Welcome to a New Edition of The Finance Gem 💎

weekly strategic finance gems to accelerate your career and grow your business

Webinar | Masterclass | Shop | Newsletter

Black Friday 50% off Ends November 26

This Week’s Strategic Finance Insights

Before we get into that however, a word from our partner

Save 50% on FareDrop Pro for Black Friday

Looking to travel more in 2024? Us too. That’s why we’re so excited to share FareDrop’s best deal ever for Black Friday. With FareDrop, you can save up to 80% on flight prices with personalized deal alerts from your home airports. The deals will be completely customized to your travel goals, including your preferred destinations, travel availability, budget, and more.

Right now, if you sign up for FareDrop you’ll receive:

50% off the Pro Plan

A FREE airport t-shirt

A FREE Lonely Planet eBook

A $50 hotel credit

And you’ll be entered to win a trip to the Maldives!

That’s a total value of $199 for just $49. This sale won't be around long, so sign up for your Pro plan now!

Register for an upcoming cash flow webinar

Join us for deep cash flow insights and actionable strategies that will help you enhance your strategic decision-making, and will compound your impact and influence in boardrooms and beyond. Get ready for a power-hour designed for ambitious professionals, executives and business leaders Click here to register.

Now let’s get into this week’s strategic finance insights

Is EBITDA the same as Free Cash Flow?

Not at all. Here’s why:

EBITDA and Free Cash Flow (FCF) are distinct financial metrics commonly used in corporate finance, but despite their differences, they are often confused or interchangeably used in financial analysis.

➡️ Don’t make the same mistake.

🎯Think of EBITDA as a non-GAAP metric with really subjective calculation

🔎 Non-Standardized Calculation:

» EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

» it is not a Generally Accepted Accounting Principles (GAAP) metric, meaning its calculation varies among companies.

» this lack of standardization allows for subjective interpretations, which can be misleading for stakeholders.

🔎 Inaccurate Cash Flow Representation:

» EBITDA suggests that net income directly converts into cash flow.

» this oversimplification ignores non-cash expenses and changes in working capital, which are crucial for understanding a company's cash generation capacity.

🔎 Exclusion of Reinvestment Requirements:

» EBITDA does not account for reinvestment in fixed assets, vital for capital-intensive businesses.

» for accurate financial health assessment, reinvestment should at least cover replacement CAPEX and align with non-cash depreciation expenses.

🔎 Misleading Debt Repayment Implication:

» Contrary to the implication that available cash flow is primarily used for debt repayment, companies may in fact prioritize dividend distributions to shareholders, affecting their debt obligations.

🔎 No Insight into Earnings Quality:

» EBITDA does not reflect the quality of earnings, which can be compromised by aggressive revenue and expense recognition policies.

🎯Great, now this of Free Cash Flow as an alternative EBITDA metric

🔎 Definition and Calculation: FCF represents the cash available in a business after accounting for operational cash outflows and maintaining the fixed asset capital base.

» The formula for FCF is Operating Cash Flow +/- Changes in Fixed Assets.

🔎 Advantages of FCF:

» Simplicity: FCF is relatively easy to calculate.

» Comprehensive: FCF addresses several EBITDA limitations by considering CAPEX and the cash impact of sales growth or working capital efficiency.

🔎Limitations:

» CAPEX Assumption: FCF assumes all capital expenditures are necessary, which is not always the case as companies often have a mix of replacement and growth CAPEX.

» Inconsistent CAPEX Representation: FCF can overstate CAPEX in the acquisition year and understate it in subsequent years.

» Lack of Standardization: Similar to EBITDA, FCF lacks a standardized formula, requiring validation with banks or investors for external uses.

» Manipulation Potential: Companies could potentially manipulate FCF by under-investing in fixed assets.

🎯Remember:

➡️EBITDA provides a quick estimate of operating performance without the influence of tax and finance structures

➡️FCF gives a more realistic view of the cash available for stakeholders after essential business investments.

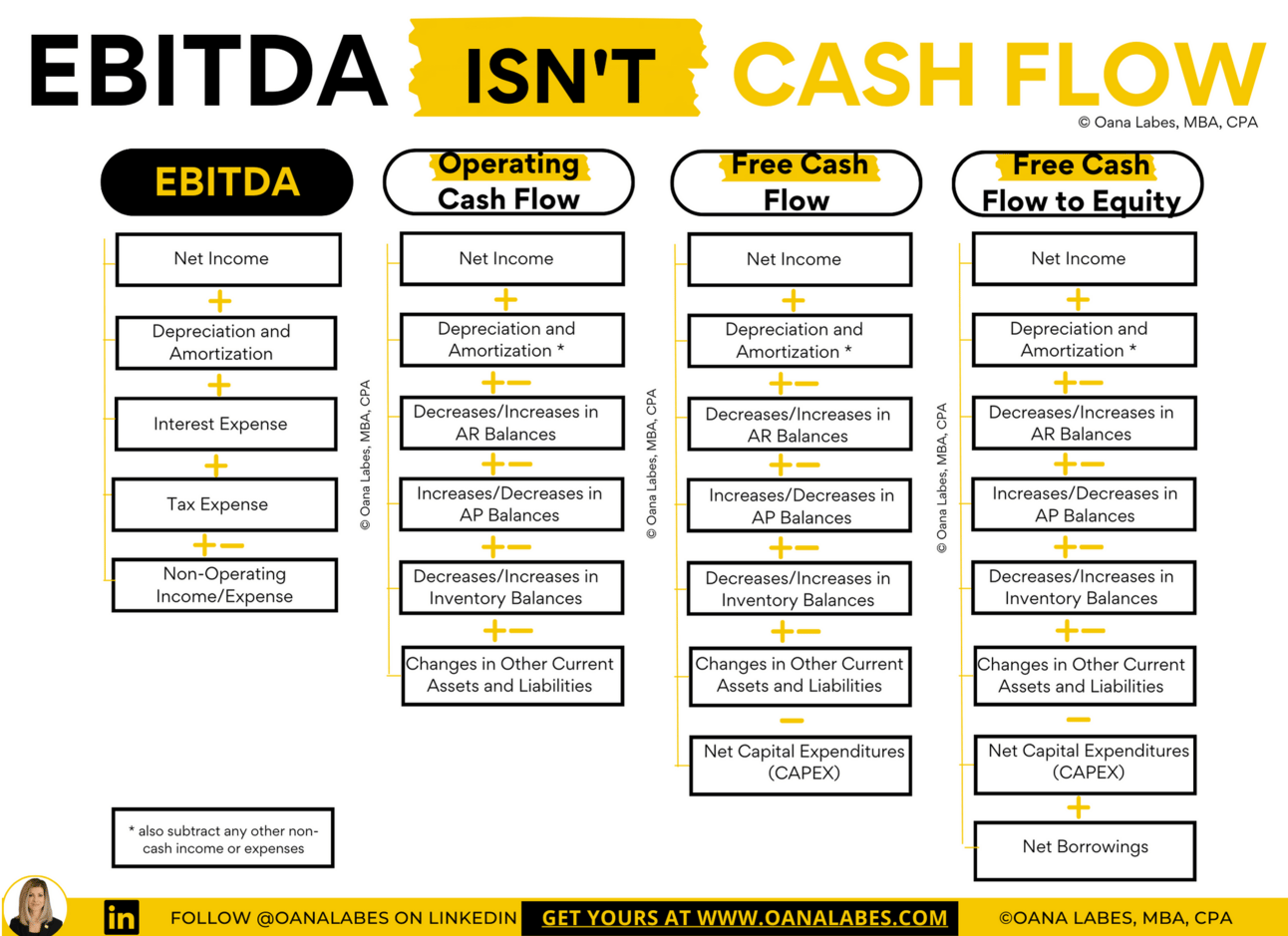

EBITDA vs. OCF vs FCF vs. FCFE

EBITDA vs. OCF vs FCF vs. FCFE

EBITDA against The Cash Flows.

This is the ultimate Battle.

Let’s see who wins.

1️⃣ EBITDA

⚫ Not a GAAP metric

⚫ Not a cash flow metric despite often being mistaken for one.

⚫ Discretionarily adjusted. Non-cash adjustments beyond Depreciation and Amortization are all the rage in quarterly calls and annual reports.

⚫ Ignores investment required for working capital assets and fixed assets, both of which can be sizeable uses of cash for growing companies. Not even going to mention how it ignores real uses of cash like interest and tax.

2️⃣ Operating Cash Flow (OCF)

⚫ It’s a GAAP metric!

⚫ Represents the cash generated from regular business operations.

⚫ Shows whether the company can generate sufficient positive cash flow to maintain and grow its operations as well as service its debt repayment obligations.

3️⃣ Free Cash Flow to Firm FCF

⚫ Not a GAAP metric.

⚫ Represents the cash remaining in the business after accounting for cash outflows that support its operations (operating expenses + working capital) and cash outflows that grow its capital asset base (capital expenditures).

⚫ Free Cash Flow however must first be used to meet principal and interest repayment obligations before it is truly “Free” to be distributed to shareholders.

4️⃣ Free Cash Flow to Equity (Levered Cash Flow)

⚫ Not a GAAP metric either.

⚫ Represents the cash remaining in the business after accounting for all business expenses, investments in working capital assets, investments in fixed assets, and also all debt obligations.

⚫ This is the true residual cash flow available to a company in any given period, and truly “Free” to be used for investments, dividend payments, returns of capital, additional debt repayments, or acquisitions.

⚫ Includes net debt which can skew the analysis.

➡️ If you are a banker looking to monitor a firm’s distributable cash flows, FCFE is a great metric to track in conjunction with leverage

➡️ If you are an investor looking to calculate the firm’s enterprise value through a DCF analysis, be aware of the downsides of using FCF

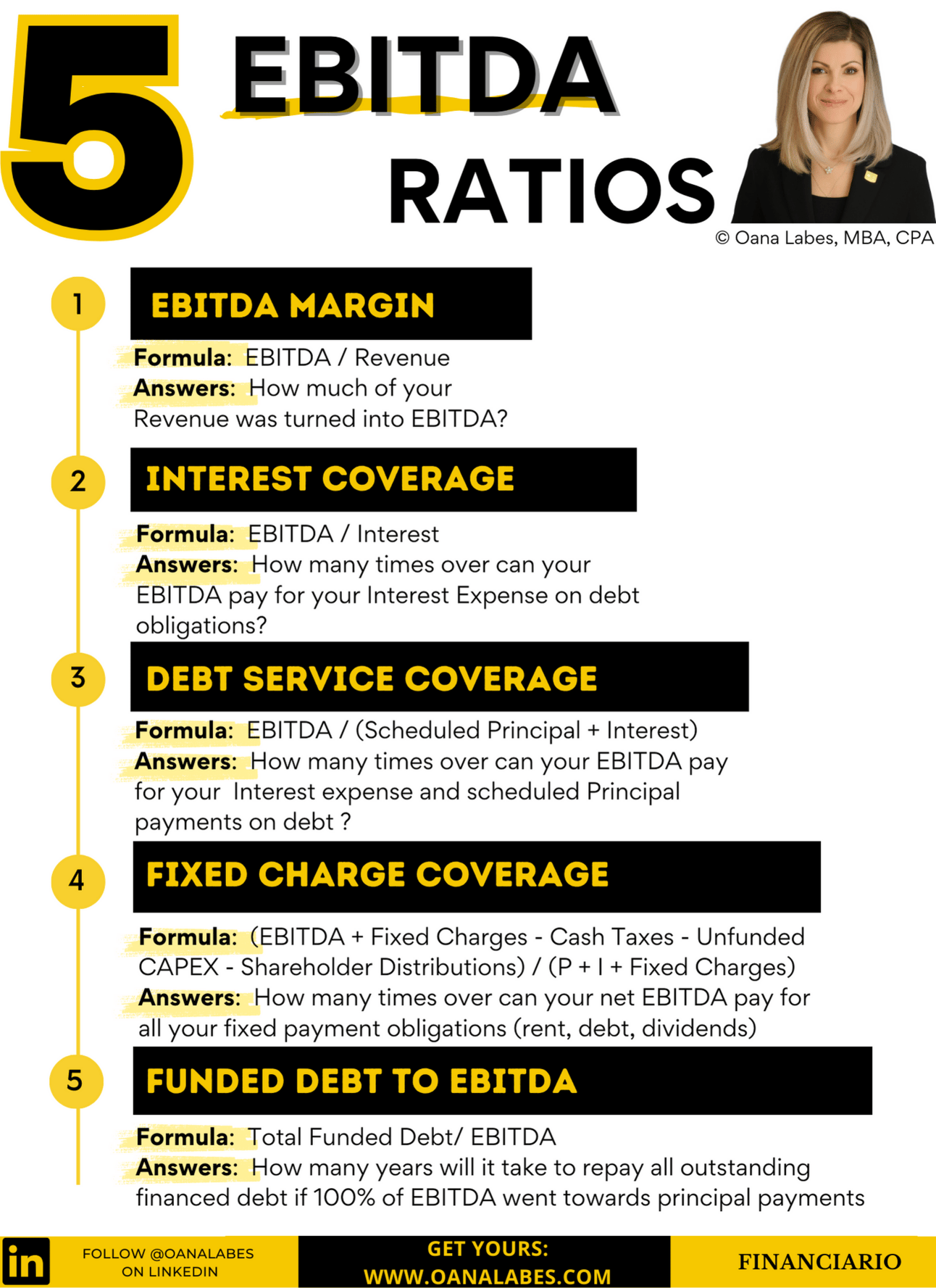

5 Key EBITDA Ratios you Should Know and Use

Here are 5 Key EBITDA Ratios you need to know.

Use them to track your profitability, debt servicing capability and leverage.

1// EBITDA margin

🎯 How to Calculate: Divide EBITDA by Revenue x 100

🎯 Why Calculate: To determine the percentage of Revenue that gets converted into EBITDA (operating profit before interest, taxes, depreciation and amortization)

🎯 How to Use:

>> Industry Benchmarking

>> Financial Analysis

2// Interest Coverage

🎯 How to Calculate: Divide EBITDA by Interest Expense

🎯 Why Calculate: To determine whether the EBITDA you generated in the period is sufficient to pay for the company’s Interest Expense during the period

🎯 How to Use:

>> Industry Benchmarking

>> Financial Analysis

>> Covenant Tracking and Compliance

3// Debt Service Coverage

🎯 How to Calculate: Divide EBITDA by the total scheduled Principal + Interest payments made during the period.

🎯 Why Calculate: To determine whether your company can pay for its Interest expense as well as scheduled Principal payment obligations using the EBITDA generated during the period.

🎯 How to Use:

>> Financial Analysis

>> Covenant Tracking and Compliance

4// Fixed Charge Coverage Ratio

🎯 How to Calculate:(EBITDA + Fixed Charges - Cash Taxes - Unfunded CAPEX - Shareholder Distributions) / (Principal +Interest +Fixed Charges)

🎯 Why Calculate: To determine whether your company can pay for its fixed payment obligations (Interest, Scheduled Principal, Rent) using the EBITDA generated in the period, adjusted to reflect the cash drain of unfinanced CAPEX and distribution payments made to shareholders

🎯 How to Use:

>> Financial Analysis

>> Covenant Tracking and Compliance

5// FD/EBITDA

🎯 How to Calculate: Divide Total Financed Debt by EBITDA

🎯 Why Calculate: To determine how many years it would take you to repay the outstanding financed debt balance, assuming current EBITDA levels are maintained in future years and 100% of annual EBITDA went towards debt repayment.

🎯 How to Use:

>> Financial Analysis

>> Covenant Tracking and Compliance

Note that these are typically calculated as annual ratios, so either Annual EBITDA, or Rolling 4 quarters EBITDA (the sum of EBITDA over 4 consecutive quarters) get used in formulas.

10 Cash Flow questions for CEOs

Your lenders want to know

And your investors want to know

That’s why as a CEO your should want to know the answers to these 10 critical cash flow questions:

1. Is our company generating positive cash flow from operations?

Targets: Understanding Positive Cash Flow from Operations

🎯 This metric is key to determining if the core business activities are profitable and sustainable, a vital sign of long-term financial health and operational success.

2. What is our company's ability to meet its short-term obligations using its operating cash flow?

Targets: Assessing Short-term Liquidity Using Operating Cash Flow

🎯This insight reflects on the company's liquidity and ability to manage immediate financial obligations, crucial for maintaining a strong financial standing.

3. How effectively is our company using its assets to generate cash flow?

Targets: Evaluating Asset Utilization for Cash Flow Generation

🎯Understanding this efficiency indicates how well the company manages and leverages its assets to produce revenue, a key aspect of operational effectiveness.

4. How much of our company's net income is being converted into cash flow from operations?

Targets: Conversion of Net Income into Operational Cash Flow

🎯This measure highlights the quality of earnings and their transformation into actual cash, a critical factor in assessing financial stability.

5. Is our company able to cover its capital expenditures with the cash generated from its operations?

Targets: Capability to Finance Capital Expenditures from Operational Cash

🎯This analysis helps to determine if the company can sustain growth and cover significant expenses without relying on external financing.

6. How much cash flow is available to our company's investors (both debt and equity)?

Targets: Assessing Available Cash Flow for Investors

🎯This figure indicates the company's ability to generate returns for investors, encompassing both debt and equity perspectives, essential for investment and financial health analysis.

7. How effectively is our company managing its cash conversion cycle?

Targets: Efficiency in Managing the Cash Conversion Cycle

🎯Evaluating this cycle provides insights into how well the company manages its inventory, receivables, and payables, impacting overall operational efficiency.

8. How leveraged is our company, and can it comfortably meet its debt obligations?

Targets: Assessing Company Leverage and Debt Management

🎯Understanding the company's leverage and its capacity to meet debt obligations is crucial for evaluating financial risk and stability.

9. Is our company generating a sufficient return on invested capital?

Targets: Evaluating Return on Invested Capital (ROIC)

🎯This metric is important for assessing the effectiveness of the company's use of capital in generating profits, reflecting on overall investment efficiency.

10. What is our company's Cash Flow per Share (CFPS)?

Targets: Analyzing Cash Flow per Share

🎯CFPS provides an understanding of the company's ability to generate cash flow on a per-share basis, an important metric for shareholder value assessment.

The Cash Flow Masterclass Has 5 Star Reviews⭐⭐⭐⭐⭐

“This course is engaging and well-organized, […] concise and effective. I highly recommend it to non-finance professionals who want to broaden their knowledge, or experienced individuals who want to improve their understanding of Cash Flow. Despite having worked with Cash Flow Statements for years, I still learned a great deal from the excellent presentation and there's a reason Oana's infographics are so popular - they are brilliant.”

In case you missed this

Gift Vouchers are now available in my digital store!

Get my viral cheat sheets, checklists and infographics in full resolution for yourself, or give them as gifts and become the coolest finance friend or mentor!

For Upcoming Course Launches, Promotions, Private Sales and Free Finance Webinars, sign up here. If you don’t hear back, please check your spam folder and move Jotform’s email to your inbox.

Give to Get Program

If you’re enjoying this newsletter, please forward it to a friend. It only takes 3 seconds. Writing this took 4 hours.

🎯Refer 5 people and get my exclusive eBook 10 Essential Strategic Finance Concepts that link Accounting, Finance and Strategy

🎯Refer 10 people and get to pick your favorite infographic from my digital store.

Poll Time

What was your favorite topic to read in this issue?

How did it feel reading this week's issue?

As always, if you have suggestions or feedback, simply reply to this email.

How can I help you?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on-demand video course. Several others are in the works, so stay tuned!

Get growth business advisory for your organization with short, medium and long term financial planning, and big-picture financial models so you’re always finance-ready. Reach out here.

Sponsor a future issue of The Finance Gem 💎

Train your team on strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana