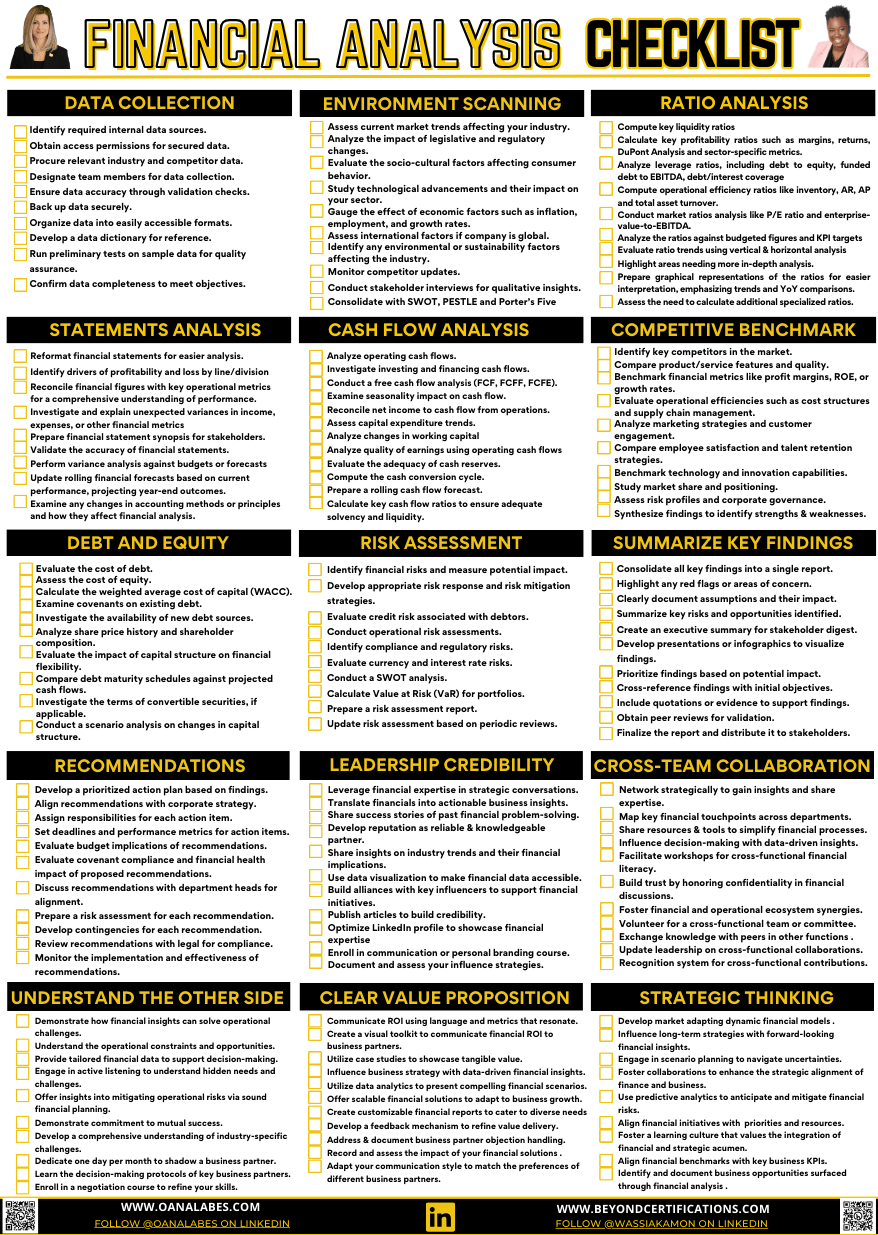

The Financial Analysis Checklist

You’ve never seen Financial Analysis done this way.

I teamed up with Wassia Kamon, CPA, CMA, MBA for a deep dive into Financial Analysis at the AFP2023 in San Diego.

‘Solving Business Problems with Financial Analysis’ delivered critical insights into how companies can pave the path for sound business decisions.

Here’s a glimpse into our session:

1️⃣ Financial Analysis Basics: key questions you should be asking:

➡️ Is the growth curve sustainable?

➡️ Are the profit margins sufficient?

➡️ Does the business use assets efficiently?

➡️ Does the business produce sufficient operating cash flow for its needs?

2️⃣ Financial Analysis through the Lifecycle Lens:

➡️ Startup: How do we become a viable business?

➡️ Growth: How do we achieve sustainable growth?

➡️ Maturity: How do we manage and retain profitability?

3️⃣ Financial Analysis through the Strategic Environment Lens:

➡️ PESTEL

➡️ Porter’s Five Forces

➡️ SWOT

4️⃣ Financial Analysis through the People Lens:

➡️ Financial Analysis will give you the What, the So What, and the Now What.

➡️ The People on your team will take you from Now What to Exactly How.

Teach them to:

>> Anticipate needs

>> Develop analytical agility

>> Cultivate their strategic vision

>> Master the art of communicating insights

🎯 Up next: The Financial Analysis Masterclass! Stay Tuned for the Pre-sale alert!

Click on the image below to download a full resolution PDF copy.

If you’re still unsure if my Cash Flow Masterclass is for you, consider this:

☑️ It’s GOOD: you will learn from one of the best coaches - a CPA, MBA with unique expertise in corporate and commercial finance, financial and managerial accounting, business management and business strategy.

☑️ It’s VALIDATED: your peers are giving The Cash Flow Masterclass 5*, join them so you don’t miss out!

☑️ It’s FAST: it takes less than 2 hours to breeze through the course on any device, and you can pause anytime

☑️ It’s PRACTICAL: you get dynamic financial models included in the course and you will be applying what you learn for the rest of your career

☑️ It’s VALUABLE: the course cost is nominal compared to the value it provides for your career, and there are several payment plans available

☑️ It’s YOURS: you get lifetime access on any device (audio mode available in the app)

☑️ It’s EXPENSIBLE: your employer or business can reimburse you, making this a win-win purchase for you and your organization.

ENROL TODAY - your Career and your Organization will thank you!

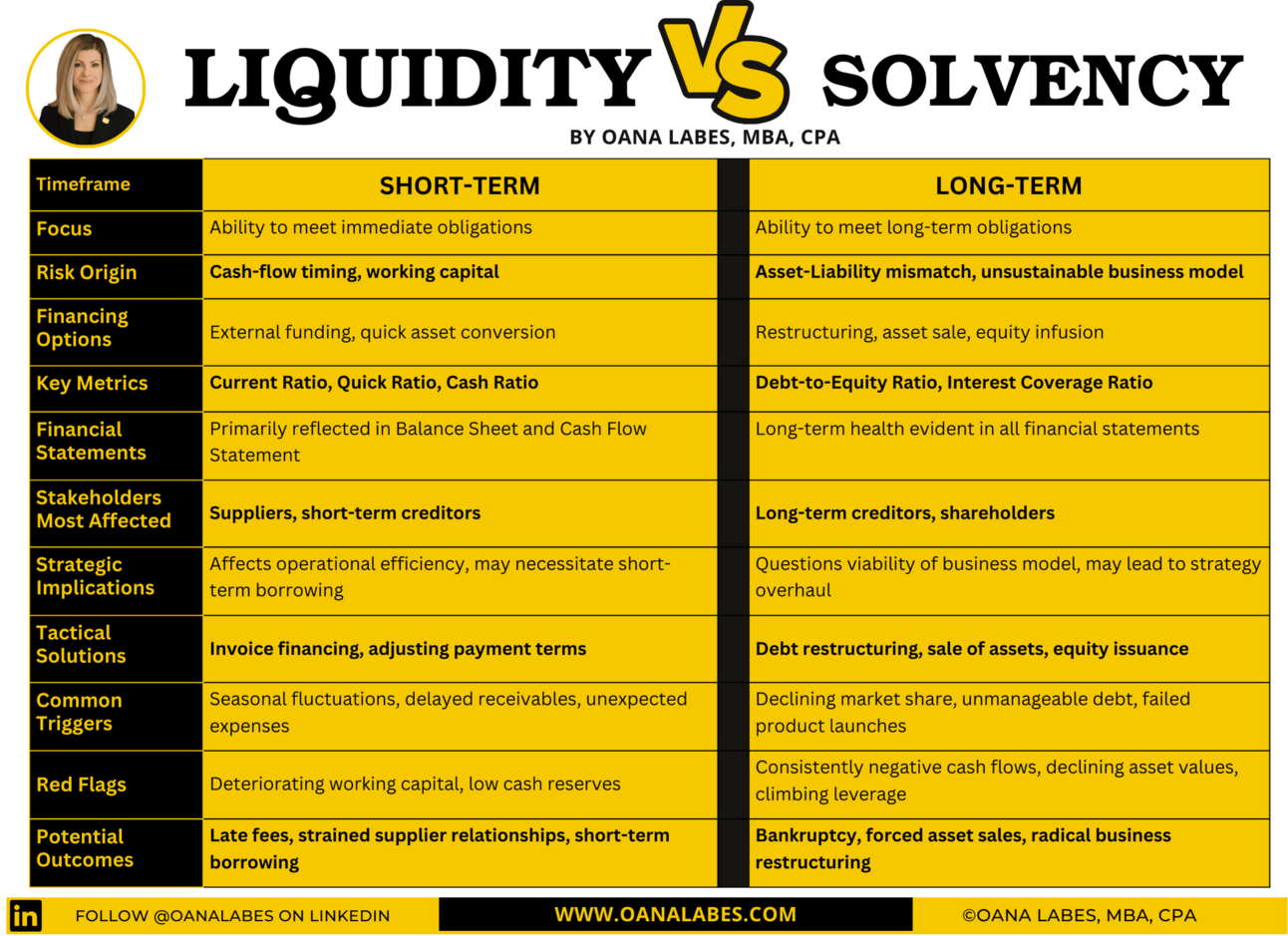

Liquidity vs. Solvency

Liquidity and Solvency are not the same.

Here’s how they’re different and why you should care.

Liquidity impacts your today.

Solvency impacts your tomorrow.

They serve different functions and have different implications.

Understanding how they are different can save your company

From a liquidity crunch, from insolvency, or even from bankruptcy.

Here are 4 critical differences you need to know:

🎯 They have different time horizons:

➡️ Liquidity: Short-term; usually focused on a 12-month period, ensuring you can meet immediate financial obligations.

➡️ Solvency: Long-term; spans years, ensuring your company has the required runway ahead to remain a viable business.

🎯 They use different financial KPIs:

➡️ Liquidity uses balance-sheet-centric, emphasizing short-term health.

Examples: Current Ratio, Quick Ratio, and Cash Ratio.

➡️ Solvency uses metrics that cross the income statement and balance sheet, examining long-term viability.

Examples: Debt-to-Equity Ratio, Interest Coverage Ratio, Funded Debt to EBIT, Fixed Charge Coverage Ratio

🎯 They monitor different underlying business concerns:

➡️ Liquidity is a timing issue testing for enough cash or easily convertible assets to cover immediate liabilities

➡️ Solvency is a mix of profitability and cash flow measuring if your business model is sustainable in the long run

🎯 They come with different consequences when ignored

➡️ Liquidity: Expect a cash crunch, operational setbacks, and tarnished creditworthiness.

If it continues beyond the current operating cycle and requires debt working capital financing, it may convert into a solvency problem, where not enough assets will be available to fund future payment obligations

➡️ Solvency: Expect risk of bankruptcy, investor mistrust, and long-term failure.

EBT vs. EBIT vs. EBITDA

Let’s break down their differences step by step.

1. Definitions:

• EBT: Profit excluding tax expenses.

• EBIT: Profit excluding interest and tax expenses.

• EBITDA: Profit excluding interest, taxes, depreciation, and amortization expenses.

2. Formulas:

• EBT = Revenue - COGS - Operating Expenses - Other Expenses + Other Income

• EBIT = Revenue - COGS - Operating Expenses

• EBITDA = Revenue - COGS - Operating Expenses + Depreciation + Amortization

3. Operational Insight:

• EBT: Insight into profitability before tax.

• EBIT: View of operating profitability excluding financing costs.

• EBITDA: Rough measure of profitability by adding back Depreciation and Amortization to EBIT.

4. Degree of Separation from Net Income/Profit:

• EBT: Closer to net income, excluding only taxes.

• EBIT: Excludes effects of financing and taxes from operating profitability.

• EBITDA: Excludes effects of financing, taxes, and capital depreciation from operating profitability.

5. Uses and Applications:

• EBT: Analyzing profitability and tax strategy.

• EBIT: Operating analysis, valuation, and company comparison.

• EBITDA: Valuation, investor analysis, and company comparison ignoring financing and tax implications.

6. Impact of Taxation and Financing:

• EBT: Highlights impact of taxation, not financing on total earnings.

• EBIT: Ignores both tax and financing impacts, focusing on operating earnings.

• EBITDA: Ignores impact of taxation, financing, depreciation, and amortization on operating earnings.

7. Key Formulas using these metrics:

• EBT:

o Net Income = EBT - Taxes

o Effective Tax Rate = (Taxes / EBT) * 100

• EBIT:

o Interest Coverage Ratio = EBIT / Interest Expense

o Net Operating Income = EBIT + Non-Operating Income

o Return on Capital Employed = EBIT / (Total Assets - Current Liabilities)

• EBITDA:

o EBITDA Margin = (EBITDA / Revenue) * 100

o Enterprise Value to EBITDA = Enterprise Value / EBITDA

o Free Cash Flow = EBITDA - CAPEX - Change in Net Working Capital - Taxes

Give to Get Program

If you’re enjoying this newsletter, please forward it to a friend. It only takes 3 seconds. Writing this took 4 hours.

🎯Refer 5 people and get my exclusive eBook 10 Essential Strategic Finance Concepts that link Accounting, Finance and Strategy

🎯Refer 10 people and get an exclusive $10 Off coupon for your favorite infographic in my digital store.

Thank you for the love - today’s featured review

Quiz Time - Answers for last week’s Cash Flow Quiz

Below you will find in bold font the answers to last week’s Five Question Quiz.

If you need help with any of these, you will enjoy learning about them in my highly reviewed, self-paced, on-demand video course.

If a company buys new manufacturing equipment with cash and later finances its operations by issuing new shares, how does this dual-action impact the net cash flow for the period?

a) Increases Cash Flow in both Operating and Financing Activities

b) Increases Cash Flow in Financing Activity, Decreases Cash Flow in Investing Activity

c) Increases Cash Flow in Investing Activity, Decreases Cash Flow in Financing Activity

d) Increases Cash Flows in both Operating and Investing Activities

Your company pays off its corporate credit card bill and receives a tax refund in the same period. Which statement best describes the net effect on operating activities cash flow?

a) Net Zero Cash Flow

b) Net Cash Inflow

c) Net Cash Outflow

d) Inconclusive without the amounts of the transactions

When a company secures a new client contract expected to significantly boost future sales, but sells off some investments in stocks and bonds to fund initial client project costs, what strategic considerations should be made in cash flow projections?

a) Future Operating Cash Inflows and Current Investing Inflows

b) Future Operating Cash Inflows and Current Investing Outflows

c) Future Investing Cash Inflows and Current Investing Outflows

d) Future Operating Cash Outflows and Current Investing Inflows

If a company sells an old piece of equipment for cash and also invests surplus cash in a term deposit, what long-term strategic implications should be considered for optimizing cash flows?

a) The Timing of Cash Inflows and Cash Positioning

b) The Timing of Cash Outflows and Liability Management

c) Tax Implications and Cost of Capital

d) Operational Efficiency and Debt Management

When a company decides to pay dividends without sufficient operating cash flow, what are the primary risks concerning its cash flows?

a) Reduced Ability to Invest in Future Opportunities

b) Jeopardizing Free Cash Flow

c) Undermining Debt Servicing Capabilities

d) Increased Tax Liabilities

Poll Time

What was your favorite topic this week?

How did it feel reading this week's issue?

As always, if you have suggestions or feedback, simply reply to this email.

Looking for More ?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on-demand video course.

Work with me 1-1. Availability is very limited. Book here.

Get growth business advisory for your organization with short, medium and long term financial planning, and big-picture financial models so you’re always finance-ready. Reach out here.

Sponsor a future issue of The Finance Gem 💎

Train your team on strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana