WELCOME TO ISSUE NO #68

Webinar | Masterclasses | Shop | Newsletter | Speaking | Training

THIS WEEK’S ISSUE AT A GLANCE

This issue’s finance Gems 💎 vote your favorite in the poll section

50 Red Flags you can’t afford to ignore

Accounting vs. Finance KPIs

The CEO Checklist

20 Most Confused Finance Topics you shouldn't confuse.

The Finance Gem has gone bi-weekly

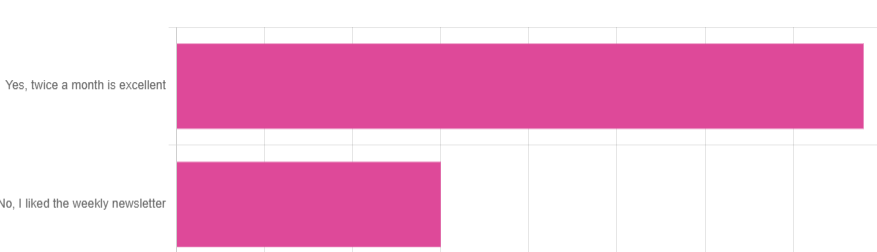

Thousands of you reached out and answered polls over the past few months to suggest the length and frequency of the newsletter could be revised. I’m starting by reducing the frequency from 4x monthly to 2x monthly. Stay tuned for more updates.

As of this issue, you will find more practical examples included in every post to help y0ou both understand and apply concepts better. Let me know if you’re loving these changes using the poll below!

Are you excited to hear The Finance Gem will publish less frequently?

My new course is now live: The Financial Analysis Masterclass sale is on. Save an additional 30% off the launch price. Details below.

I’m speaking once again at the largest finance conference in the world! AFP2024 takes place in Nashville in October - reply to this email to let me know if you’re attending!

If you had a magic wand, what would you change about The Finance Gem💎?