Welcome to a New Edition of The Finance Gem 💎

weekly strategic finance gems to accelerate your career and grow your business

This Week’s Strategic Finance Insights

The Strategic Finance Checklist

ROI vs ROE vs ROA

ROIC vs. ROCE

5 Types of Cash Flow and How to Use them

10 Accounting Principles

The Finance for Non-Finance Cheat Sheet

Let’s dive in!

But first, allow me to share some seriously amazing Fall Savings.

To celebrate Canadian 🍁Thanksgiving, for a limited time all new Cash Flow Masterclass enrollments get a $100 coupon for my digital store.

That’s 33% more value for you.

Head over to www.oanalabes.com to get my viral cheat sheets, checklists and infographics bundles in full resolution, for posters or gifts. Coupon code will be emailed privately following full course enrolment. Expires October 14.

For custom orders please get in touch.

This newsletter issue is brought to you by Notion and Notion AI. Notion is an all-in-one workspace which lets you write, plan, collaborate, and organize effectively. Notion AI allows you to analyze meeting notes & generate summaries, improve your writing, translate and edit your voice, and get help writing your blog, article, or social media post. Use my affiliate links to get started for free with Notion and Notion AI and give them a try today!

New this week

I use Thinkific to power up The Cash Flow Masterclass and the several upcoming courses I have in the works. Download the new Thinkific mobile app and access my courses anywhere, anytime — on any device.

For Upcoming Course Launches, Promotions, Private Sales and Free Finance Webinars, sign up here.

The Finance Gem 💎 Referral Program is here - share this newsletter with your network and earn rewards! Scroll down to find out more!

Reading for the first time? Please Subscribe here.

Now let’s get into this week’s strategic finance insights:

The Strategic Finance Checklist

Do you want to break into Strategic Finance?

You’re not alone.

Many get stuck on the way from accounting to finance.

And even more get stuck on the way from operational to strategic finance.

But strategic finance is where you build the future, so keep pushing through.

As someone who has managed and enabled hundreds of multi-million dollar strategic finance transactions, I promise you it's worth it.

🎯But what’s Strategic Finance anyway?

It's what:

- enables your long term business objectives.

- aligns your financial and your business strategy.

- creates long-term sustainable value for your stakeholders.

🎯Here’s a 120 point checklist to help you navigate Strategic Finance, split between:

☑️Here are 6 main areas to get right.

How do we create and maximize value?

How do we best allocate our limited capital?

How do we manage costs strategically?

How do we forecast strategically?

How do we effectively plan for, and navigate M&A?

How do we manage strategic risks?

☑️And 6 more supporting areas to understand well.

What is strategic finance?

How do we implement effective corporate governance?

What are the main international considerations?

How does digital transformation enable strategic finance?

What key ESG considerations influence strategic finance?

How do we use strategic finance in corporate restructuring?

Click the image to download a PDF copy.

ROI vs ROE vs ROA

ROI vs ROE vs ROA

A trifecta of powerful financial metrics to help you assess:

➡️ the profitability of an investment

➡️➡️ the effectiveness of total asset management

➡️➡️➡️ the efficiency of a company's use of shareholders' equity

But beware:

⚫ ROI distorts profitability and could lead to financial trouble, because it doesn't consider the time value of money and it doesn't account for risks involved in the investment

⚫⚫ ROE can be manipulated by management decisions that artificially reduce equity (share buybacks) and could lead to deteriorating business financial health by encouraging management to take on too much debt in the effort to increase returns

⚫⚫⚫ ROA could also lead to deteriorating business financial health by ignoring asset financing choices (debt vs equity) and it can also make comparisons across industries challenging by coming in disproportionately low for capital-intensive businesses

Here’s what you need to remember:

1️⃣ Return on Investment (ROI)

- Formula: ROI = (Net Profit / Cost of Investment) * 100%

- Caveat: ROI doesn't consider the time value of money, which makes it less useful for multi-period investments, plus it ignores the investment risk profile

2️⃣ Return on Equity (ROE)

- Formula: ROE = (EBIT - Interest - Tax) / Equity

- Caveat: ROE can be heavily inflated by excessive use of leverage and artificially reduced equity balances

3️⃣ Return on Assets (ROA)

- Formula: ROA = (EBIT - Interest - Tax) / Total Assets

- Caveat: ROA includes depreciation so it will be lower for capital-intensive businesses which already have higher Total Asset balances

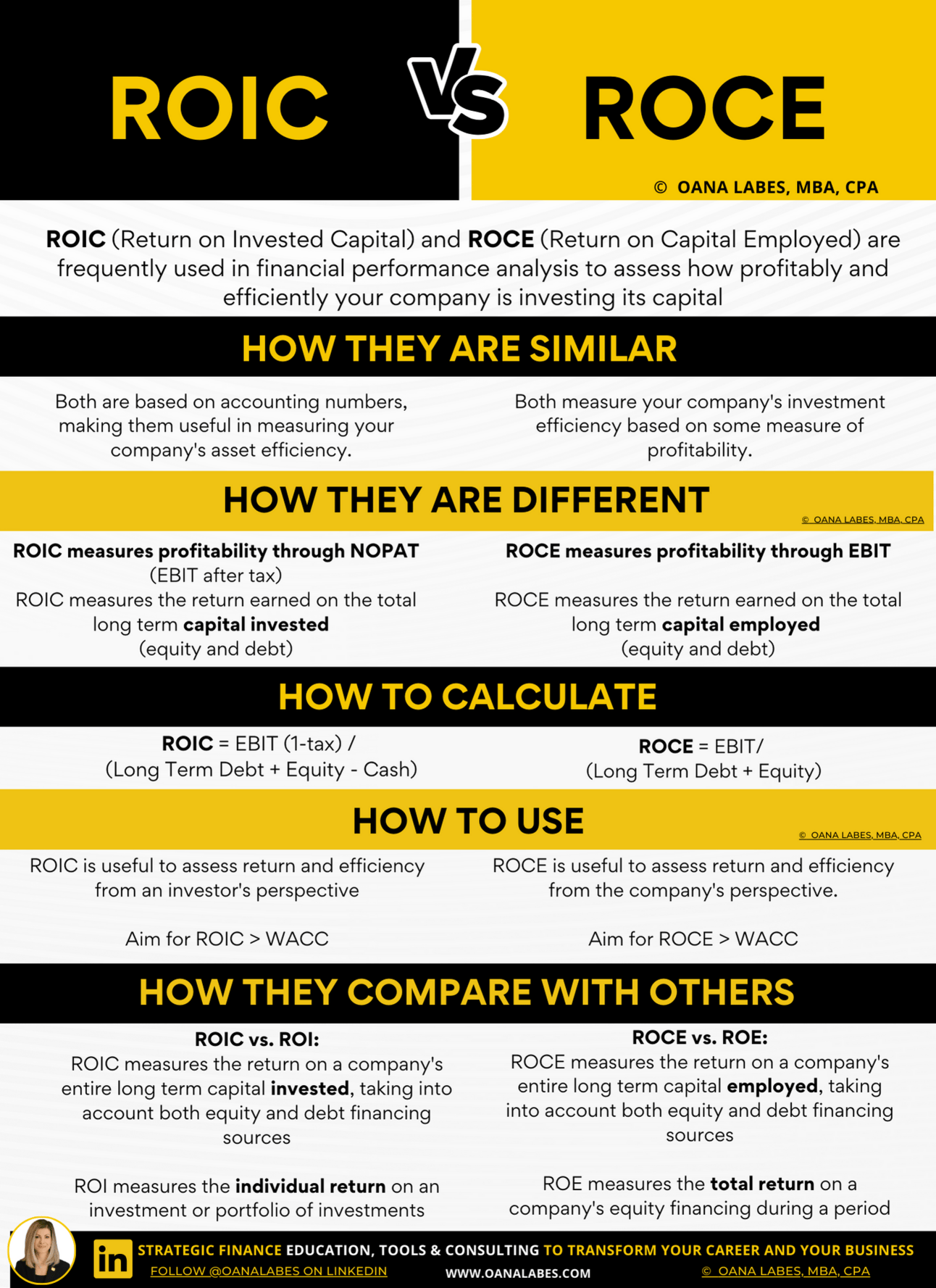

ROIC vs. ROCE

ROIC vs. ROCE

Don't let them confuse you.

Learn what they are, how to calculate them

And most importantly, learn precisely how to use them.

☑️ ROIC (Return on Invested Capital) and ☑️ ROCE (Return on Capital Employed) are frequently used in financial performance analysis to assess how profitably and efficiently your company is investing its capital

☑️ These ratios are easily confused because at first glance they appear to be very similar.

☑️ Here’s how they’re different:

🎯 ROIC measures profitability through NOPAT (Net Operating Profit After Tax), while ROCE measures profitability through EBIT (Earnings before Tax)

🎯 ROIC measures the after tax return earned on the total long-term capital invested

🎯 ROCE measures the return earned on the total long-term capital employed

☑️ Here’s how to calculate them:

🎯 ROIC = EBIT (1-tax) / (Long Term Debt + Equity - Cash)

🎯 ROCE = EBIT/ (Long Term Debt + Equity)

☑️ Here’s how they compare to other similar return ratios:

🎯 ROCE vs. ROE:

ROCE measures the return on your company's entire long term capital actually employed in generating shareholder returns, taking into account both equity and debt financing sources

ROE measures the return on your company's equity financing only during a period

🎯 ROIC vs. ROI:

ROIC measures the return on your company's entire long term capital invested, taking into account both equity and debt financing sources

ROI measures the individual return on an investment or portfolio of investments

☑️ Here’s how to use ROIC vs ROCE

🎯 ROIC is calculated after tax and excludes cash balances (deemed to be non-operating assets), so it’s useful as a profitability and efficiency measure from your investors’ perspective

🎯 ROCE is calculated before tax, so it’s useful as a profitability and efficiency measure from your company’s perspective, as well as to compare different companies independent of their tax jurisdictions

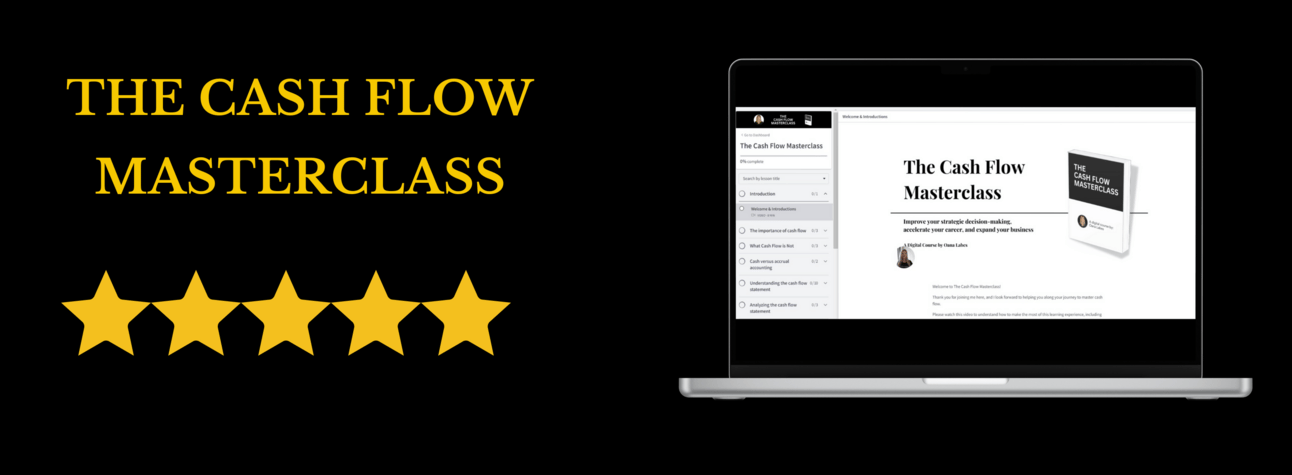

If you’re still unsure if my Cash Flow Masterclass is for you, consider this:

☑️ It’s GOOD: you will learn from one of the best coaches - a CPA, MBA with unique expertise in corporate and commercial finance, financial and managerial accounting, business management and business strategy.

☑️ It’s VALIDATED: your peers are giving The Cash Flow Masterclass 5*, join them so you don’t miss out!

☑️ It’s FAST: it takes less than 2 hours to breeze through the course on any device, and you can pause anytime

☑️ It’s PRACTICAL: you get dynamic financial models included in the course and you will be applying what you learn for the rest of your career

☑️ It’s VALUABLE: the course cost is nominal compared to the value it provides for your career, and there are several payment plans available

☑️ It’s YOURS: you get lifetime access on any device (audio mode available in the app)

☑️ It’s EXPENSIBLE: your employer or business can reimburse you, making this a win-win purchase for you and your organization.

ENROLL TODAY - your Career and your Organization will thank you!

5 Types of Cash Flow and How to Use them

Do you Know the 5 Types of Cash Flow and How to Use them?

They are highly confused, often misunderstood and mostly underutilized.

1️⃣ Operating cash flow

⚫ Represents the net cash generated by your company's core operations

⚫ Calculated by adjusting Net Income for non-cash items & changes in net working capital assets.

⚫ Used to assess:

>> your company's financial health

>> your company's ability to meet its financial obligations

>> your company’s ability to generate sufficient cash to fund ongoing business operations

>> trends in how the business generates cash

2️⃣ Investing cash flow

⚫ Represents the net cash generated by your company's investments in long-term assets such as property, plant and equipment (PPE).

⚫ Calculated by totaling the net investments in PPE over the period (purchases less sales of PPE)

⚫ Used to assess:

>> your company's investment decisions

>> your company's ability to generate returns from its investments

3️⃣ Financing cash flow

⚫ Represents the cash generated by your company's net debt and/or equity activity.

⚫ Calculated by totaling net debt and equity proceeds over the period.

⚫ Used to assess:

>> your company's financing choices and risk profile

>> your company's ability to raise capital

4️⃣ Free Cash Flow to Firm (FCFF or Unlevered Cash Flow)

⚫ Represents the cash remaining in your business after accounting for cash outflows that support product sales and operations (product costs + operating expenses + working capital) and cash outflows that maintain the capital asset base (capital expenditures).

⚫ Calculated by adjusting Operating Cash Flow for after tax interest expense and investments in capital assets

⚫ Used to assess:

>> your company's financial strength and ability to generate sufficient cash for growth and reinvestment

>> your company's value based on the discounted cash flow (DCF) valuation.

5️⃣ Free Cash Flow to Equity (FCFE or Levered Cash Flow)

⚫ Represents the cash remaining in your business after accounting for all business expenses, investments in working capital assets, investments in fixed assets, and also all debt obligations.

⚫ Calculated by adjusting Operating Cash Flow for after tax, interest expense, investments in capital assets and net debt payments.

⚫ Cash flow available to be used for investments, dividend payments, returns of capital, additional debt repayments, or acquisitions, but skewed by new debt raises.

⚫ Used to assess:

>> your company's ability to generate cash for distributions to shareholders holders

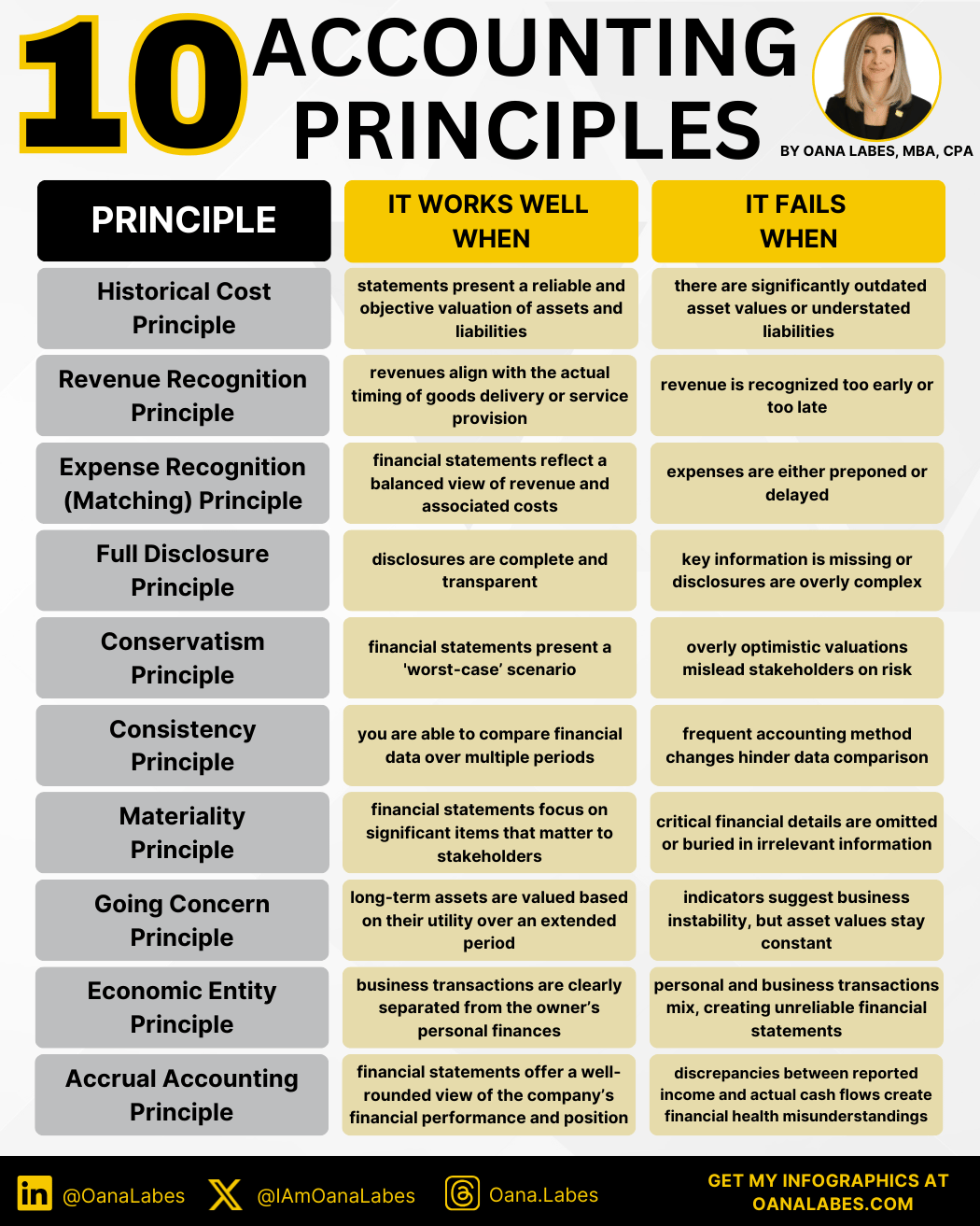

10 Accounting Principles

The Essential Guide to Accounting Principles

How to know they are actually working

And how to know they failed.

1. Historical Cost Principle

- What It Is: Assets and liabilities are initially recorded at their original acquisition cost.

- How to Know It Works: The financial statements provide a reliable and objective valuation of assets and liabilities.

- When to Get Concerned: when you notice significantly outdated asset values or understated liabilities, distorting the company's financial position.

2. Revenue Recognition Principle

- What It Is: Revenue is recorded when earned.

- How to Know It Works: Revenues align with the actual timing of goods delivery or service provision.

- When to Get Concerned: when revenue is recognized too early or too late, creating an inaccurate representation of financial performance.

3. Expense Recognition (Matching) Principle

- What It Is: Expenses are recognized in the same period as the revenue they generate.

- How to Know It Works: Financial statements reflect a balanced view of revenue and associated costs.

- When to Get Concerned: when expenses are either preponed or delayed, causing distortions in reported profitability and trends.

4. Full Disclosure Principle

- What It Is: All relevant information should be disclosed in financial statements and accompanying notes.

- How to Know It Works: Disclosures are complete and transparent.

- When to Get Concerned: when key information is missing or disclosures are overly complex, making it difficult for stakeholders to make informed decisions.

5. Conservatism Principle

- What It Is: when uncertain, accountants should choose the more cautious approach.

- How to Know It Works: Financial statements present a 'worst-case scenario,' serving as a buffer against unexpected adverse conditions.

- When to Get Concerned: when valuations seem overly optimistic or pessimistic, misleading stakeholders about risk levels.

6. Consistency Principle

- What It Is: Accounting methods should remain consistent over time.

- How to Know It Works: You are able to compare financial data over multiple periods.

- When to Get Concerned: when there are frequent changes in accounting methods, which creates challenges in comparing financial data over time.

7. Materiality Principle

- What It Is: Information is considered material if its omission or misstatement could influence decisions.

- How to Know It Works: Financial statements focus on significant items that matter to stakeholders.

- When to Get Concerned: when important financial details are either omitted or buried in irrelevant information.

8. Going Concern Principle

- What It Is: Assumes the business will continue its operations indefinitely.

- How to Know It Works: Long-term assets are valued based on their utility over an extended period.

- When to Get Concerned: when there are clear indicators that the business might not continue as a going concern, yet asset valuations remain unchanged.

9. Economic Entity Principle

- What It Is: Each business is considered a separate economic entity.

- How to Know It Works: Business transactions are clearly separated from the owner’s personal finances.

- When to Get Concerned: when personal and business transactions are mixed, leading to unreliable financial statements.

10. Accrual Accounting Concept

- What It Is: Transactions are recorded when they occur, not when cash changes hands.

- How to Know It Works: Financial statements offer a well-rounded view of the company’s financial performance and position.

- When to Get Concerned: when discrepancies between reported income and actual cash flows create misunderstandings about the company's financial health.

The Finance for Non-Finance Cheat Sheet

Do you have a good grasp of Finance?

Especially if you’re not in Finance & Accounting.

This knowledge may soon become your greatest asset.

In a world full of exceptional entrepreneurs, sales professionals, engineers, lawyers, bankers, doctors, dentists

Everyone could 100% their effectiveness and decision making with better finance knowledge.

🎯🎯🎯Here are 12 critical topics designed to give you a 360-degree view of corporate finance:

1. Income Statement, Balance Sheet, and Cash Flow Statement: The holy trinity of financial statements.

2. NPV, IRR, and Payback Calculations: Unpacking investment decision-making.

3. Capital Budgeting Inputs: A deep dive into how to evaluate long-term investments.

4. Profit vs. EBITDA vs. Cash Flow: Exploring different lenses through which to view profitability.

5. Financial Statement Illustration: A waterfall chart from revenues to profit to cash.

6, Cash Flow Management: How to navigate through the three cash flow drivers.

7, Financial Analysis Illustration: Categories of ratio analysis, vertical and horizontal analysis, and more.

8. Cash Flow Drivers: Revenue growth, operating margin, and capital efficiency dissected.

9. Cost and Profit KPIs: Key metrics that drive your bottom line.

10. Cash Inflows and Outflows: A breakdown by cash flow statement section.

Click on the image to download a PDF copy.

Referral Program

If you’re enjoying this newsletter, please forward it to a friend. It only takes 3 seconds. Writing this took 4 hours.

🎯Refer 5 people and get my exclusive eBook 10 Essential Strategic Finance Concepts that link Accounting, Finance and Strategy

🎯Refer 10 people and get an exclusive $10 Off coupon for your favorite infographic in my digital store.

Last Week’s Best Review

Poll Time

What topic did you enjoy reading about most this week?

How did it feel reading this week's issue?

As always, if you have suggestions or feedback, simply reply to this email.

Looking for More ?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on-demand video course.

Work with me. Tap into my 20+ years of strategic finance & business intelligence, and get coaching for your own career. Availability is very limited. Book here.

Get growth business advisory for your organization with short, medium and long term financial planning, and big-picture financial models so you’re always finance-ready. Reach out here.

Sponsor a future issue of The Finance Gem 💎 or hire me to guest speak in your events and webinars

Train your team on strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana

: