Welcome to a new edition of The Finance Gem 💎

Here are this week’s strategic finance gems to help you accelerate your career and grow your business.

Today is the last day to get an exclusive BONUS when you enroll in my highly reviewed strategic finance course - The Cash Flow Masterclass. Don’t miss this exclusive opportunity to gain a deeper understanding of EBITDA, and the practical skills needed to make better strategic decisions when using this critical financial metric. Hurry up - this special offer is ends August 12!

This week’s issue is brought to you by Ownr - a legal platform to start, build, and grow your Canadian business. Starting a business can be overwhelming. Let Ownr make it easier! Incorporate your business in minutes, find the perfect name, automate your legal and business documents, and get access to the support you need. Click here to get started and benefit from 15% off business formation services.

In Case you Missed This

My viral cheat sheets, checklists and infographics are now available in full resolution. Visit my web store and turn your favorites into posters! Or give them as gifts and become the coolest finance buff!

If you’re on Twitter, please follow me there as well and reach out to connect: @IAmOanaLabes

If you’re in San Diego for AFP 2023, let’s connect! I’m speaking on Monday October 23, and would love to meet you there!

To get notified in priority of my upcoming Promos, course launches and Free Webinars click here.

What I’ve Been Reading

Mostly metrics is a weekly business newsletter for CFOs and high performers. It's written by a tech CFO, CJ Gustafson, and read by +30,000 of your favorite Finance Leaders, Startup Operators and VCs. Subscribe to get smarter on business metrics, financial operations, and monetization models today.

This week’s Strategic Finance Insights

Accounting is just about tracking Numbers

NOPAT vs. EBIT

ROIC vs. ROE

Looking to analyze a company’s profitability?

10 Cash Flow Questions your CEO wants you to answer

Accounting is just about tracking Numbers

Or is it?

In fact, it's also about figuring out what the Numbers mean for the Business.

And about helping make Strategic Decisions with that understanding.

Here are the most critical 15 Accounting areas to cover.

🎯Cash Flow Management

• Track and analyze cash inflows and outflows regularly.

• Ensure sufficient liquidity for operational needs.

🎯Revenue Recognition

• Ensure timely and accurate revenue recognition.

• Comply with applicable accounting standards (e.g., US GAAP, ASPE, IFRS).

🎯Expense Management

• Categorize and monitor business expense management.

• Automate claims, reimbursements and reporting

🎯Financial Reporting

• Keep stakeholders informed with regular financial reporting

• Include visuals, provide context and follow what/so what/now what framework.

🎯Budgeting and Forecasting

• Prepare annual budgets in line with the business strategy

• Regularly update financial forecasts and extend forward to provide a 12 month rolling view.

🎯Debt Management

• Monitor solvency ratios and strategize debt management.

• Track covenants for compliance to maintain strong credit profile.

🎯Asset Management

• Track and manage both physical and intangible assets.

• Ensure correct and timely depreciation or amortization reporting.

🎯Payroll Management

• Leverage a payroll provider for timely and accurate payments and regulatory compliance.

• Follow strict internal control policies to avoid fraud and optimize cash flow.

🎯Tax Planning and Compliance

• Keep a long-term view when strategizing to minimize tax liabilities.

• Ensure compliance with tax laws and strategically utilize deductions.

🎯Risk Management

• Identify & assess financial risks

• Create an effective financial risk management policy for credit, market, and operational risks.

🎯Inventory Management

• Track and value inventory accurately.

• Understand inventory impact on cash flow and profitability.

🎯Accounts Receivable and Payable Management

• Manage receivables and payables for optimal cash flow.

• Monitor aging and collection regularly.

🎯Financial Analysis and Benchmarking

• Analyze financial performance using key metrics.

• Track against plans and industry benchmarks for improvement opportunities.

🎯Capital Expenditure (CAPEX) Management

• Proactively plan your investment in fixed assets

• Differentiate between replacement and growth.

🎯Regulatory Compliance and Reporting

• Ensure compliance with financial and business regulations.

• Ensure effective tracking and reporting of non-compliance events.

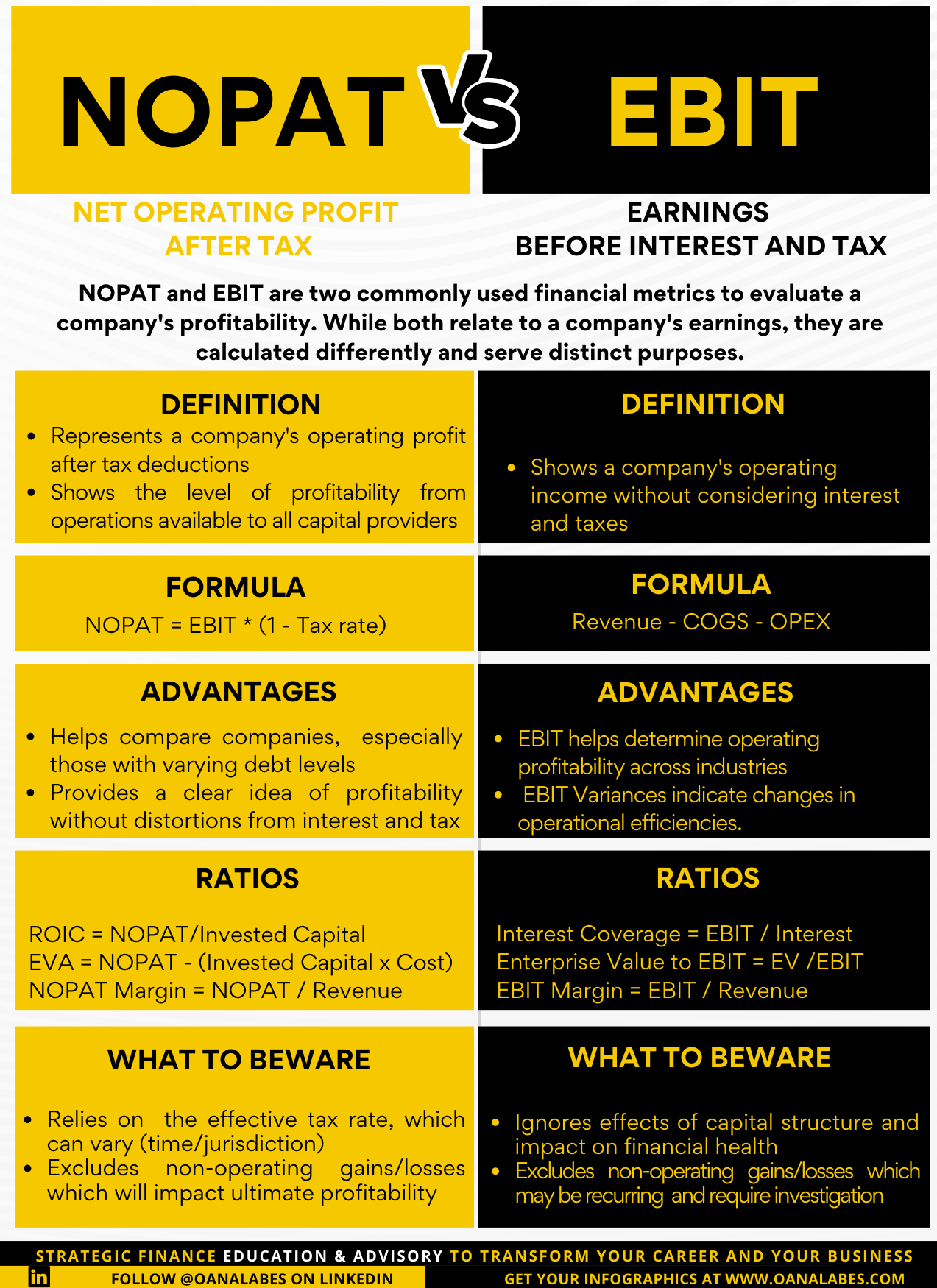

NOPAT vs. EBIT

Which one should you use?

How are they different?

Do you need both?

🎯NOPAT and EBIT are frequently used to evaluate a company's profitability.

However, they are calculated differently and serve distinct purposes.

↪️ NOPAT (Net Operating Profit After Tax) represents a company's operating profit after tax deductions.

It’s a hypothetical metric showing what operating profit would be if the company had no debt and no tax advantages or obligations from its current debt structure

NOPAT = EBIT * (1 - Tax rate)

↪️ EBIT (Earnings Before Interest and Taxes) represents the company's operating income without considering interest and taxes.

EBIT = Operating Income

EBIT = Revenue - Cost of Goods Sold - Operating Expenses

🎯How to use NOPAT and EBIT:

NOPAT is useful for comparing companies with differing debt structures

EBIT is useful for benchmarking companies within the same sector

Both metrics should be assessed together with revenue growth, net income, and return on equity (ROE)

🎯NOPAT Ratios to know:

ROIC = NOPAT/Invested Capital

EVA = NOPAT - (Invested Capital x Cost)

NOPAT Margin = NOPAT / Revenue

🎯EBIT Ratios to know:

Interest Coverage = EBIT / Interest

Enterprise Value to EBIT = EV /EBIT

EBIT Margin = EBIT / Revenue

ROIC vs. ROE

Do you know what these metrics are?

How to actually calculate them?

When (not) to use them?

🎯 ROIC (Return on Invested Capital) and ROE (Return on Equity) are widely used in financial performance analysis to assess how efficiently your company is investing in growth.

🎯 These profitability ratios are often confused because they’re as similar as they are different.

🎯 How they are similar:

⚫ Both are based on accounting numbers, making them useful in measuring a company's asset efficiency.

⚫ Both measure your company's investment efficiency based on profitability,

🎯 How they’re different:

⚫ ROE measures profitability through Net Income, ROIC measures profitability through NOPAT

⚫ ROE measures the return on just the equity invested in your business, ROIC evaluates the return earned on the total capital (attributable to equity investors and creditors) invested in your business

🎯 How to calculate them:

⚫ ROE = Net income / Shareholder's equity

⚫ ROIC = Net operating profit after taxes / (Debt + Equity - Cash)

🎯 How to use them:

⚫ ROE (vs WACC) to assess whether a firm is generating shareholder value or destroying value

⚫ ROIC if you want to compare the capability of firms to generate returns on their capital with different capital structures

🎯 What to be aware of:

⚫ ROE can be misleading for companies with huge cash balances since it does not deduct cash from the denominator in the calculation

⚫ ROIC is generally considered more useful because it includes the debt component of a firm and thus becomes insensitive to actions that can heavily impact shareholder equity.

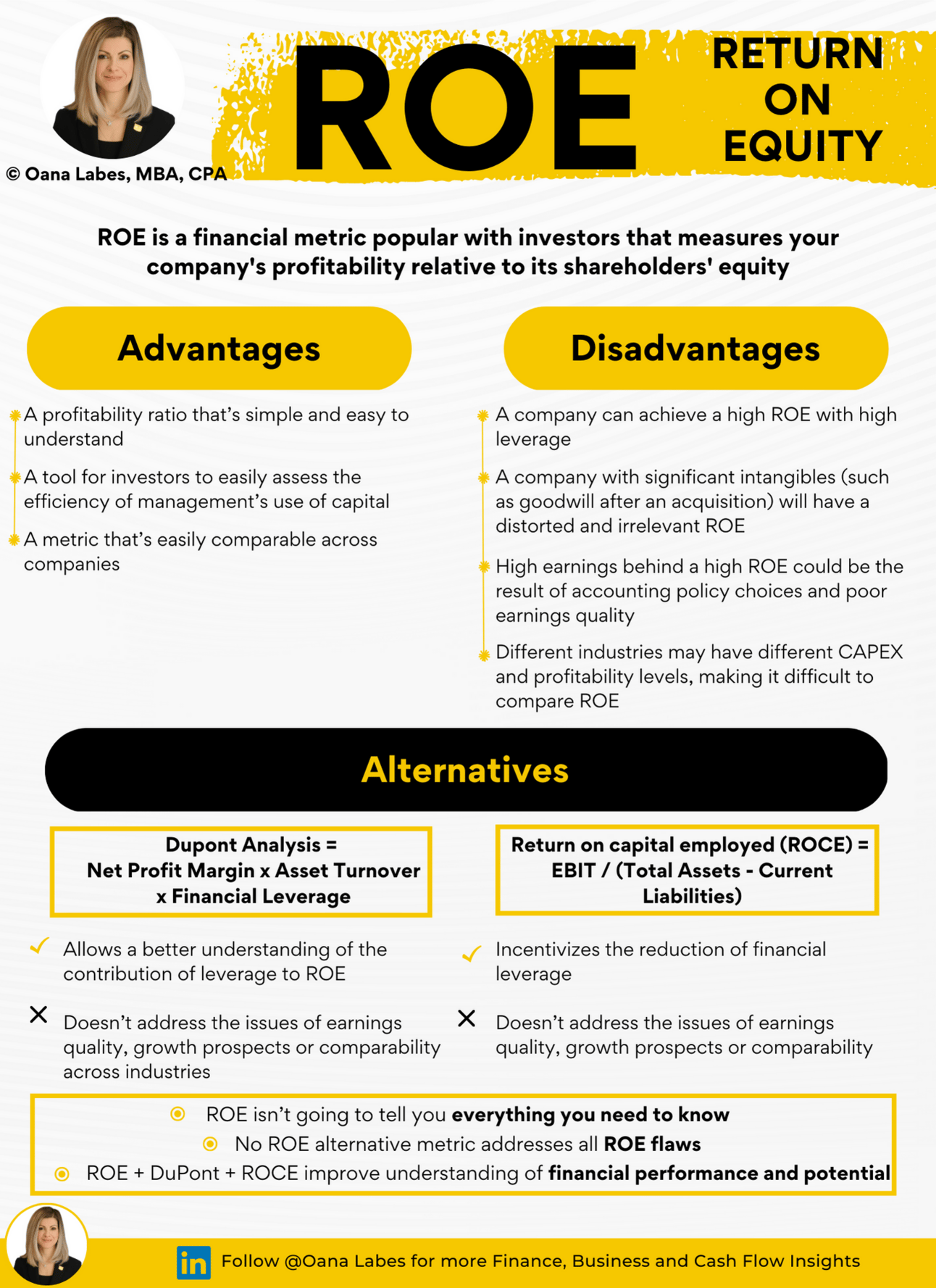

Looking to Analyze a Company’s Profitability?

Don’t just use ROE.

If you track ROE, you probably calculate it with the simple formula:

ROE = Net Income / Shareholders Equity

While this is helpful as:

⚫️ a profitability ratio that’s simple and easy to understand

⚫️ a tool for investors to easily assess the efficiency of management’s use of capital

⚫️ a metric that’s easily comparable across companies

It is also misleading because:

🔴 a company can achieve a high ROE with high leverage, increasing its risk profile and jeopardizing its ability to continue operating as a going concern in the future

🔴 a company with significant intangibles (such as goodwill after an acquisition) will have a distorted and irrelevant ROE

🔴 high earnings behind a high ROE could be the result of accounting policy choices and poor earnings quality

🔴 different industries may have different CAPEX requirements and different profitability levels, making it difficult to compare ROE

🔴 a high growth company could have a low ROE despite significant potential for future returns

So, if ROE is misleading, we need better, more insightful metrics to use for a more complete picture of a company's financial health.

How about:

1️⃣ The DuPont analysis ?

ROE = Net Profit Margin x Asset Turnover x Financial Leverage

where:

Net Profit Margin = Net Income / Total Revenue

Asset Turnover = Total Revenue / Average Total Assets

Financial Leverage = Average Total Assets / Average Shareholder's Equity

✔️ allows a better understanding of the contribution of leverage to ROE

❌ doesn’t address the issues of earnings quality, growth prospects or comparability across industries

2️⃣ Return on capital employed (ROCE) ?

ROCE = EBIT / (Total Assets - Current Liabilities)

where:

EBIT = Earnings Before Interest and Taxes

✔️ incentivizes the reduction of financial leverage

❌ doesn’t address the issues of earnings quality, growth prospects or comparability across industries

Therefore, if you want to analyze profitability and investor returns

🎯 ROE isn’t going to tell you everything you need to know

🎯 No ROE alternative metric addresses all ROE flaws

🎯 A combination of ROE, DuPont Analysis and ROCE will provide a more comprehensive understanding of a company's financial performance and potential

10 Cash Flow Questions your CEO wants you to answer

1. Is our company generating positive cash flow from operations?

⚫ Metric: Operating Cash Flow (OCF)

⚫ Formula: Net Income + Non-cash Expenses (e.g., depreciation, amortization) + Changes in Working Capital

2. What is our company's ability to meet its short-term obligations using its operating cash flow?

⚫ Metric: Operating Cash Flow to Current Liabilities Ratio

⚫ Formula: Operating Cash Flow / Current Liabilities

3. How effectively is our company using its assets to generate cash flow?

⚫ Metric: Cash Flow Return on Assets (CFROA)

⚫ Formula: Operating Cash Flow / Total Assets

4. How much of our company's net income is being converted into cash flow from operations?

⚫ Metric: Cash Flow to Net Income Ratio

⚫ Formula: Operating Cash Flow / Net Income

5. Is our company able to cover its capital expenditures with the cash generated from its operations?

⚫ Metric: Free Cash Flow (FCF)

⚫ Formula: Operating Cash Flow - Capital Expenditures

6. How much cash flow is available to our company's investors (both debt and equity)?

⚫ Metric: Cash Flow to Investors

⚫ Formula: Free Cash Flow - Debt Payments

7. How effectively is our company managing its cash conversion cycle?

⚫ Metric: Cash Conversion Cycle (CCC)

⚫ Formula: Days Sales Outstanding (DSO) + Days Inventory Outstanding (DIO) - Days Payable Outstanding (DPO)

8. How leveraged is our company, and can it comfortably meet its debt obligations?

⚫ Metric: Cash Debt Service Coverage Ratio (CDSCR)

⚫ Formula: Operating Cash Flow / Total Debt Service (Principal + Interest)

9. Is our company generating a sufficient return on invested capital?

⚫ Metric: Cash Flow Return on Investment (CFROI)

⚫ Formula: Free Cash Flow / Invested Capital

10. How efficiently is our company generating cash flow for its shareholders?

⚫ Metric: Cash Flow per Share (CFPS)

⚫ Formula: (Operating Cash Flow - Preferred Dividends) / Weighted Average Number of Common Shares Outstanding

Poll Time

How did it feel reading this week's issue?

As always, if you have suggestions or feedback, simply reply to this email.

Looking for More ?

Upgrade your strategic finance skills with The Cash Flow Masterclass, my highly reviewed, on demand video course

Leverage my unique on-demand video course to improve your knowledge, elevate your decision making and accelerate your career. For customized team training please apply here.

Sponsor a future issue of The Finance Gem 💎and get your brand in front of an exceptional audience of strategic finance, accounting, sales and technology professionals and executives.

Train your team in strategic finance concepts and elevate their knowledge, decision-making and productivity. Reach out here.

Thanks so much for reading. See you next week.

Oana